Opendoor Technologies (OPEN) Is Down 7.1% After Multi-Index Removal Amid AI Pivot - What's Changed

- In late November 2025, Opendoor Technologies was removed from multiple S&P indices, including the S&P Total Market Index and S&P Global BMI, reflecting weaker index eligibility amid ongoing business pressures.

- This index exclusion comes as Opendoor is absorbing larger-than-expected quarterly losses while overhauling its model toward a software- and AI-driven home-selling platform, intensifying questions about its transition.

- We’ll now examine how Opendoor’s multi-index removal, alongside its AI-focused overhaul, may reshape the company’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Opendoor Technologies Investment Narrative Recap

To own Opendoor today, you need to believe it can turn its capital intensive iBuying engine into a scalable, software and AI powered platform that improves margins and manages housing risk. The multi index removal itself is unlikely to change the near term catalyst, which still centers on proving that higher acquisition volumes can be handled profitably, but it does underline the biggest risk right now: continued losses and constrained financial flexibility in a choppy housing market.

The recent Q3 2025 results bring this into focus, with a US$90 million quarterly net loss and a follow on equity offering filed soon after. That combination is highly relevant to the index exits, because it highlights both the need to fund Opendoor’s AI heavy overhaul and the risk that further dilution or balance sheet strain could blunt the upside from better pricing models, product expansion and higher conversion rates if execution falls short.

Yet behind the AI story, investors should be aware that Opendoor’s high levels of nonrecourse asset backed borrowings could...

Read the full narrative on Opendoor Technologies (it's free!)

Opendoor Technologies’ narrative projects $4.7 billion revenue and $239.7 million earnings by 2028. This assumes revenues decline by 2.9% per year and an earnings increase of about $544.7 million from -$305.0 million today.

Uncover how Opendoor Technologies' forecasts yield a $2.99 fair value, a 58% downside to its current price.

Exploring Other Perspectives

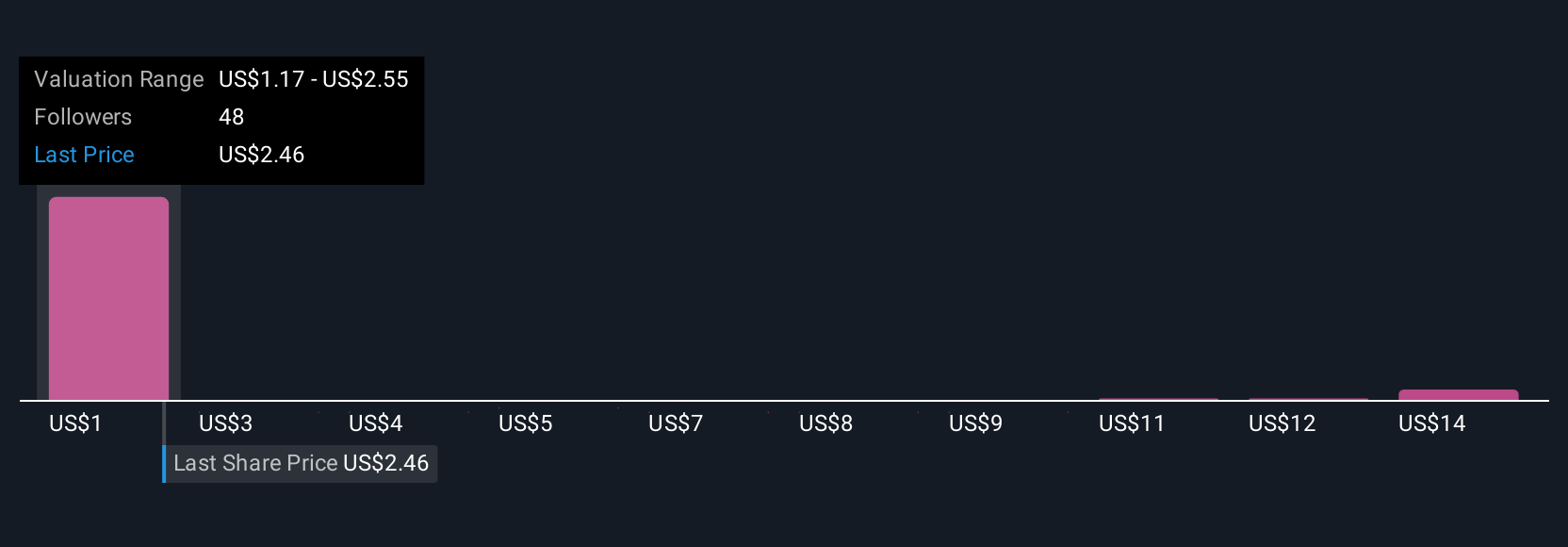

Twenty three members of the Simply Wall St Community estimate Opendoor’s fair value between US$0.70 and US$30.94 per share, reflecting highly divergent views. Against that wide dispersion, Opendoor’s exposure to inventory staying on market beyond 120 days raises important questions about earnings sensitivity that readers may want to explore through multiple viewpoints.

Explore 23 other fair value estimates on Opendoor Technologies - why the stock might be worth less than half the current price!

Build Your Own Opendoor Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Opendoor Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Opendoor Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Opendoor Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com