Stronger Results, Raised Guidance and New Buyback Could Be A Game Changer For Cintas (CTAS)

- Cintas recently reported past-quarter results with earnings per share of US$1.20 on revenue of US$2.72 billion, topping forecasts, while raising full-year guidance for both earnings and sales.

- The company also authorized a new US$1.00 billion share repurchase program alongside existing capacity, reinforcing management’s confidence in its long-term outlook and capital return plans.

- Now we’ll consider how the upgraded guidance and fresh US$1.00 billion buyback authorization could reshape Cintas’ investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Cintas Investment Narrative Recap

To own Cintas, you generally need to believe in the durability of its uniform and facility services model and its ability to keep growing earnings despite cyclical swings. The latest earnings beat and higher full year guidance support that narrative in the near term, while the main watchpoint remains whether remote work and automation slowly chip away at demand for physical workplace services. For now, the Q1 update does not materially change that risk profile.

The new US$1.00 billion share repurchase authorization is the clearest near term development for investors, particularly after a year in which the stock has lagged both the sector and the wider market. Combined with ongoing dividend growth, it reinforces capital return as a key catalyst at a time when revenue and earnings are forecast to grow, but at more modest rates than the broader US market.

Yet even with these upgrades, the longer term risk that automation and remote work could reshape Cintas’ core customer base is something investors should be aware of...

Read the full narrative on Cintas (it's free!)

Cintas' narrative projects $12.8 billion revenue and $2.4 billion earnings by 2028. This requires 7.2% yearly revenue growth and about a $0.6 billion earnings increase from $1.8 billion.

Uncover how Cintas' forecasts yield a $214.88 fair value, a 15% upside to its current price.

Exploring Other Perspectives

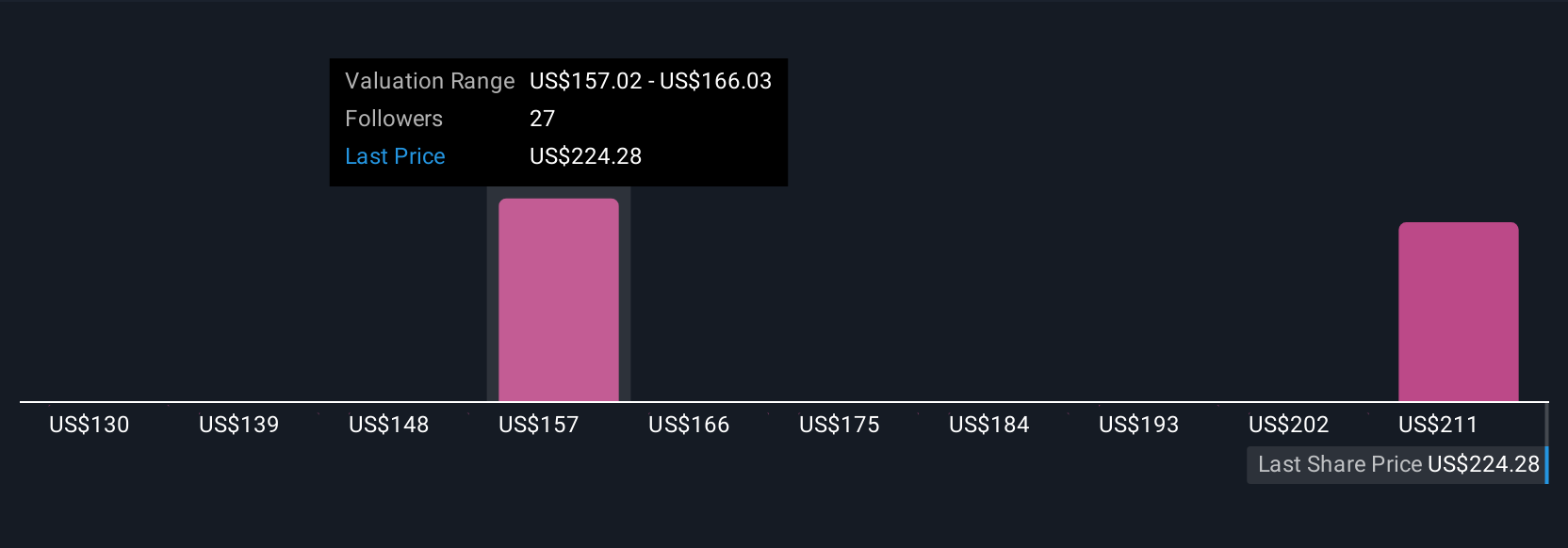

Five members of the Simply Wall St Community currently see Cintas’ fair value between US$164.92 and US$214.88, highlighting how far opinions can spread. Set that against the raised earnings guidance and fresh US$1.00 billion buyback, and you can see why it pays to weigh several different views before deciding how this business fits into your own expectations.

Explore 5 other fair value estimates on Cintas - why the stock might be worth 12% less than the current price!

Build Your Own Cintas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cintas research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cintas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cintas' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com