ChargePoint (CHPT) Valuation Check After Strong Q3 Beat, Debt Cut and Improved Outlook

ChargePoint Holdings (CHPT) just delivered a third quarter that finally tilted the story toward progress, with revenue growth, a sharply narrower loss, upbeat guidance, and meaningful debt reduction catching investors attention.

See our latest analysis for ChargePoint Holdings.

The strong third quarter and upbeat guidance have clearly shifted sentiment, with a 7 day share price return of 27.35% and a 1 day jump of 22.42% contrasting sharply with a 1 year total shareholder return of negative 60.19%. This suggests early signs of momentum after a brutal reset.

If this earnings pop has you rethinking the EV space, it is worth seeing what else is setting up for growth in auto manufacturers beyond the usual names.

With shares still down more than 60% over the past year but trading just below consensus targets after the earnings spike, is ChargePoint now a beaten down EV infrastructure play on sale, or has the market already priced in a real turnaround?

Most Popular Narrative Narrative: 4.3% Overvalued

ChargePoint trades just above the $10 narrative fair value at $10.43, a small premium that reflects cautious optimism rather than exuberance.

5 Years (2030): If fleet electrification continues at pace and infrastructure spending remains robust, ChargePoint could reach $1B+ in annual revenue. By this point, the mix should shift more decisively toward software, network services, and fleet management solutions.

Curious how a hardware heavy charger business aims for a software style valuation multiple, powered by scaled revenue growth and richer margins over time? Click through to see the exact growth runway and profitability assumptions behind that fair value call.

Result: Fair Value of $10.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained cash burn or slower fleet electrification could quickly undermine the software-led margin story that underpins this fair value narrative.

Find out about the key risks to this ChargePoint Holdings narrative.

Another Take on Value

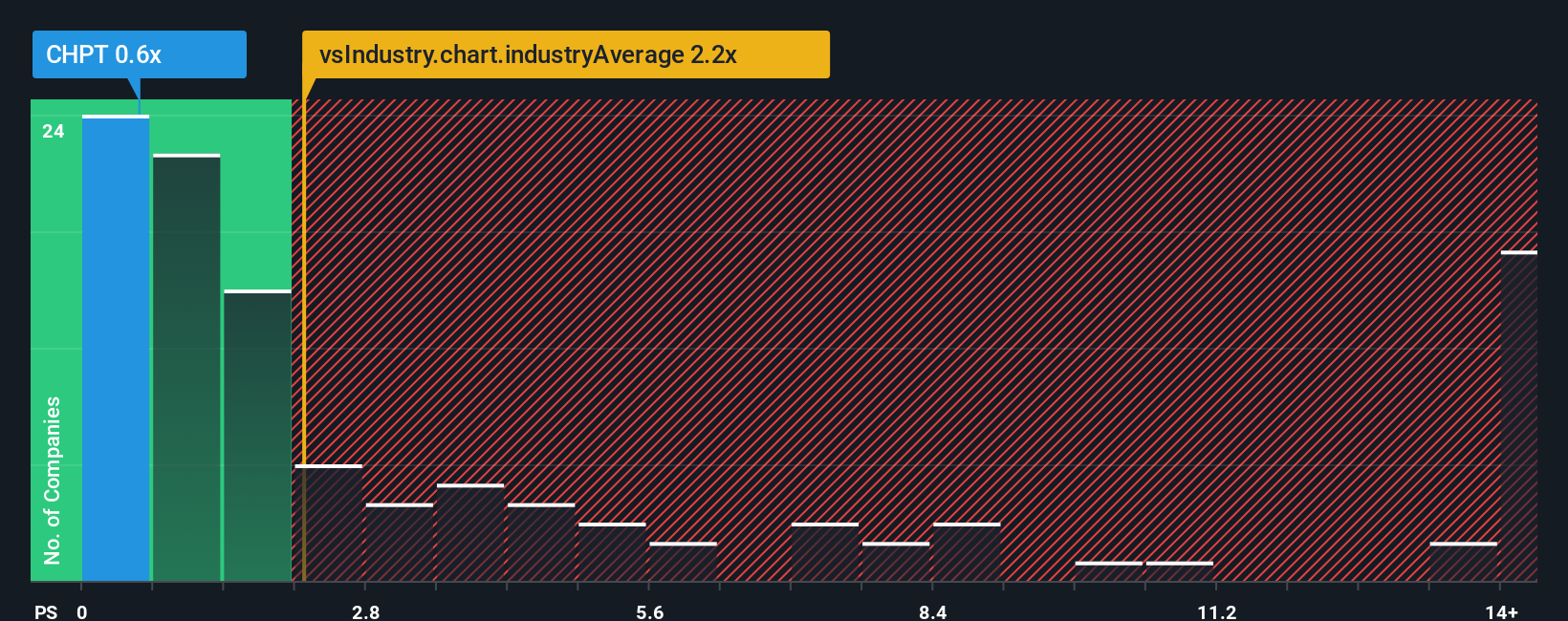

While the popular narrative sees ChargePoint as 4.3% overvalued at $10.43, its 0.6x price to sales looks cheap versus peers at 2x and a fair ratio of 1.2x. If sentiment normalizes, could simple repricing, rather than blue sky growth, drive the next leg higher?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ChargePoint Holdings Narrative

If you see the outlook differently or simply prefer to dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your ChargePoint Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, give yourself an edge by using the Simply Wall Street Screener to uncover fresh, data driven ideas that most investors are still overlooking.

- Explore potential market mispricings by targeting quality companies trading below intrinsic value through these 908 undervalued stocks based on cash flows and consider how this might position you ahead of sentiment shifts.

- Focus on structural developments in medicine and diagnostics by examining innovators advancing intelligent care with these 30 healthcare AI stocks.

- Review your income strategy by scanning for reliable payouts and sustainable yields in these 15 dividend stocks with yields > 3% rather than reacting after broader interest increases.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com