Perrone Robotics’ Patent Suits Over Automated Driving Software Might Change The Case For Investing In Mazda Motor (TSE:7261)

- Perrone Robotics and its affiliate recently filed patent infringement lawsuits in U.S. federal courts against seven major automakers, including Mazda, alleging unauthorized use of their automated vehicle and robotics technologies in advanced driving systems.

- The case spotlights how foundational software platforms for autonomy, once pioneered by a smaller specialist like Perrone, have become deeply embedded in mainstream vehicle safety and convenience features across the industry.

- We’ll now examine how Mazda’s inclusion in this broad patent dispute over automated driving software could shape its longer-term investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Mazda Motor's Investment Narrative?

To own Mazda today, you really need to believe in a steady, execution‑driven story: modest top‑line growth, a push into electrification and advanced software, and management’s ability to convert that into healthier margins after a year distorted by a large one‑off loss. The key near‑term catalysts still look centered on cost cuts to offset U.S. tariffs, uptake of newer models like the CX‑5 and plug‑in concepts, and whether earnings can move closer to the bullish growth forecasts that currently justify a relatively full earnings multiple and increased dividends. The new Perrone Robotics lawsuit adds a legal overhang, but at this stage it appears more like a background risk to Mazda’s software roadmap than something that changes the core earnings trajectory, unless it escalates into substantial licensing costs or damages.

But there is one legal and profitability risk here that investors should not ignore. Despite retreating, Mazda Motor's shares might still be trading 7% above their fair value. Discover the potential downside here.Exploring Other Perspectives

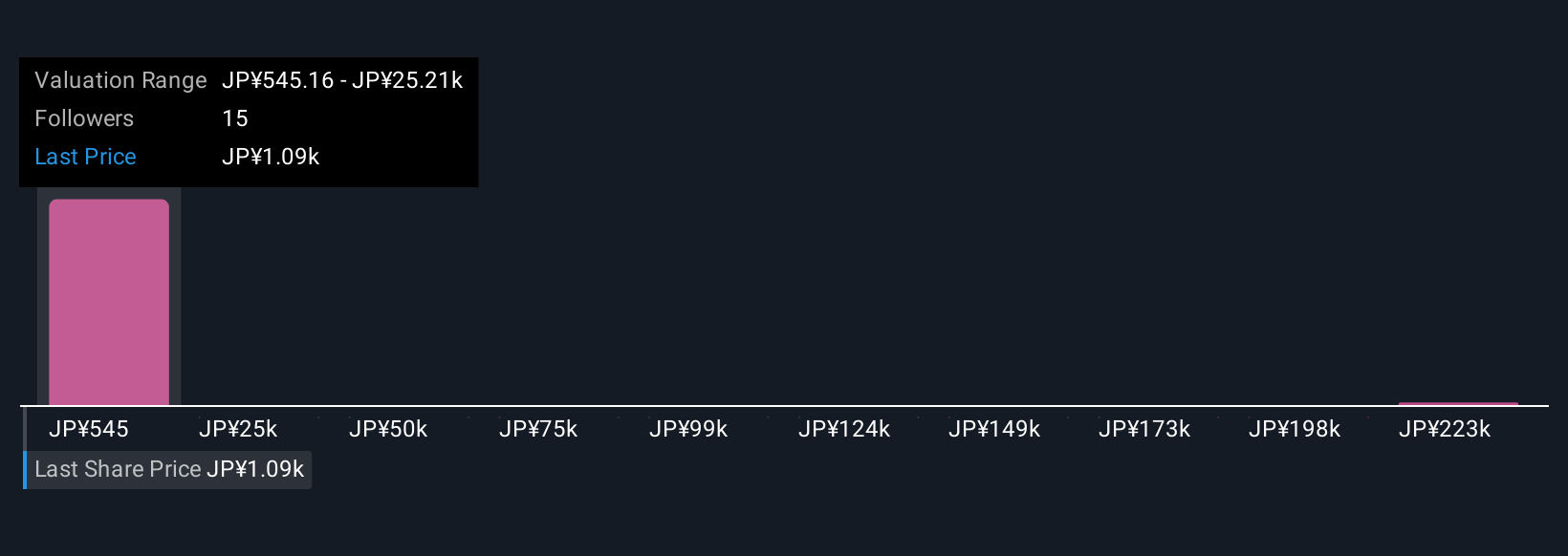

Eight Mazda fair value estimates from the Simply Wall St Community range from about ¥545 to a very large ¥247,182, showing how far apart individual views can be. Set that against Mazda’s current reliance on cost cuts and margin repair while a fresh software patent lawsuit quietly builds in the background, and you can see why it helps to weigh several perspectives before forming your own view.

Explore 8 other fair value estimates on Mazda Motor - why the stock might be worth less than half the current price!

Build Your Own Mazda Motor Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mazda Motor research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Mazda Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mazda Motor's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com