Does Academy Sports (ASO) Board Refresh and Dividend Hint at a Shift in Its Growth Playbook?

- Earlier this week, Academy Sports and Outdoors, Inc. declared a quarterly cash dividend of US$0.13 per share for the fiscal quarter ended November 1, 2025, payable on January 15, 2026, to shareholders of record as of December 18, 2025.

- The company also recently expanded its Board of Directors by adding three executives with deep experience in finance, digital transformation, and large-scale retail operations, signaling a sharpened focus on governance and execution of its long-range growth plans.

- Next, we’ll examine how adding digital and retail veterans to the board could influence Academy’s expansion, e-commerce, and margin-improvement narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Academy Sports and Outdoors Investment Narrative Recap

To be a shareholder in Academy Sports and Outdoors, you need to believe in its ability to turn steady store expansion, e-commerce growth, and private-label development into durable earnings, despite margin pressure from promotions and costs. The latest dividend declaration and board expansion do not materially change the near-term focus on execution around new store productivity and profitability, or the key risk from intensifying promotional activity compressing margins.

The most relevant update here is the appointment of three new directors with deep backgrounds in finance, digital, and large-scale retail operations, which aligns directly with Academy’s push into e-commerce and technology-enabled efficiency. For investors watching the upcoming earnings and store rollouts, these appointments frame how the company might approach cost control, digital assortment, and omnichannel profitability over time.

But before getting comfortable with that story, investors should be aware that rising tariffs, labor costs, and e-commerce shipping expenses could...

Read the full narrative on Academy Sports and Outdoors (it's free!)

Academy Sports and Outdoors' narrative projects $7.2 billion revenue and $460.3 million earnings by 2028. This requires 6.6% yearly revenue growth and about a $89.4 million earnings increase from $370.9 million today.

Uncover how Academy Sports and Outdoors' forecasts yield a $57.50 fair value, a 14% upside to its current price.

Exploring Other Perspectives

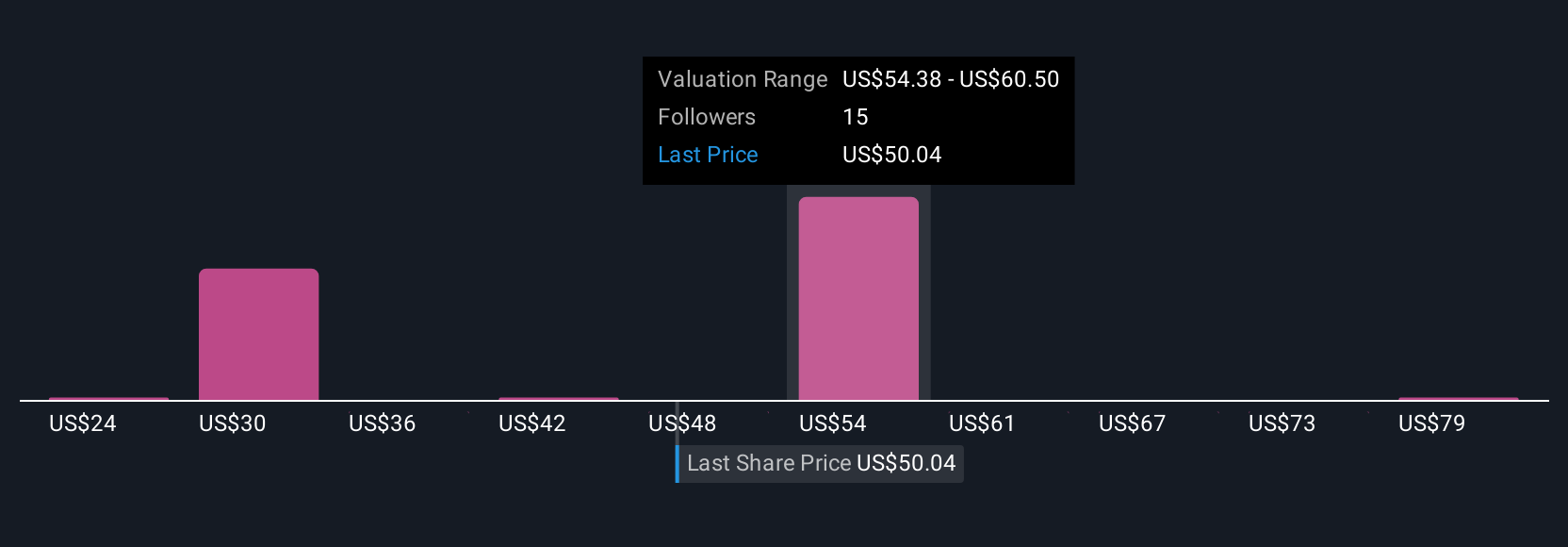

Four members of the Simply Wall St Community currently place Academy’s fair value between US$23.75 and about US$68.80, underscoring how far apart individual views can be. As you weigh those opinions, remember that rising promotional intensity and pressure on pricing power could materially shape how the company’s growth investments show up in future margins and overall performance.

Explore 4 other fair value estimates on Academy Sports and Outdoors - why the stock might be worth less than half the current price!

Build Your Own Academy Sports and Outdoors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Academy Sports and Outdoors research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Academy Sports and Outdoors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Academy Sports and Outdoors' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com