What Analysts Are Saying About BioNTech Stock

Throughout the last three months, 8 analysts have evaluated BioNTech (NASDAQ:BNTX), offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 2 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 2 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 0 | 0 | 0 |

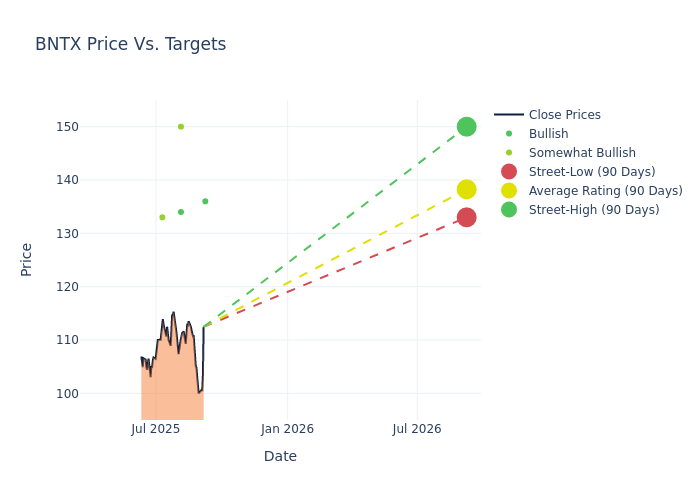

Insights from analysts' 12-month price targets are revealed, presenting an average target of $136.38, a high estimate of $150.00, and a low estimate of $126.00. This current average represents a 1.88% decrease from the previous average price target of $139.00.

Understanding Analyst Ratings: A Comprehensive Breakdown

A clear picture of BioNTech's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Robert Burns | HC Wainwright & Co. | Maintains | Buy | $136.00 | $136.00 |

| Robert Burns | HC Wainwright & Co. | Lowers | Buy | $136.00 | $138.00 |

| Mohit Bansal | Wells Fargo | Lowers | Overweight | $150.00 | $170.00 |

| Tazeen Ahmad | B of A Securities | Raises | Buy | $134.00 | $126.00 |

| Tazeen Ahmad | B of A Securities | Lowers | Buy | $126.00 | $127.00 |

| Terence Flynn | Morgan Stanley | Raises | Overweight | $133.00 | $132.00 |

| Robert Burns | HC Wainwright & Co. | Maintains | Buy | $138.00 | $138.00 |

| Robert Burns | HC Wainwright & Co. | Lowers | Buy | $138.00 | $145.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to BioNTech. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of BioNTech compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for BioNTech's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into BioNTech's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on BioNTech analyst ratings.

Discovering BioNTech: A Closer Look

BioNTech is a Germany-based biotechnology company that focuses on developing cancer therapeutics, including individualized immunotherapy, as well as vaccines for infectious diseases, including covid. The company's oncology pipeline contains several classes of drugs, including mRNA-based drugs to encode antigens, neoantigens, cytokines, and antibodies; cell therapies; bispecific antibodies; and antibody-drug conjugates, or ADCs. Comirnaty, its Pfizer-partnered covid vaccine, is its first commercialized product.

Unraveling the Financial Story of BioNTech

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: BioNTech displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 102.64%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: BioNTech's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of -148.24%, the company may face hurdles in effective cost management.

Return on Equity (ROE): BioNTech's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -2.07%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): BioNTech's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -1.81%, the company may face hurdles in achieving optimal financial returns.

Debt Management: BioNTech's debt-to-equity ratio is below the industry average at 0.01, reflecting a lower dependency on debt financing and a more conservative financial approach.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.