Is Shareholder Probe Into FDA Disclosures Reshaping the Investment Case for Cytokinetics’ Aficamten Story (CYTK)?

- In recent days, Grabar Law Office began investigating Cytokinetics, Inc. for potential breaches of fiduciary duty related to allegedly misleading disclosures about the FDA’s review of its New Drug Application for aficamten, including timing and communication around a Risk Evaluation and Mitigation Strategy requirement.

- This probe spotlights how communication around complex FDA processes can materially affect shareholder trust, particularly when life cycle–defining therapies like aficamten are involved.

- We’ll now examine how this shareholder investigation over FDA communication and REMS disclosure could reshape Cytokinetics’ investment narrative and risk profile.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Cytokinetics Investment Narrative Recap

To own Cytokinetics, you have to believe aficamten and the broader cardiac pipeline can justify today’s losses and heavy investment. The Grabar Law Office probe into disclosures around the FDA’s aficamten review and REMS timing directly touches the key near term catalyst and reinforces regulatory communication as a central business risk, but it does not by itself change the current PDUFA timeline or disclosed approval path.

Among recent announcements, the US Food and Drug Administration’s decision on 1 May 2025 to extend aficamten’s PDUFA action date to 26 December 2025, to fully review REMS considerations without requesting new data, is most relevant here. It underlines how REMS design and disclosure are now tightly linked to both the approval clock and Cytokinetics’ credibility at a moment when the company remains loss making and is relying on future cardiomyopathy revenues to support its US$500,000,000-plus capital raises and ongoing trial spend.

However, investors should be aware that the evolving REMS process could still...

Read the full narrative on Cytokinetics (it's free!)

Cytokinetics’ narrative projects $649.5 million revenue and $90.6 million earnings by 2028. This requires 96.4% yearly revenue growth and a $696.9 million earnings increase from $-606.3 million today.

Uncover how Cytokinetics' forecasts yield a $79.56 fair value, a 21% upside to its current price.

Exploring Other Perspectives

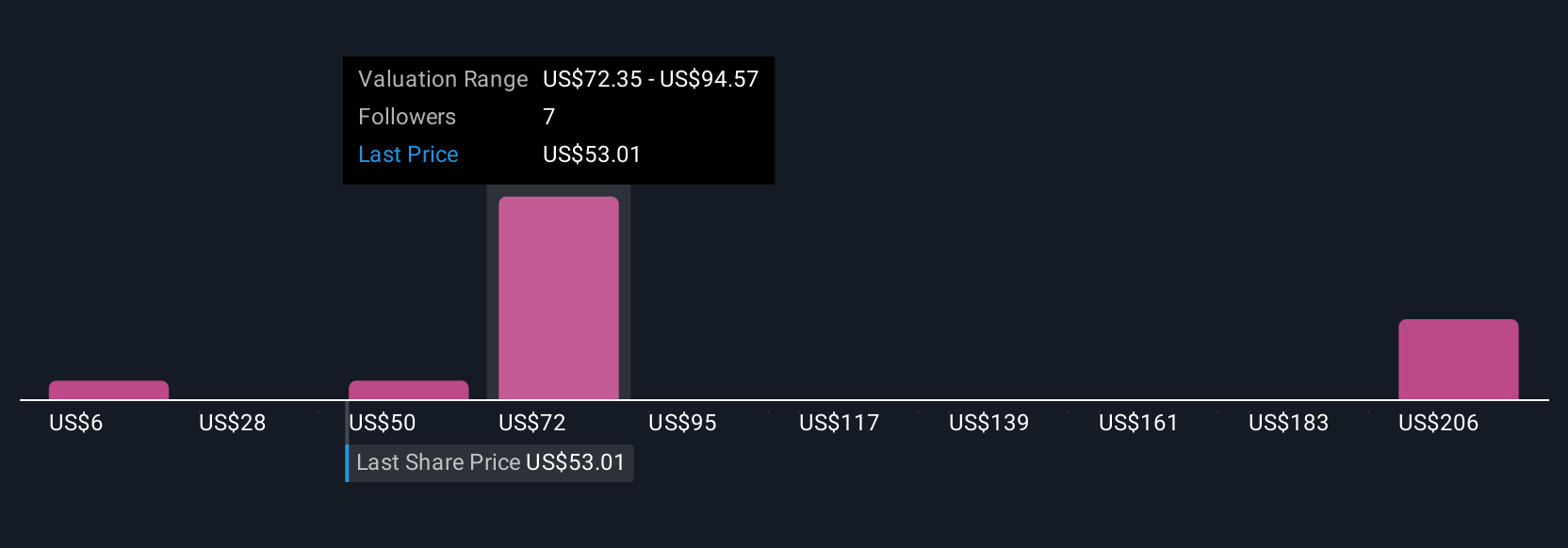

Five fair value estimates from the Simply Wall St Community range widely from about US$2.0 to US$112.9 per share, showing how far apart individual views can be. You are seeing that spread against a backdrop where aficamten’s extended FDA review and REMS related scrutiny sit at the heart of both upside potential and the most immediate regulatory risk, so it is worth exploring several perspectives before forming a view.

Explore 5 other fair value estimates on Cytokinetics - why the stock might be worth as much as 72% more than the current price!

Build Your Own Cytokinetics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cytokinetics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Cytokinetics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cytokinetics' overall financial health at a glance.

No Opportunity In Cytokinetics?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com