Chord Energy (CHRD): Reassessing Valuation After Q3 Beat, XTO Deal Closure and Higher Shareholder Payouts

Chord Energy (CHRD) just delivered an earnings beat, supported by higher revenue and earnings per share, while simultaneously closing the XTO deal and increasing shareholder returns through dividends and buybacks.

See our latest analysis for Chord Energy.

Investors have started to notice, with Chord Energy’s roughly 12 percent 1 month share price return standing out against a weaker year to date share price return and softer 1 year total shareholder return. This hints at improving momentum despite earlier caution around Bakken oil prices.

If this kind of rebound has you curious about what else might be setting up for a run, it could be worth exploring fast growing stocks with high insider ownership.

With earnings beating expectations, cash returns ramping up, and the share price still trading at a sizeable discount to analyst targets, is Chord Energy quietly undervalued or is the market already pricing in its next leg of growth?

Most Popular Narrative: 23.4% Undervalued

With Chord Energy last closing at $97.65 versus a narrative fair value of $127.56, the story leans toward meaningful upside if the thesis plays out.

Robust and consistent free cash flow generation, outperforming guidance and enabling 90%+ payout ratios via buybacks and dividends, indicates the potential for continued accelerated earnings per share growth as capital allocation discipline remains a management priority.

Want to see the math behind this upside case? The narrative leans heavily on thicker margins, faster earnings growth, and a surprisingly low future earnings multiple. Curious which assumptions really do the heavy lifting, and how they combine into that fair value per share? The full narrative lays out the projections driving this call.

Result: Fair Value of $127.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on smooth execution, as concentrated Bakken exposure and potential regulatory tightening could quickly pressure margins and cash flow expectations.Find out about the key risks to this Chord Energy narrative.

Another View: Rich on Earnings

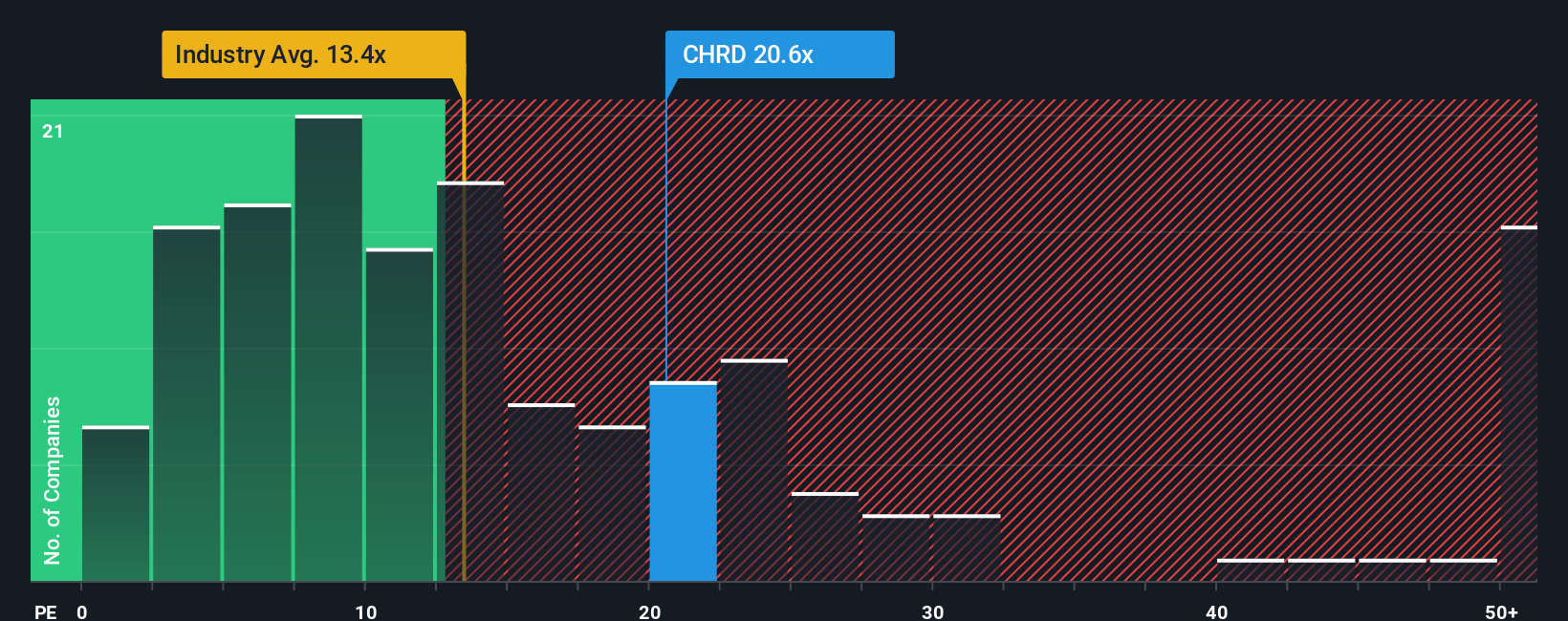

On a simple price to earnings lens, Chord Energy screens as expensive. It trades on about 33 times earnings versus a 13.8 times average for the US Oil and Gas industry and a 25 times fair ratio, suggesting less margin of safety if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chord Energy Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Chord Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more smart investment ideas?

Before you move on, lock in your next potential winner by using the Simply Wall St screener to quickly surface focused, data driven opportunities you might otherwise miss.

- Strengthen your portfolio foundation with reliable income streams by targeting these 15 dividend stocks with yields > 3% that can help smooth returns through different market cycles.

- Ride structural growth trends by zeroing in on these 26 AI penny stocks positioned at the heart of automation, intelligent software, and data driven decision making.

- Boost your upside potential by hunting for mispriced opportunities across these 908 undervalued stocks based on cash flows where cash flows suggest the market is still catching up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com