WesBanco (WSBC) Valuation Check After Dividend Hike and Preferred Stock Refinancing Steps

WesBanco (WSBC) just gave investors a clearer signal on capital priorities, lifting its quarterly dividend by 3% and outlining a full redemption of its Series A preferred shares, funded with newer Series B preferred.

See our latest analysis for WesBanco.

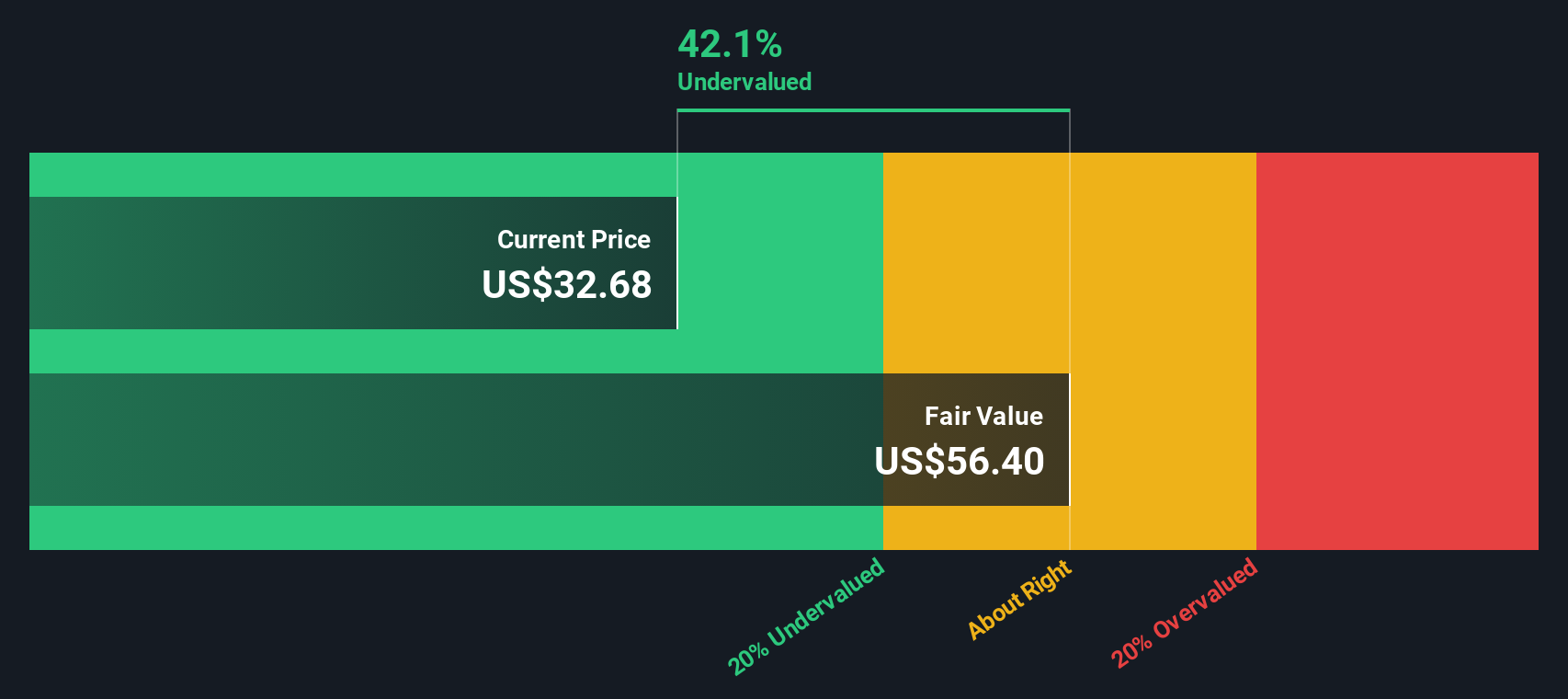

That message seems to be resonating slowly in the market, with a 1 month share price return of 5.8% taking WesBanco to $32.68, even as the 1 year total shareholder return remains slightly negative and long term gains stay respectable. Recent headlines, from the dividend hike to a director share sale and the preferred stock refinancing, all point to a bank tightening its capital structure and nudging expectations for steadier growth rather than chasing rapid re rating.

If you like the combination of income and stability here, it is also worth seeing how other regional and niche lenders stack up by screening for solid balance sheet and fundamentals stocks screener (None results).

With earnings and income growth outpacing the share price, and analysts still seeing double digit upside, the real question now is whether WesBanco is quietly undervalued or if the market is already pricing in the next leg of growth.

Most Popular Narrative: 12.7% Undervalued

Compared with WesBanco's last close at $32.68, the most widely followed narrative points to a higher fair value, built on aggressive growth and margin expansion assumptions.

Analysts expect earnings to reach $821.3 million (and earnings per share of $7.52) by about September 2028, up from $125.2 million today. The analysts are largely in agreement about this estimate.

Want to see how such a steep earnings ramp, richer profit margins and a compressed future earnings multiple still add up to upside? The full narrative unpacks the exact growth runway, profitability shift and discount rate those forecasts depend on, and how they combine into a fair value that sits comfortably above where the market is pricing WesBanco today.

Result: Fair Value of $37.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained commercial real estate softness or slower digital investment could derail those growth assumptions and lead investors to temper their expectations.

Find out about the key risks to this WesBanco narrative.

Another Angle on Valuation

While the narrative points to a 12.7% upside, our DCF model paints a far bolder picture, putting fair value near $56.40, roughly 42% above today’s price. That kind of gap could signal real mispricing or just very demanding assumptions. Which story do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own WesBanco Narrative

If you see the story differently or simply prefer running your own numbers, you can build a personalized view in under three minutes: Do it your way.

A great starting point for your WesBanco research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next opportunity?

If WesBanco interests you, do not stop here. Use the Simply Wall St Screener to uncover fresh ideas that could strengthen and diversify your portfolio.

- Capture powerful income potential by scanning these 15 dividend stocks with yields > 3% that may support regular cash returns while still leaving room for long term growth.

- Position yourself early in transformative tech by filtering for these 26 AI penny stocks that are using artificial intelligence to reshape entire industries.

- Sharpen your value strategy by targeting these 908 undervalued stocks based on cash flows where market prices appear out of sync with underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com