Xiaomi (SEHK:1810) Valuation Check After Record Q3 and 199% Smart EV Revenue Surge

Xiaomi (SEHK:1810) just posted a standout third quarter, with several metrics hitting record highs and its Cars unit delivering a breakthrough as smart electric vehicle and innovation revenue surged more than 199% year over year.

See our latest analysis for Xiaomi.

The upbeat quarter has helped Xiaomi regain some investor confidence, with the latest HK$42.78 share price sitting against a solid year to date share price return. A powerful three year total shareholder return above 270% suggests longer term momentum is still very much intact even after recent pullbacks.

If this earnings beat has sharpened your interest in the sector, it might be a good time to explore other high growth tech names through high growth tech and AI stocks.

With earnings surging, a record Cars breakout, and the share price still trading at a notable discount to analyst targets, is Xiaomi quietly undervalued here, or has the market already priced in its next wave of growth?

Most Popular Narrative Narrative: 26.1% Undervalued

With Xiaomi last closing at HK$42.78 against a narrative fair value near HK$57.89, the valuation case leans firmly toward meaningful upside potential.

Accelerated R&D investments in core areas like AI, chips, smart EVs, and connected hardware enable differentiated offerings and ecosystem lock in. This allows Xiaomi to ride the trend of AI hardware software convergence. Over time, these capabilities should expand higher margin services and recurring revenue, boosting earnings resilience.

Curious how fast revenue needs to climb, how margins must expand, and which future earnings multiple underpins that upside story? The full narrative reveals the exact growth runway and profit profile behind this bullish valuation roadmap.

Result: Fair Value of $57.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained smartphone price competition and slower international premiumization could squeeze margins and delay the earnings ramp needed to unlock that upside.

Find out about the key risks to this Xiaomi narrative.

Another View On Valuation

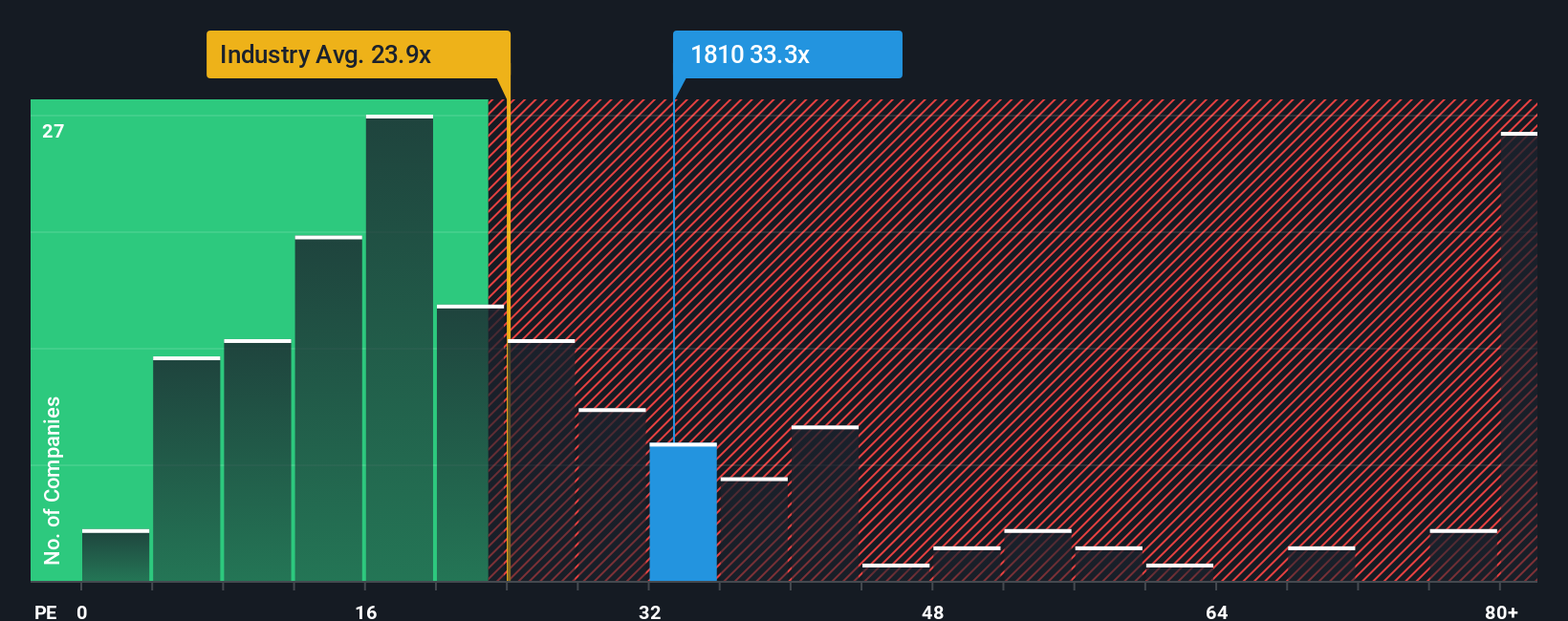

While the narrative fair value suggests upside, Xiaomi's current 22.9x earnings multiple looks stretched versus its 17.9x peer average, 22.8x Asian tech, and a 20.5x fair ratio. If sentiment cools, could a simple de rating erase much of that perceived undervaluation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xiaomi Narrative

If you see the numbers differently or want to dig into the assumptions yourself, you can build a personalized Xiaomi valuation narrative in minutes: Do it your way.

A great starting point for your Xiaomi research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one compelling story, your next edge could be hiding in plain sight among other high potential opportunities in the Simply Wall St Screener.

- Capture powerful price swings by scanning these 3572 penny stocks with strong financials that pair smaller market caps with surprisingly solid fundamentals and balance sheet strength.

- Ride structural tailwinds in automation and machine intelligence by zeroing in on these 26 AI penny stocks built to benefit from long term AI adoption across industries.

- Lock in income potential and stability by targeting these 15 dividend stocks with yields > 3% that offer attractive yields without sacrificing financial resilience or long term growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com