Did First-in-Human BRAVESST2 Trial of CRN09682 Just Shift Crinetics Pharmaceuticals' (CRNX) Investment Narrative?

- Crinetics Pharmaceuticals recently dosed the first patient in its Phase 1/2 BRAVESST2 trial of CRN09682 for metastatic or locally advanced somatostatin receptor type 2 (SST2)-positive neuroendocrine and other SST2-expressing solid tumors.

- The trial marks the first clinical test of Crinetics’ nonpeptide drug conjugate platform, which aims to deliver potent cytotoxic therapy selectively to SST2-expressing tumor cells using small-molecule manufacturing rather than antibody or radiopharmaceutical approaches.

- Next, we’ll examine how this first-in-human trial of CRN09682, built on Crinetics’ nonpeptide drug conjugate platform, shapes its investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Crinetics Pharmaceuticals' Investment Narrative?

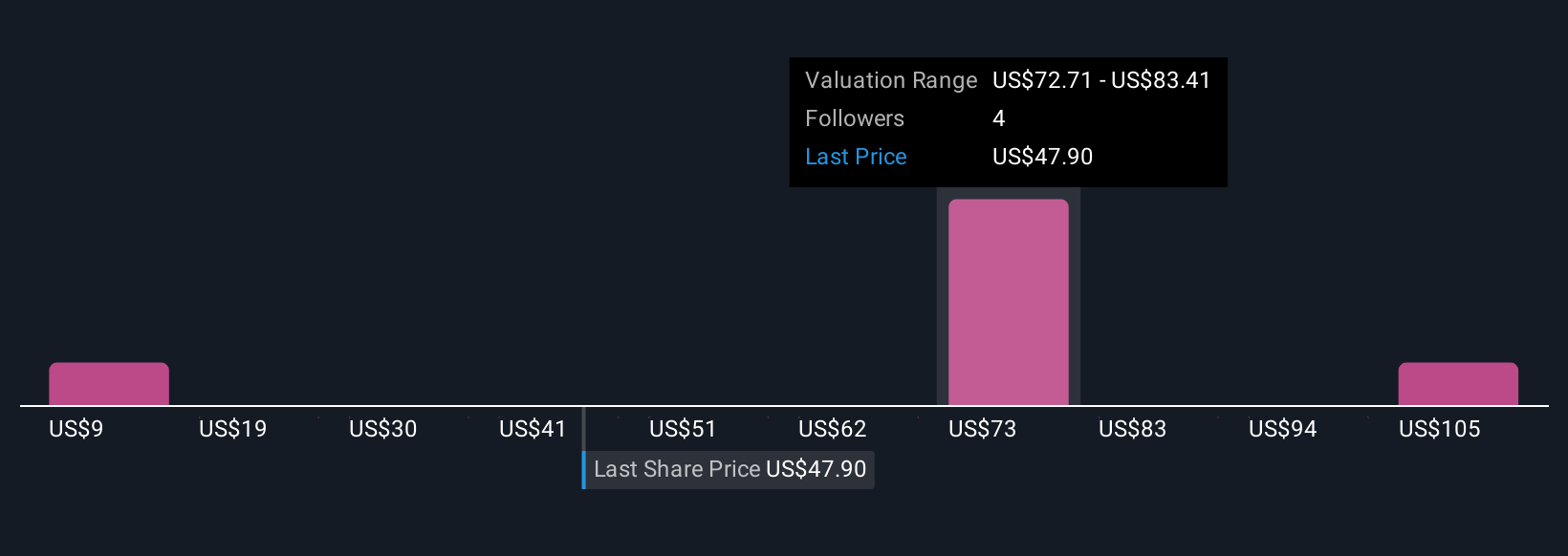

For someone considering Crinetics, the basic belief is that its endocrine-focused pipeline can eventually justify years of losses and limited current revenue. The recent first-patient dosing of CRN09682 adds an earlier-stage, higher-risk oncology angle on top of the core paltusotine story, but it is unlikely to shift the near-term catalysts that still hinge on PALSONIFY’s commercial ramp in acromegaly and key Phase 3 data in carcinoid syndrome. Instead, BRAVESST2 subtly reshapes the risk–reward profile: success could broaden the franchise into SST2-expressing tumors, while setbacks would reinforce dependence on a single commercial asset in the face of heavy annual net losses and ongoing cash burn. Given the share price is still well below consensus fair value, how investors weigh these trade-offs is crucial.

However, one operational risk tied to that widening pipeline may surprise some investors. Crinetics Pharmaceuticals' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Crinetics Pharmaceuticals - why the stock might be worth over 2x more than the current price!

Build Your Own Crinetics Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crinetics Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Crinetics Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crinetics Pharmaceuticals' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com