Reassessing GLP J-REIT (TSE:3281) Valuation After Its ESG-Linked Green Loan Refinancing Initiative

GLP J-REIT (TSE:3281) has announced a sizable refinancing plan that rolls upcoming 2025 and 2026 debt into longer dated loans, including a green facility, which tightens its balance sheet while reinforcing its ESG financing story.

See our latest analysis for GLP J-REIT.

The refinancing news lands after a solid run, with GLP J-REIT’s 90 day share price return of 8.47% and 1 year total shareholder return of 21.24%, suggesting momentum is still building rather than fading.

If this kind of steady, income focused story appeals, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With units still trading at a double digit discount to analyst targets despite healthy growth and a de risked debt profile, is GLP J-REIT quietly undervalued, or is the market already pricing in years of future expansion?

Price-to-Earnings of 40.2x: Is it justified?

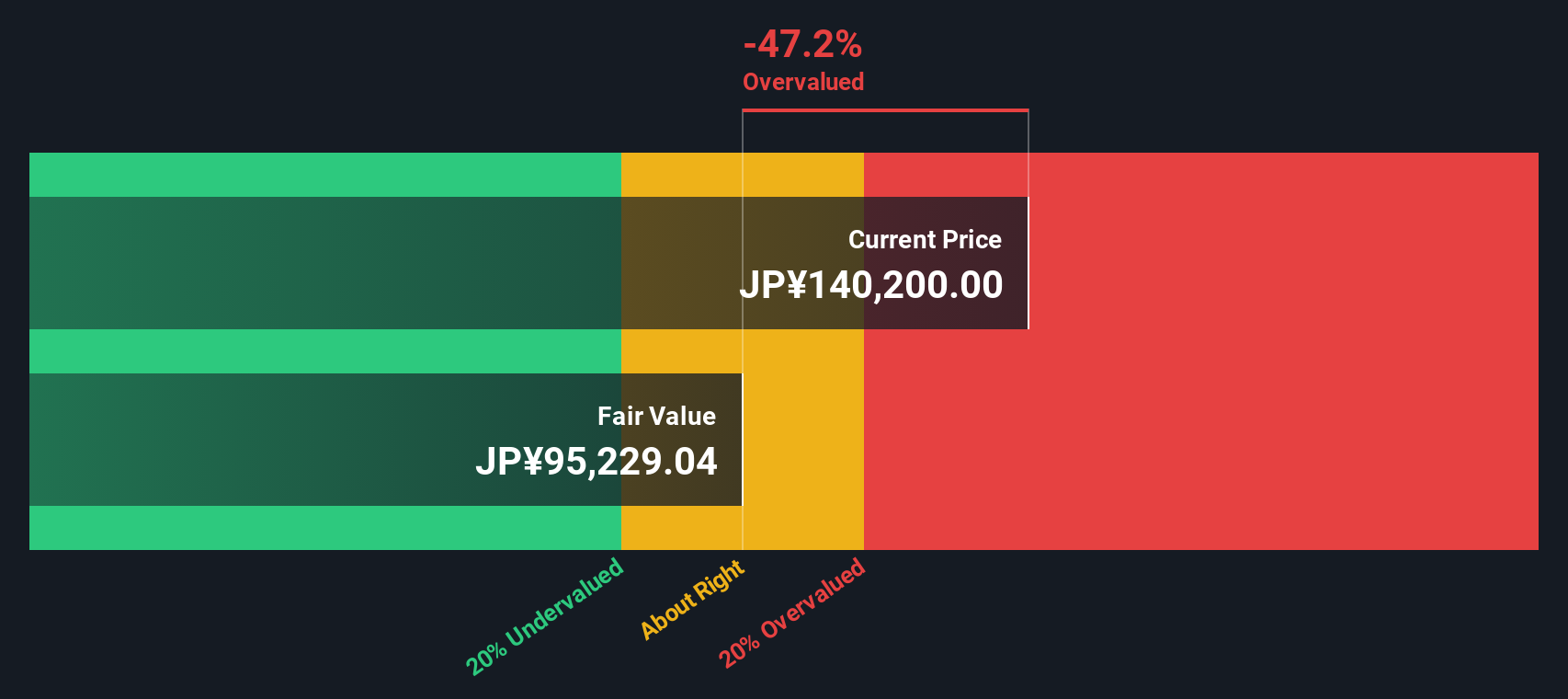

On a simple comparison, GLP J-REIT looks richly priced at ¥143,500 per unit, with its 40.2x price to earnings multiple sitting well above both peers and fair value estimates.

The price to earnings ratio compares today’s unit price with the REIT’s earnings, so a higher figure usually signals that investors are paying up for future profit growth or income stability. For a logistics focused J-REIT with solid growth ambitions, a premium is not unusual. However, the current gap raises the question of how much future expansion is already embedded in the price.

Against its own estimated fair price to earnings ratio of 27.2x, the current 40.2x suggests the market is assigning a far richer multiple than the level our fair ratio work implies it could ultimately gravitate toward. The premium is even starker versus the Asian industrial REITs average of 18.4x and a peer group average of 33.2x. This means investors are paying more per unit of earnings than they are for comparable names in the same space.

Explore the SWS fair ratio for GLP J-REIT

Result: Price-to-earnings of 40.2x (OVERVALUED)

However, lingering macro risks, including higher rates or weaker logistics demand, could pressure valuations and challenge assumptions behind GLP J-REIT’s premium pricing.

Find out about the key risks to this GLP J-REIT narrative.

Another View: DCF Flags Even Less Value Support

Our DCF model paints an even starker picture, putting fair value at about ¥88,643 versus the current ¥143,500 price. That implies GLP J-REIT is trading well above what its future cash flows may justify, raising the question of how long sentiment alone can sustain this premium.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GLP J-REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GLP J-REIT Narrative

If you would rather challenge these assumptions and work from the raw numbers, you can build a personalised view in minutes: Do it your way.

A great starting point for your GLP J-REIT research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider your next move by scanning fresh opportunities our screeners surface every day so you are not left watching from the sidelines.

- Capture growth by targeting underappreciated businesses using these 908 undervalued stocks based on cash flows, which pairs solid fundamentals with prices still catching up to their potential.

- Tap into structural shifts in healthcare by zeroing in on companies harnessing artificial intelligence through these 30 healthcare AI stocks to support advances in patient outcomes and efficiency.

- Focus on income by concentrating on reliable payers via these 15 dividend stocks with yields > 3%, combining attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com