Toro (NasdaqCM:TORO) Q3 EPS Turns Positive, But Trailing Losses Reinforce Bearish Narrative

Toro (NasdaqCM:TORO) has just posted Q3 2025 results, with revenue of about $5.4 million and basic EPS of $0.01, keeping the spotlight firmly on how its thin profitability stacks up against a history of choppy earnings. The company has seen quarterly revenue hover in a tight band, from $5.3 million in Q3 2024 to $5.4 million in Q3 2025, while EPS has swung from a loss of $0.01 per share a year ago to modestly positive territory this quarter, leaving investors focused on whether these margin shifts signal a more durable path toward consistent profitability.

See our full analysis for Toro.With the headline numbers on the table, the next step is to compare these results with the dominant narratives around Toro and assess where the latest margins and earnings trends confirm that story and where they begin to push it in a different direction.

Curious how numbers become stories that shape markets? Explore Community Narratives

Trailing Losses Despite Q3 Profit

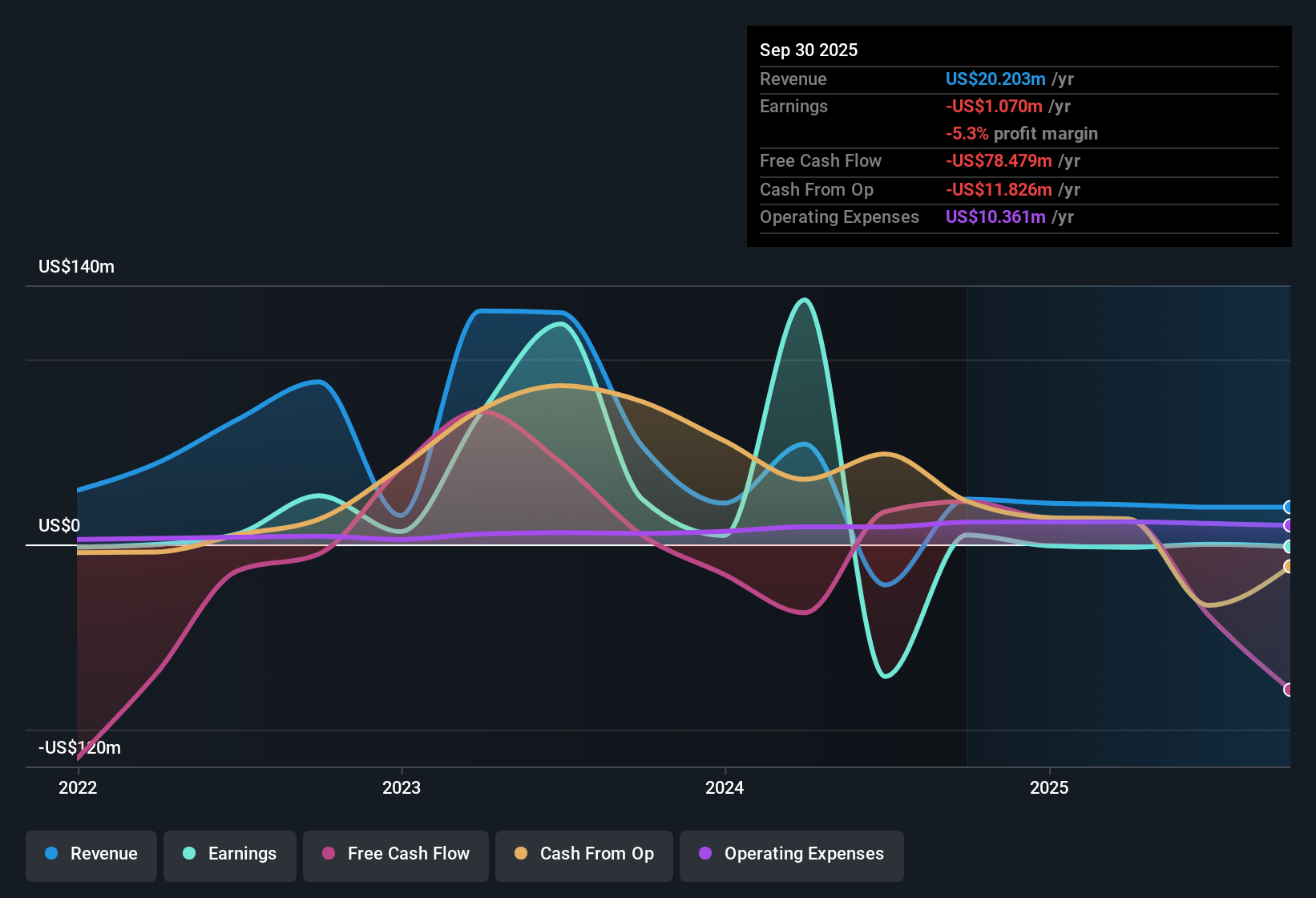

- Over the last twelve months, Toro posted a net loss of about $1.1 million on $20.2 million of revenue, even though Q3 2025 itself showed a small net profit of roughly $0.1 million.

- Bears argue that Toro’s profit profile is deteriorating, and the data backs that concern over the longer run:

- Losses have grown at roughly 20.4% per year over the past five years, and trailing twelve month EPS sits at around negative $0.06 despite the latest positive $0.006 per share in Q3 2025.

- The shift from a Q3 2024 net loss of about $0.2 million to a modest Q3 2025 profit has not yet translated into consistently positive trailing earnings. This keeps the bearish focus on sustainability rather than a single quarter’s turnaround.

Price To Sales Far Above Peers

- Toro trades on a trailing price to sales ratio of about 5.8 times, compared with roughly 0.6 times for peers and 0.9 times for the wider US shipping industry.

- Critics highlight this valuation gap as a key bearish point, and the fundamentals give that view some footing:

- With trailing twelve month revenue of about $20.2 million and ongoing net losses of roughly $1.1 million, investors are paying a higher multiple than industry averages despite the absence of positive trailing earnings.

- The combination of a $5.80 share price and a high sales multiple, without accompanying figures for revenue or earnings growth, aligns with the bearish argument that the stock faces valuation pressure if performance does not improve.

Volatile Stock On Weak Profit Trend

- Share price moves have been more volatile than the broader US market over the past three months, at the same time as trailing twelve month EPS remains around negative $0.06.

- Bears point to this mix of volatility and weak profitability as a risk, and the numbers support that focus:

- Recent quarters swung from a Q1 2025 net income of about $0.4 million to a smaller Q3 2025 profit of roughly $0.1 million, while the twelve month view is still a loss of about $1.1 million.

- That backdrop of choppy profit outcomes and a history of losses worsening around 20.4% a year gives recent price swings more weight for cautious investors who prefer steadier earnings profiles.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Toro's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Toro’s high price to sales ratio, persistent trailing losses, and volatile earnings suggest investors may be overpaying for a business without proven, sustainable profitability.

If that trade off worries you, use our these 907 undervalued stocks based on cash flows today to quickly focus on companies where cash flows and earnings momentum better justify the price you pay.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com