Old National Bancorp (ONB): Assessing Valuation Following Longtime Commercial Banking Leader’s Retirement Announcement

Old National Bancorp (ONB) just signaled a major leadership transition by announcing that longtime Commercial Banking CEO Jim Sandgren will retire in April 2026, raising fresh questions about succession and future strategy.

See our latest analysis for Old National Bancorp.

The leadership news lands as Old National’s share price trades around $22.30, with a 1 month share price return of 6.24 percent but a slightly negative 1 year total shareholder return. This suggests that near term momentum is improving while longer term gains are still consolidating.

If this kind of leadership shift has you thinking more broadly about where growth and conviction overlap, it might be worth exploring fast growing stocks with high insider ownership as your next discovery step.

With earnings still growing briskly and the shares trading at a noticeable discount to analyst targets and some intrinsic value estimates, is Old National quietly undervalued, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 13.4% Undervalued

With Old National trading at $22.30 against a narrative fair value of $25.75, the story points to notable upside if the growth path holds.

Strategic investment in digital banking infrastructure, highlighted by recent technology hires and ongoing upgrades, is enabling ONB to scale services efficiently, enhance client experience, and capitalize on the sector wide shift toward digital and data driven banking. This may support greater noninterest income, changes in net margins, and changes in client retention over time.

The valuation reflects specific assumptions about potential future earnings, revenue trends, and margins. The full narrative details the underlying growth expectations, the anticipated shift in profit mix, and the multiple used to support the fair value estimate.

Result: Fair Value of $25.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained CRE exposure and softer loan growth from Bremer run offs could pressure credit quality and revenue, which would challenge the upside implied by today’s valuation.

Find out about the key risks to this Old National Bancorp narrative.

Another View: Market Multiple Sends a Different Signal

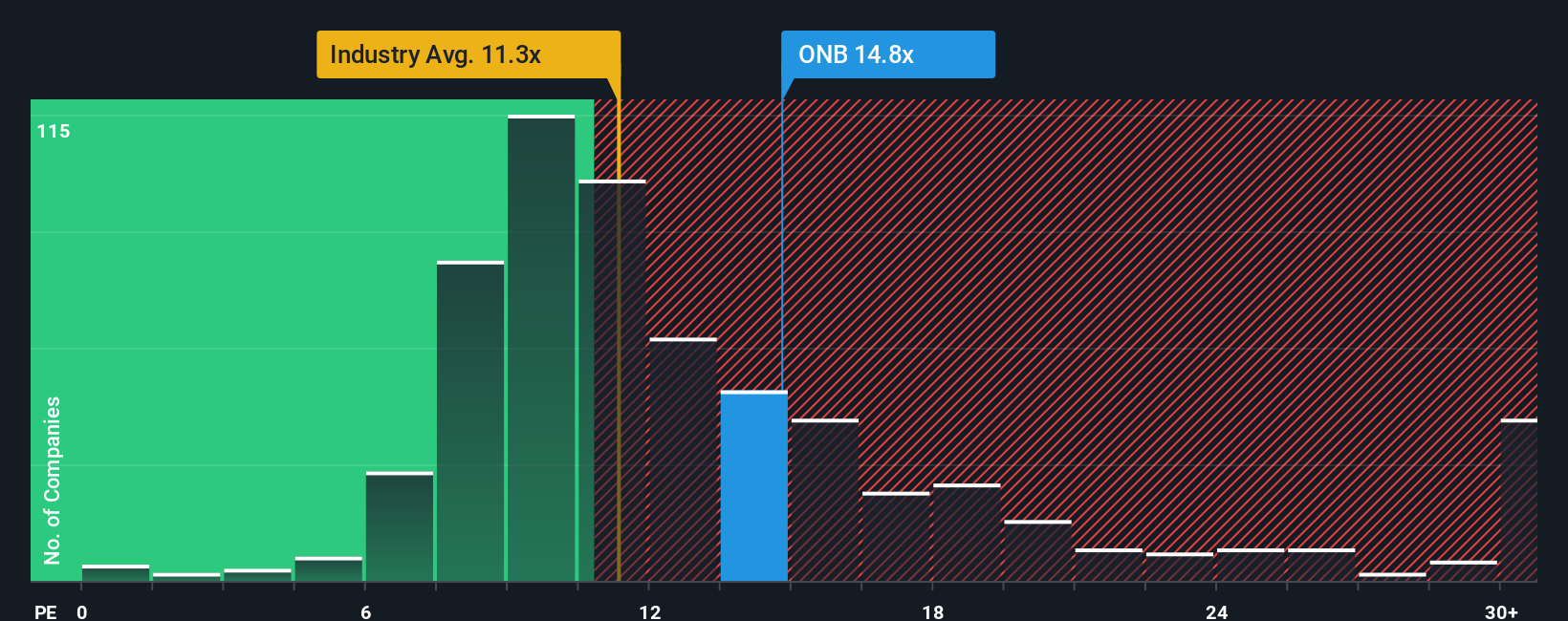

While the narrative and intrinsic estimates point to upside, the market’s own yardstick tells a more cautious story. ONB trades on a price to earnings ratio of 14.8 times, richer than both the US Banks industry at 11.6 times and close peers at 12.3 times. Even against a fair ratio of 18.2 times, that premium suggests less obvious mispricing and more valuation risk if growth underwhelms.

Does this higher earnings multiple reflect durable earnings power, or is it leaving less room for error than the intrinsic value case implies?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Old National Bancorp Narrative

If you prefer to weigh the numbers yourself and challenge these assumptions, you can build a personalized view of ONB in just minutes: Do it your way.

A great starting point for your Old National Bancorp research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next opportunity by using the Simply Wall Street Screener to spot fresh, data backed ideas you might otherwise overlook.

- Identify potential mispricings early by scanning these 908 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Support your growth strategy by targeting these 26 AI penny stocks that could be well placed to benefit from the adoption of artificial intelligence across industries.

- Reinforce your income stream by focusing on these 15 dividend stocks with yields > 3% that may offer ongoing payouts while still leaving room for capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com