LendingClub (LC): Rethinking Valuation as Balance Sheet Strategy and ‘Motivated Middle’ Focus Drive Growth Potential

Balance Sheet Shift Puts LendingClub in a New Light

LendingClub (LC) is drawing attention after leaning harder into its “motivated middle” borrowers and shifting more loans from held for investment to held for sale, a strategic pivot with clear revenue implications.

See our latest analysis for LendingClub.

That shift in balance sheet strategy seems to line up with the market’s view, with a roughly 18 percent 3 month share price return and a 3 year total shareholder return above 100 percent, signaling that investors see momentum building rather than fading.

If this kind of lending driven re rating has your attention, it might be worth scanning other solid balance sheet and fundamentals stocks screener (None results) for similar balance sheet strength and upside potential.

With the shares up strongly over three and five years, but still trading below analyst targets and some intrinsic value estimates, is LendingClub quietly undervalued today or already reflecting the bulk of its future growth?

Most Popular Narrative Narrative: 11.3% Undervalued

With LendingClub last closing at $19.43 against a narrative fair value of $21.91, the story leans toward upside if the growth path holds.

The hybrid digital marketplace/bank model continues to scale. Marketplace originations and balance sheet loans are growing in tandem, with the former providing high-margin, capital-light revenue, and the latter building durable recurring net interest income; this dual engine offers operating leverage for sustained growth in earnings and tangible book value.

Curious what kind of revenue glidepath and margin expansion could justify that higher fair value, even as growth cools. Want to see the full playbook?

Result: Fair Value of $21.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and heavier reliance on personal loans could squeeze margins and amplify credit cycle hits, which could quickly challenge the current undervaluation case.

Find out about the key risks to this LendingClub narrative.

Another Angle on Valuation

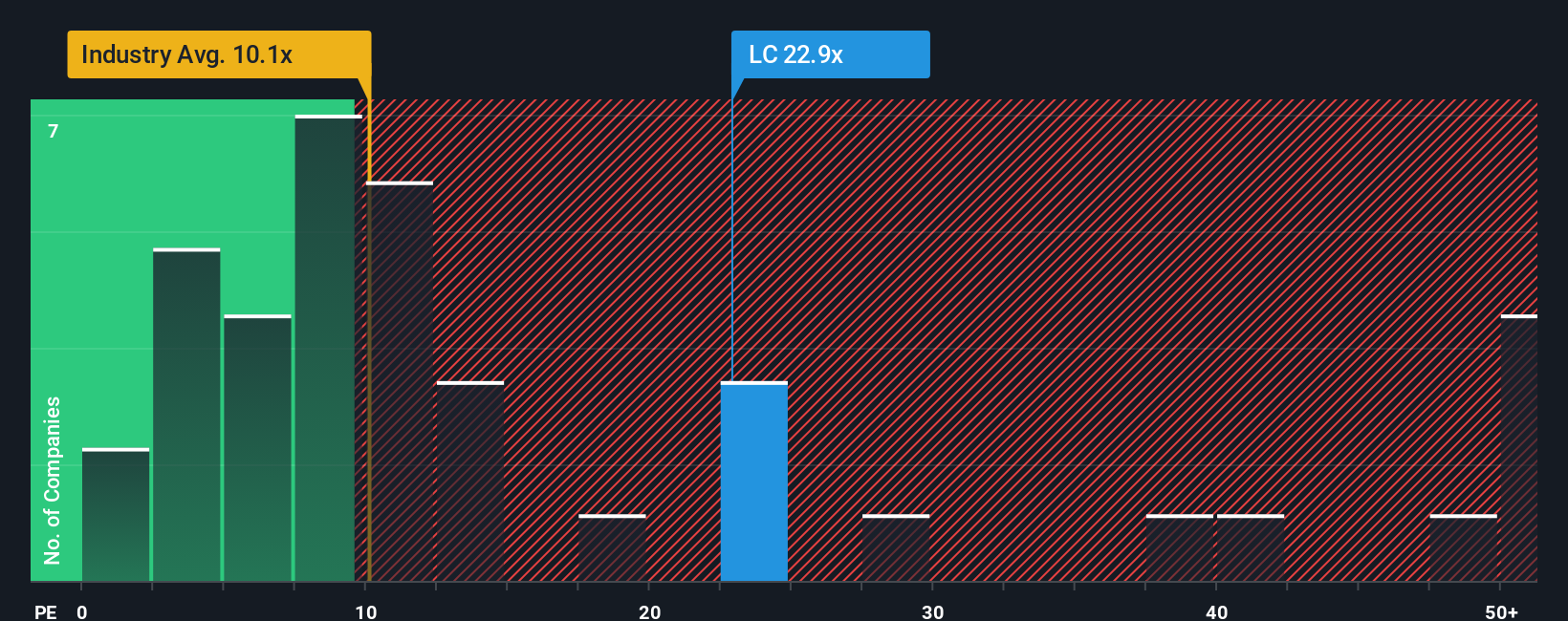

On earnings, LendingClub looks anything but cheap, trading at about 21.6 times profits, more than double the US consumer finance average of 10.3 times and well above peers at 6 times. Even if the fair ratio sits nearer 23.1 times, investors may be paying up early for growth that still has to arrive.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LendingClub Narrative

If you see the numbers differently or want to stress test your own assumptions, you can spin up a fresh narrative in minutes: Do it your way

A great starting point for your LendingClub research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop with one opportunity. Use the Simply Wall St Screener to uncover fresh, data driven ideas that could quietly reshape your portfolio returns.

- Capture high potential bargains early by scanning these 907 undervalued stocks based on cash flows built around cash flow strength and mispriced growth.

- Turbocharge your growth watchlist by targeting these 26 AI penny stocks that fuse automation, data and scalable software economics.

- Lock in potential income streams by reviewing these 15 dividend stocks with yields > 3% that pair reliable payouts with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com