Argan (AGX) Is Down 20.6% After Record Backlog And Strong Q3 Earnings Beat Has The Bull Case Changed?

- On December 4, 2025, Argan, Inc. reported third-quarter fiscal 2026 results with sales of US$251.15 million, net income of US$30.74 million, and diluted EPS from continuing operations of US$2.17, while also highlighting a record project backlog of about US$3.00 billion.

- Beyond the earnings beat, Argan’s combination of a growing backlog, higher margins, and a third consecutive annual dividend increase underscores how its power infrastructure projects are translating into stronger cash generation and shareholder returns.

- Next, we’ll examine how Argan’s record US$3.00 billion backlog and margin improvement may reshape its existing investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Argan Investment Narrative Recap

To own Argan, I think you need to believe its engineering strength in large, complex power projects will keep turning a sizable backlog into solid earnings and cash flow, even as the power mix evolves. The latest results support that view in the near term, with higher margins and record US$3.00 billion backlog reinforcing the key short term catalyst of project execution, while the core risks around gas-heavy exposure and lumpier margins are not meaningfully changed by this quarter.

The most relevant recent development here is Argan’s 33% dividend increase to US$0.50 per share, its third straight annual raise, which now looks more comfortably backed by higher earnings and stronger cash generation in Q3. For investors, that rising payout sits alongside the record backlog and ongoing execution as a potential support for returns at a time when the share price has already moved sharply.

Yet despite these positives, investors still need to be aware of how dependent Argan remains on a small number of large EPC projects...

Read the full narrative on Argan (it's free!)

Argan’s narrative projects $1.5 billion revenue and $142.0 million earnings by 2028. This requires 18.1% yearly revenue growth and about a $24.8 million earnings increase from $117.2 million today.

Uncover how Argan's forecasts yield a $295.75 fair value, a 6% downside to its current price.

Exploring Other Perspectives

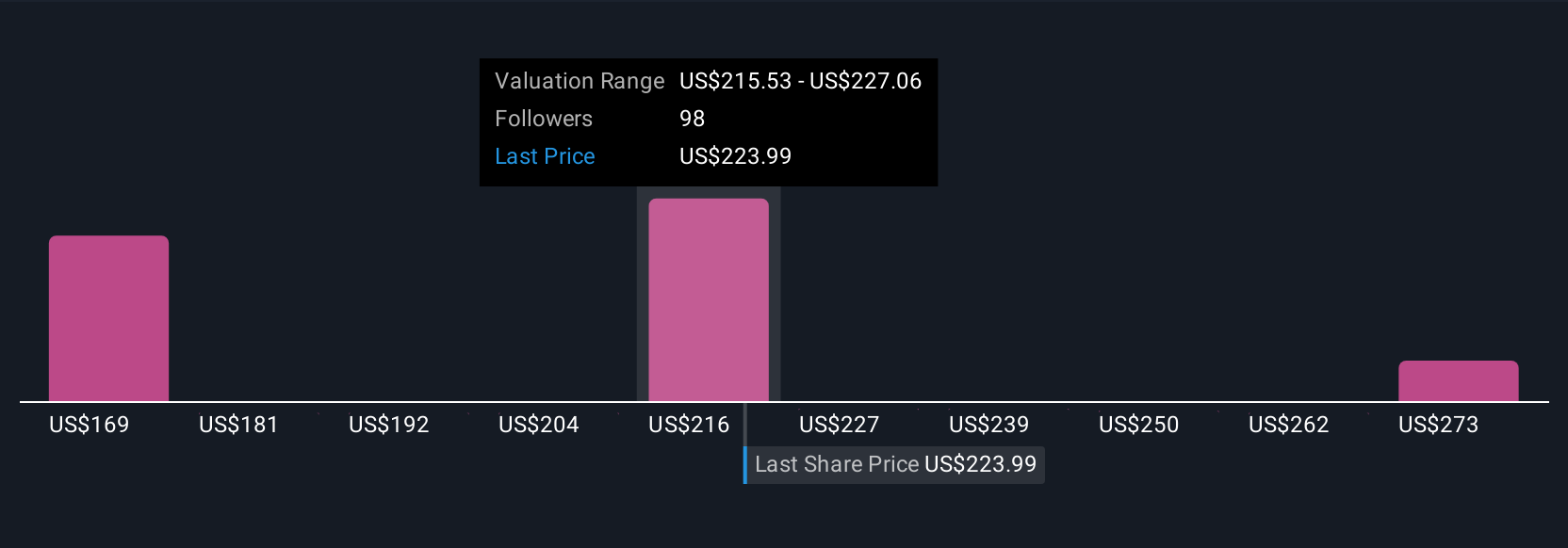

Nine Simply Wall St Community members place Argan’s fair value between US$182.67 and US$295.75, underlining how far opinions can stretch. Set against a US$3.00 billion backlog concentrated in large gas and centralized power projects, that spread invites you to weigh how execution and energy transition risks could affect Argan’s future performance.

Explore 9 other fair value estimates on Argan - why the stock might be worth 42% less than the current price!

Build Your Own Argan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Argan research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Argan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Argan's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com