First Quantum Minerals (TSX:FM) Valuation After New Hachita Copper-Gold Exploration Option Deal

First Quantum Minerals (TSX:FM) just struck an option deal with Elemental Royalties for the Hachita copper gold project in New Mexico, a measured step that quietly extends its long term exploration runway.

See our latest analysis for First Quantum Minerals.

The move comes as First Quantum’s share price sits at $33.31 and has enjoyed a strong run, with a roughly 35% 3 month share price return and year to date share price gains above 70%. This suggests momentum is rebuilding as investors reassess its growth pipeline and risk profile.

If this deal has you thinking about where the next leg of growth in resources might come from, it could be worth exploring fast growing stocks with high insider ownership for other fast moving ideas.

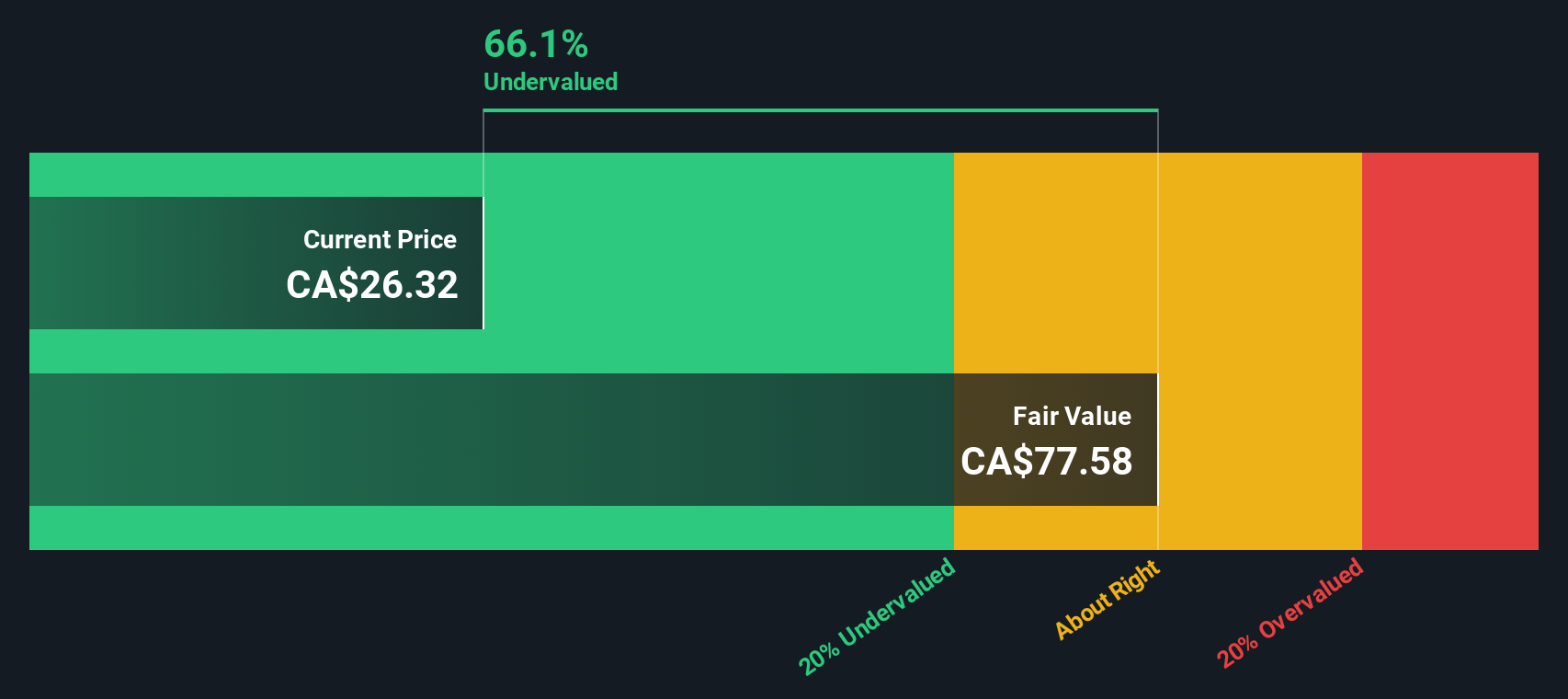

With earnings rebounding, a rich project pipeline, and the shares trading only slightly below analyst targets despite a sizable intrinsic value gap, the key question now is simple: is First Quantum still attractive at current levels, or is future growth already priced in?

Price to Sales of 4x, is it justified?

On a price to sales basis, First Quantum screens as modestly undervalued versus peers, even after the sharp share price rebound toward CA$33.31.

The price to sales multiple compares the company’s market value to its annual revenue. This can be a useful lens for cyclical, capital intensive miners where earnings can swing sharply. For First Quantum, the current price to sales ratio sits at roughly 4 times, slightly below the peer average of 4.1 times. This implies investors are not paying a premium for its current revenue base despite the recovery in profitability.

Relative to the broader Canadian Metals and Mining industry, the gap is even starker. The sector trades around 6.4 times sales while First Quantum sits closer to 4 times. That discount also persists against an estimated fair price to sales ratio of 4.4 times, suggesting there is room for the market to re rate the shares higher if its strong forecast revenue and earnings growth materialise.

Explore the SWS fair ratio for First Quantum Minerals

Result: Price to Sales of 4x (UNDERVALUED)

However, risks remain, including potential setbacks at key copper assets and volatility in commodity prices that could derail earnings momentum and potential valuation gains.

Find out about the key risks to this First Quantum Minerals narrative.

Another View, the DCF gap is much wider

While the 4x price to sales ratio hints at modest undervaluation, our DCF model presents a much wider gap in estimated value. It places fair value near CA$93.85 per share, around 65% above today’s CA$33.31. This raises the question of whether the market is significantly mispricing First Quantum’s long term cash generation.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Quantum Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Quantum Minerals Narrative

If you see the numbers differently or simply prefer your own due diligence, you can build a personalised view of First Quantum in minutes: Do it your way.

A great starting point for your First Quantum Minerals research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, consider using the Simply Wall St Screener to explore high conviction opportunities you might otherwise miss.

- Capture early stage momentum by scanning these 3574 penny stocks with strong financials that pair smaller market caps with relatively solid financial foundations.

- Position yourself for innovation-focused exposure by targeting these 26 AI penny stocks that combine artificial intelligence tailwinds with scalable business models.

- Seek more resilient portfolio income by focusing on these 15 dividend stocks with yields > 3% that offer yields supported by sustainable payout capacity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com