Is Taseko Mines (TSX:TKO) Overvalued After Its Strong Share Price Momentum?

Taseko Mines (TSX:TKO) has quietly turned into a serious momentum story this year, with the share price climbing sharply while its copper focused portfolio keeps churning out cash flow driven growth.

See our latest analysis for Taseko Mines.

That strong copper narrative is showing up in the numbers, with the share price now at $7.32 and a powerful uptrend reflected in its 30 day share price return of 18.64 percent and one year total shareholder return of 164.26 percent. This points to clear momentum rather than a short lived bounce.

If Taseko’s run has you thinking about what else might be gaining traction, this is a good moment to explore fast growing stocks with high insider ownership as potential next wave candidates.

Yet with analysts slightly below the current price and traditional valuation metrics looking stretched, the key question is whether Taseko Mines is still attractive at current levels, or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 3.4% Overvalued

Compared to the narrative fair value of CA$7.08, Taseko Mines last close at CA$7.32 bakes in a premium that hinges on ambitious growth assumptions.

The Florence Copper project is nearing completion, with first cathode production targeted for later this year and ramp up to design capacity next year. As one of few U.S. based producers, Florence stands to benefit from growing domestic demand for refined copper, particularly due to policy support for U.S. manufacturing and ongoing global electrification efforts, creating strong potential for revenue and earnings growth.

Curious how much future copper output, rising margins and a re rated profit multiple must climb to defend that price tag? The full narrative reveals the exact blueprint behind those projections, and the single assumption that does most of the heavy lifting.

Result: Fair Value of $7.08 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent permitting hurdles and heavy reliance on just a few assets mean any regulatory setback or operational issue could quickly undermine these upbeat assumptions.

Find out about the key risks to this Taseko Mines narrative.

Another Take on Valuation

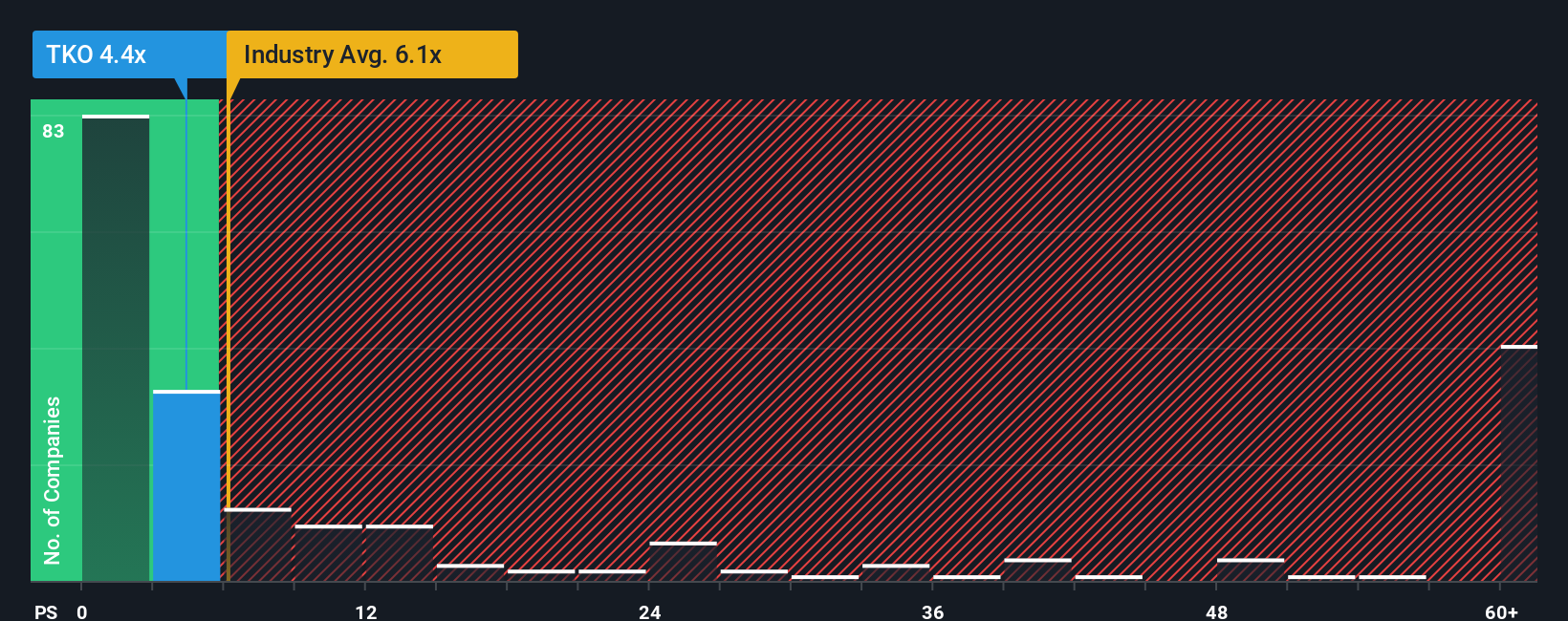

While the narrative fair value suggests Taseko Mines is 3.4 percent overvalued, its current price-to-sales ratio of 4.4 times paints a different picture. That is cheaper than the Canadian metals and mining industry at 6.4 times but richer than peers and the fair ratio of 3.4 times, which hints at limited margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Taseko Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Taseko Mines Narrative

If you see things differently or would rather dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Taseko Mines research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more high conviction ideas?

Before markets move on without you, put Simply Wall Street’s Screener to work and lock in your next set of smart, data backed opportunities today.

- Target powerful potential re rating stories by zeroing in on these 907 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Tap into tomorrow’s technology leaders by scanning these 26 AI penny stocks positioned to benefit from accelerating investment in artificial intelligence.

- Secure steadier income streams by reviewing these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow foundation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com