Denison Mines (TSX:DML) Is Up 5.6% After New Métis Partnership Agreement - What's Changed

- Denison Mines Corp. recently signed an Impact Benefit Agreement and an Exploration Agreement with the Métis Nation–Saskatchewan and its regional groups, securing Indigenous consent and support for the Wheeler River uranium project and broader exploration activities in the Métis Homeland.

- The agreements highlight a long-term partnership framework that ties project development to environmental stewardship, cultural respect, and employment and business opportunities for Métis citizens, potentially reducing social and permitting risks for Denison’s flagship asset.

- Next, we’ll examine how this long-term partnership with Métis Nation–Saskatchewan shapes Denison Mines’ investment narrative around project certainty.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Denison Mines' Investment Narrative?

To own Denison Mines today, you have to believe that its uranium assets in Saskatchewan, led by Wheeler River and supported by McClean and Midwest, will eventually justify years of limited revenue and persistent losses. The key near term catalysts still sit around permitting progress at Wheeler River, de‑risking of the McClean SABRE mining method, and how effectively Denison deploys capital into the new Russell Lake and surrounding joint ventures. The fresh Impact Benefit and Exploration Agreements with Métis Nation–Saskatchewan slot directly into that story: they may ease social licence and permitting uncertainty around Wheeler River and nearby exploration at a time when the balance sheet is absorbing higher spending and earnings remain deeply in the red, without changing the reality that execution and uranium prices remain central swing factors.

But there is one funding‑related risk that current shareholders cannot afford to ignore. Denison Mines' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

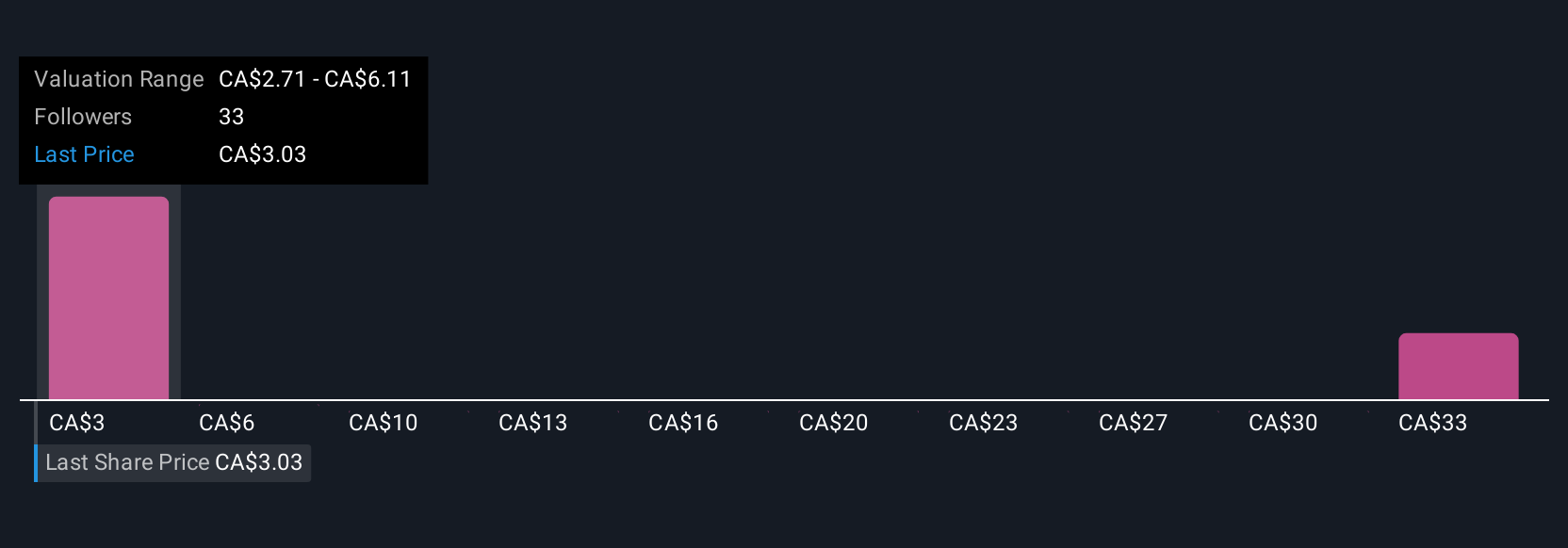

Simply Wall St Community members put Denison’s fair value anywhere from about CA$0.05 to CA$5 across 9 separate models, underlining just how far apart individual expectations can be. When you set that spread against a business still unprofitable, with ambitious ISR growth plans and fresh Indigenous partnership agreements reshaping project certainty, it becomes even more important to weigh several viewpoints before deciding how Denison fits in your portfolio.

Explore 9 other fair value estimates on Denison Mines - why the stock might be worth less than half the current price!

Build Your Own Denison Mines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Denison Mines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Denison Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Denison Mines' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com