Weimob (SEHK:2013) Valuation After CEO’s AI-Focused Share Purchase and New Incentive Plans

Weimob (SEHK:2013) just saw its chairman and CEO, Sun Taoyong, scoop up another 1,534,000 shares. This move puts real money behind the company’s AI focused strategy and recent incentive plans.

See our latest analysis for Weimob.

That confidence comes after a tough stretch, with Weimob’s share price down 40.18 percent year to date and a 90 day share price return of minus 17.84 percent, even as the 1 year total shareholder return is a positive 21.47 percent. This suggests recent insider buying and new RSU incentives may be an attempt to reignite fading momentum.

If this mix of pressure and potential has your attention, it could be a good moment to see what else is happening across high growth tech and AI names through high growth tech and AI stocks.

With the stock still down sharply over three and five years but trading at a sizeable discount to analyst targets, investors are left weighing the upside of an AI turnaround against the risk that the market already anticipates it.

Most Popular Narrative: 26.5% Undervalued

With Weimob last closing at HK$1.98 against a narrative fair value near HK$2.69, the story hinges on aggressive growth and margin recovery.

The analysts have a consensus price target of HK$2.692 for Weimob based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$3.22, and the most bearish reporting a price target of just HK$1.55.

Want to see what kind of revenue ramp, margin swing, and future earnings multiple are being baked into that target? The growth assumptions behind this valuation might surprise you.

Result: Fair Value of $2.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Tencent ecosystem stability and manageable competition, with tougher platform terms or rival gains quickly undermining the growth and margin story.

Find out about the key risks to this Weimob narrative.

Another Way to Look at Valuation

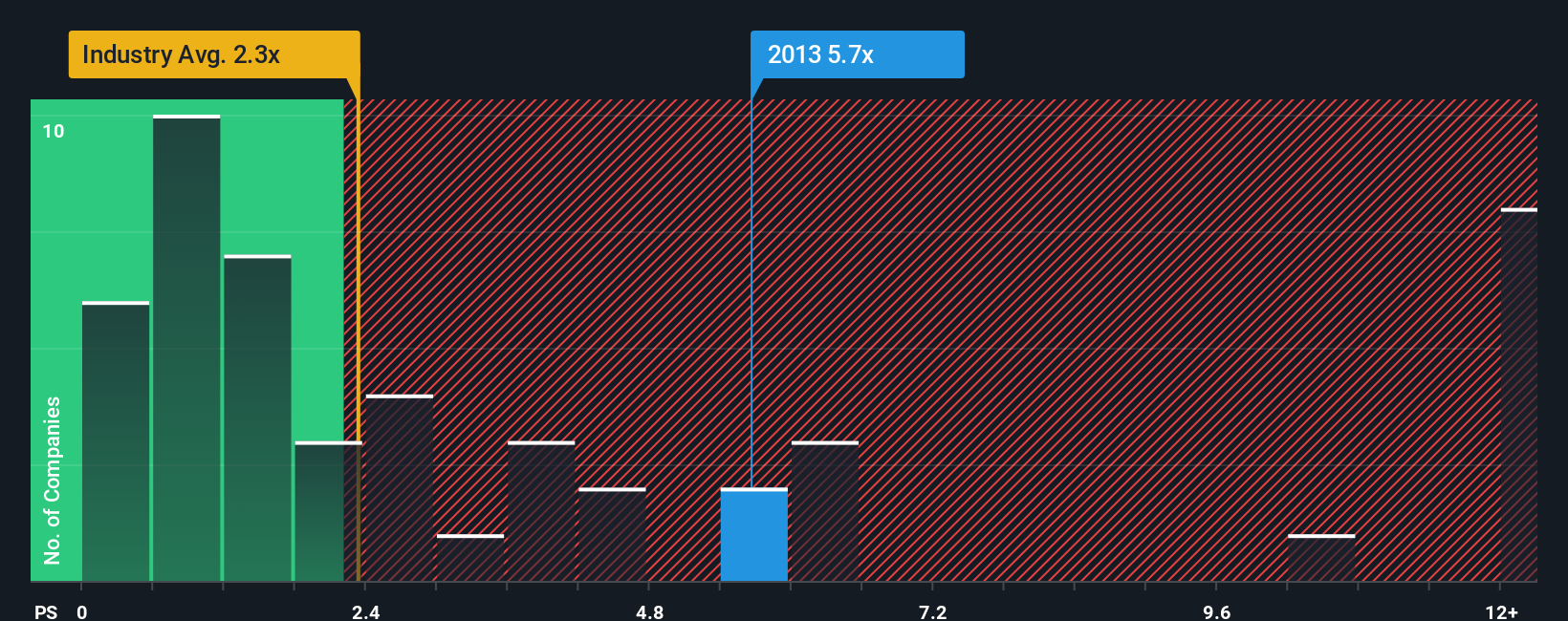

On sales, Weimob looks far less forgiving. Its price to sales ratio is around 5.7 times versus 3.1 times for peers and a fair ratio of 3.5 times. This implies the market already prices in a big recovery, leaving less room for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Weimob Narrative

If you see things differently or want to dig into the numbers yourself, you can build a custom view of the story in under three minutes: Do it your way.

A great starting point for your Weimob research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one story; use the Simply Wall St Screener to uncover fresh opportunities that match your strategy before the market moves on without you.

- Target reliable income by scanning these 15 dividend stocks with yields > 3% that can help anchor your portfolio with steady cash flow.

- Capitalize on structural growth by reviewing these 30 healthcare AI stocks transforming medicine, diagnostics, and patient care with intelligent technology.

- Position yourself early in the digital finance shift by evaluating these 81 cryptocurrency and blockchain stocks shaping the future of payments and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com