Evaluating StorageVault Canada (TSX:SVI) After Its New CAD 50 Million Hybrid Debenture Issue

New CAD 50 Million Debenture Issue Shifts Focus to StorageVault Canada's Balance Sheet

StorageVault Canada (TSX:SVI) has just closed a CAD 50 million fixed income deal, issuing 5.60% senior subordinated unsecured hybrid debentures due 2030. This move reshapes its funding mix and future flexibility.

See our latest analysis for StorageVault Canada.

The CAD 50 million debenture issue lands after a quietly improving run for the stock, with a year to date share price return of around 28% and a five year total shareholder return near 29%, suggesting momentum is rebuilding after a weaker three year TSR patch.

If this funding move has you rethinking where growth and resilience might come from next, it could be worth exploring fast growing stocks with high insider ownership as another source of ideas beyond StorageVault.

With fresh capital secured, solid revenue growth, and a modest upside to analyst targets, is StorageVault quietly setting up an attractive entry point for patient investors, or is the market already factoring in its next leg of expansion?

Price-to-Sales of 5.6x: Is it justified?

StorageVault Canada trades on a rich 5.6x price to sales ratio at its last close of CA$5.08, signaling the market is paying a premium versus peers.

The price to sales multiple compares the company’s market value to its annual revenue and is a common yardstick in real estate and other asset heavy, cash flow focused sectors where earnings can be volatile or currently negative, as is the case for StorageVault.

Here, investors are effectively accepting a higher price tag today, potentially in anticipation of steady mid single digit revenue growth and a path to improved profitability. Yet our work suggests that this premium stretches beyond what recent fundamentals and sector norms alone would usually support. A fair price to sales closer to 3.8x points to room for that valuation to compress.

Compared with the broader Canadian real estate industry average of about 2.6x price to sales and a peer group around 5.1x, StorageVault’s 5.6x stands out as distinctly expensive. The fair ratio of 3.8x highlights a level the market could eventually gravitate towards if sentiment or growth expectations cool.

Explore the SWS fair ratio for StorageVault Canada

Result: Price-to-Sales of 5.6x (OVERVALUED)

However, sustained losses and a valuation that already reflects robust growth leave little margin for execution missteps or a slowdown in storage demand.

Find out about the key risks to this StorageVault Canada narrative.

Another View on Value

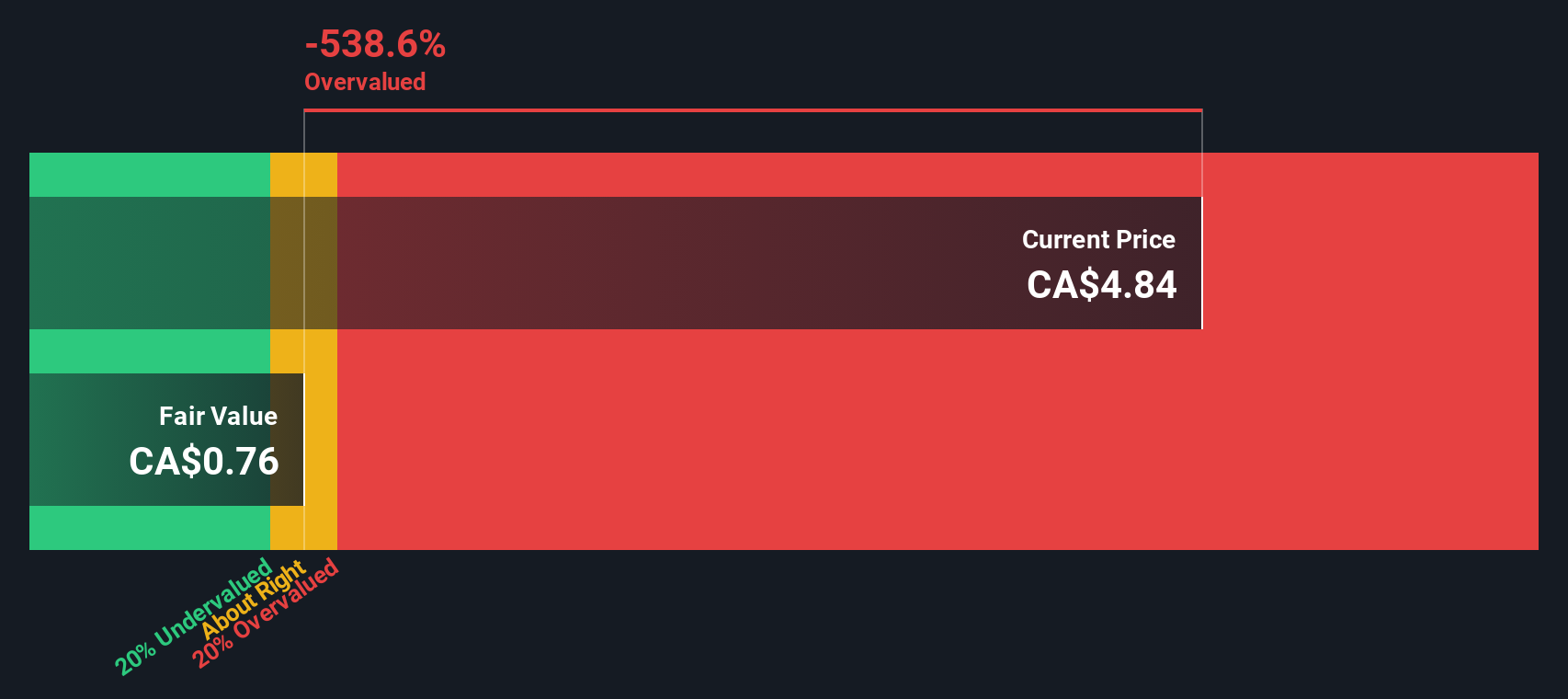

Our DCF model also points to a stretched valuation, with StorageVault trading around CA$5.08 versus an estimated fair value near CA$3.44. When both sales based metrics and cash flow estimates flag limited upside, it raises the question: what exactly is the market pricing in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out StorageVault Canada for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own StorageVault Canada Narrative

If you see StorageVault differently or simply want to dig into the numbers yourself, you can build a tailored view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding StorageVault Canada.

Looking for more investment ideas?

If you want to stay ahead of the crowd, use the Simply Wall St Screener to uncover fresh, data backed opportunities before the market fully catches on.

- Explore potential mispricings by scanning these 907 undervalued stocks based on cash flows that may offer different prospects than well known names like StorageVault.

- Prepare for the next wave of growth by targeting these 26 AI penny stocks that could benefit as artificial intelligence adoption develops.

- Review these 15 dividend stocks with yields > 3% to find companies that combine dividend yields with business models that appear resilient.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com