Can CBRE’s Latest Industrial Sale and Life Science Leases Redefine Its Mixed‑Use Strategy (CBRE)?

- Recently, CBRE arranged the sale of a 20‑property last‑mile industrial and light manufacturing portfolio across eight US states and secured four new leases totaling 101,144 square feet at its redeveloped Andover, Massachusetts office and life science campus.

- Together, these transactions highlight CBRE’s ability to win complex industrial mandates while also capturing demand for flexible, higher‑quality office, medical and lab space in key regional markets.

- We’ll now examine how this strong deal flow, particularly the industrial portfolio sale, could influence CBRE’s existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

CBRE Group Investment Narrative Recap

To own CBRE, you need to believe in its ability to convert its global real estate platform into steady fee income across cycles, while managing interest rate and recession sensitivity in its transaction heavy businesses. The recent last mile industrial portfolio sale and Andover leasing wins support that thesis but do not materially change the near term catalyst, which remains transaction volumes, or the key risk from a slowdown in large leasing and capital markets deals.

Among recent announcements, Barclays initiating coverage with an Overweight rating and a US$190 price target is most relevant, because it directly speaks to how the market currently views CBRE’s deal pipeline, capital deployment and earnings power. Against that backdrop, the new industrial mandate and life science oriented leasing help illustrate the kind of activity that underpins those expectations, but investors still need to watch how sensitive similar transactions are to rates and macro conditions.

Yet while deal flow looks healthy, investors should be aware of how quickly a slowdown in large industrial leasing could...

Read the full narrative on CBRE Group (it's free!)

CBRE Group's narrative projects $50.0 billion revenue and $2.3 billion earnings by 2028. This requires 9.5% yearly revenue growth and roughly a $1.2 billion earnings increase from $1.1 billion today.

Uncover how CBRE Group's forecasts yield a $180.50 fair value, a 12% upside to its current price.

Exploring Other Perspectives

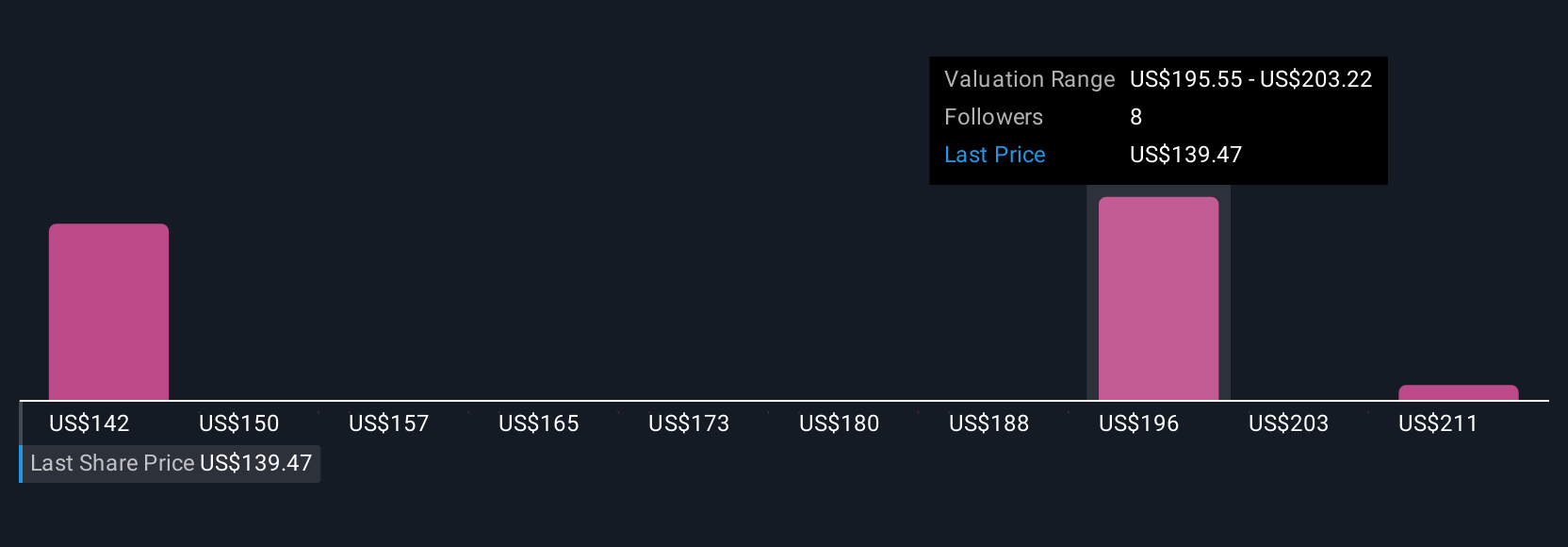

Three Simply Wall St Community valuations for CBRE span roughly US$144 to US$219 per share, underscoring how far apart individual views can be. You can weigh those against the current concern that weaker large scale leasing could pressure CBRE’s transaction revenue and margins, then explore how different assumptions on deal activity shape very different outcomes.

Explore 3 other fair value estimates on CBRE Group - why the stock might be worth 10% less than the current price!

Build Your Own CBRE Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CBRE Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBRE Group's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com