Is Q3 Beat And Higher Guidance Altering The Investment Case For Quanta Services (PWR)?

- In the past quarter, Quanta Services reported stronger-than-expected Q3 2025 results, with both adjusted EPS and revenue surpassing forecasts, and raised its full-year revenue guidance while reaffirming confidence in its adjusted EPS outlook.

- This outperformance highlights the momentum in Quanta’s electric and renewable infrastructure segments, underlining how large, long-duration power projects are increasingly shaping its earnings profile.

- We’ll now examine how Quanta’s raised full-year revenue guidance may influence its existing investment narrative around long-term grid and renewables growth.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Quanta Services Investment Narrative Recap

To own Quanta Services, you need to believe that long-lived investments in power grids and renewables will keep translating into profitable, contract-backed work. The Q3 2025 beat and higher revenue guidance reinforce that trend and appear to support, rather than materially change, the near term catalyst around large transmission and renewable project awards, while the key risk remains potential slowdowns in utility and data center capital spending that could weaken backlog visibility.

Among recent announcements, the roughly 10% increase in the quarterly dividend to US$0.11 per share stands out in the context of Quanta’s raised revenue outlook. For investors, this pairing of stronger top line expectations with a higher cash return can signal confidence in converting today’s record project pipelines into future earnings and cash flows, even as complex, politically sensitive grid projects and permitting hurdles remain an overhang for execution timing.

Yet despite the strong recent results, investors should also be aware of the risk that large power transmission projects can face politically driven delays and cancellations...

Read the full narrative on Quanta Services (it's free!)

Quanta Services' narrative projects $37.5 billion revenue and $1.7 billion earnings by 2028. This requires 12.9% yearly revenue growth and roughly a $0.7 billion earnings increase from $971.8 million today.

Uncover how Quanta Services' forecasts yield a $474.38 fair value, a 3% upside to its current price.

Exploring Other Perspectives

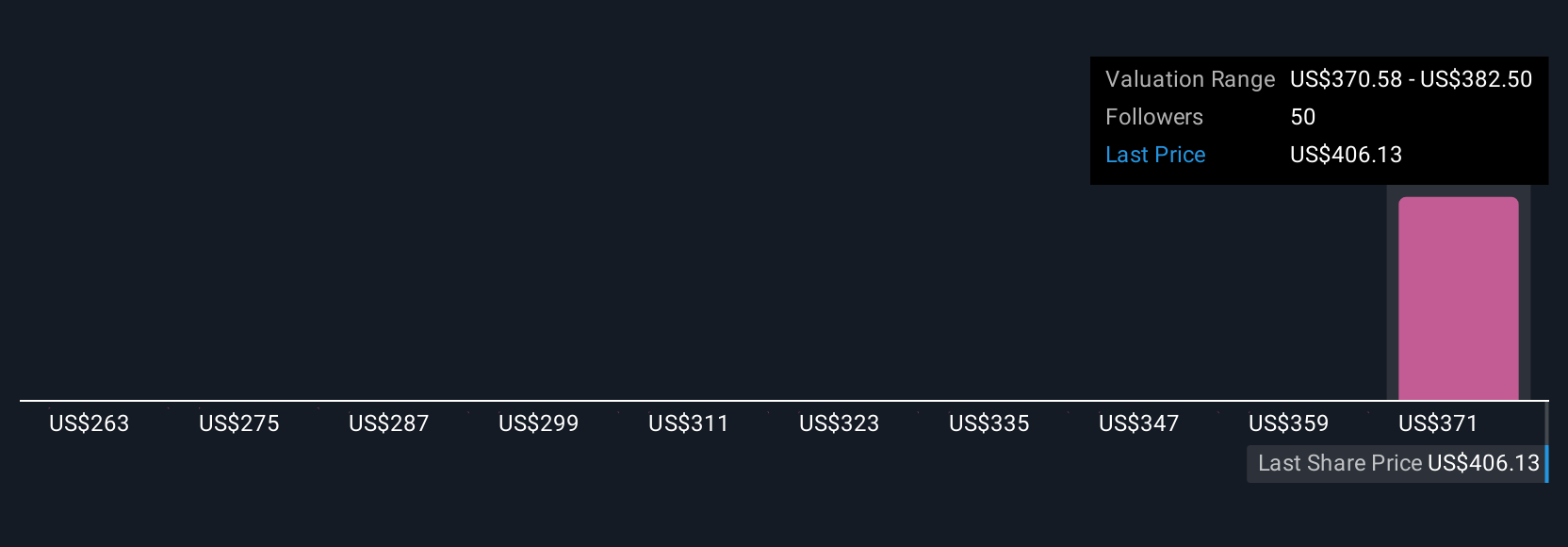

Five Simply Wall St Community fair value estimates for Quanta span roughly US$263 to US$474 per share, underscoring how widely individual views can differ. Against this backdrop, the raised full year revenue guidance tied to grid and renewables demand highlights why some investors see powerful long term tailwinds, while others remain cautious about project timing and regulatory risk.

Explore 5 other fair value estimates on Quanta Services - why the stock might be worth 43% less than the current price!

Build Your Own Quanta Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quanta Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Quanta Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quanta Services' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com