Teradyne (TER) Is Up 10.4% After AI-Focused Analyst Upgrades Reframe Its Semiconductor Role

- In recent days, Teradyne’s shares moved higher after multiple research firms, including Stifel and Mizuho Securities, upgraded the semiconductor test and robotics company based on stronger AI-related growth expectations.

- These analyst calls highlight how Teradyne’s role in testing AI-focused chips and networking hardware is becoming more central to the broader semiconductor ecosystem.

- We’ll now examine how these AI-focused analyst upgrades could reshape Teradyne’s investment narrative built around semiconductor test and robotics expansion.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Teradyne Investment Narrative Recap

To be a Teradyne shareholder, you need to believe that AI-driven demand for semiconductor test and automation can offset margin pressure from a mixed product cycle and softer robotics trends. The latest analyst upgrades reinforce AI as the key short term catalyst, while the biggest near term risk remains earnings volatility from shifting test demand and geopolitical uncertainty, which this news does not fundamentally change.

The Mizuho and Stifel upgrades, with both firms moving to Buy and lifting price targets to US$225, are most relevant here because they explicitly tie Teradyne’s story to AI networking and GPU / ASIC test growth. That focus lines up with existing catalysts such as new production board test opportunities for AI compute, which could help diversify revenue away from more cyclical end markets if AI-related orders stay resilient.

Yet, despite this AI optimism, investors should be aware that limited visibility beyond the next couple of quarters could still...

Read the full narrative on Teradyne (it's free!)

Teradyne's narrative projects $4.1 billion revenue and $952.0 million earnings by 2028. This requires 13.2% yearly revenue growth and about a $482.8 million earnings increase from $469.2 million today.

Uncover how Teradyne's forecasts yield a $184.69 fair value, a 8% downside to its current price.

Exploring Other Perspectives

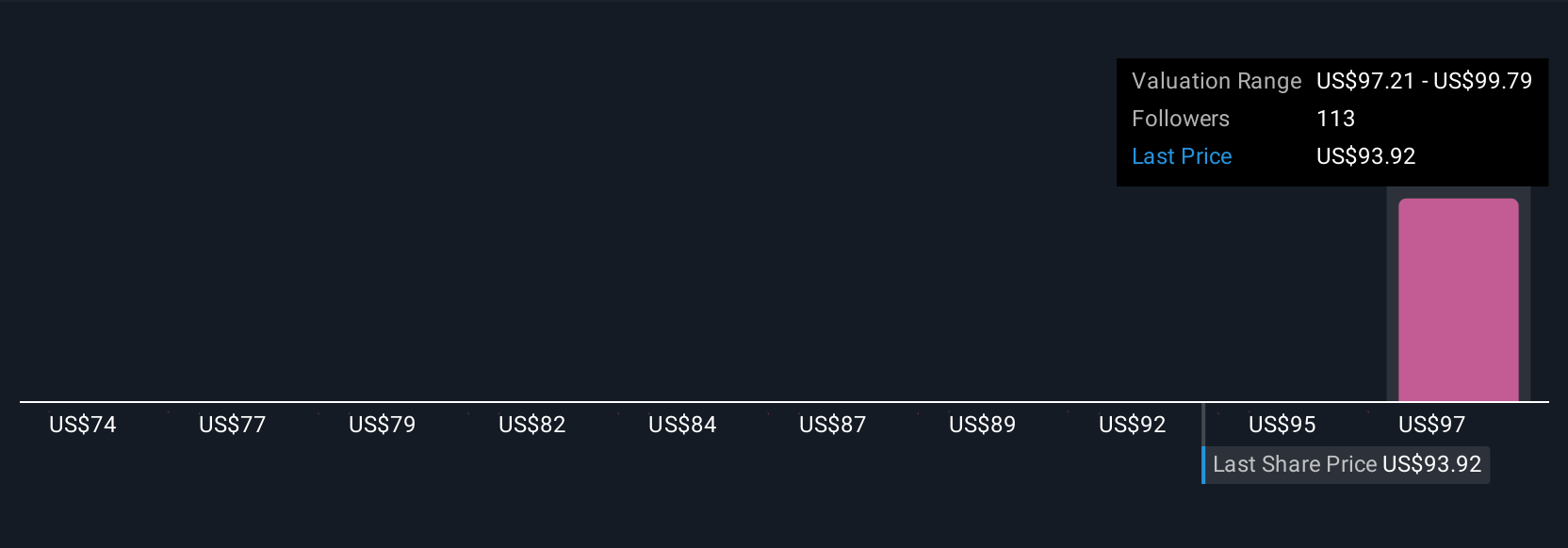

Nine fair value estimates from the Simply Wall St Community span roughly US$74 to US$185 per share, showing how far apart individual views can be. You can set those opinions against the idea that AI centric test demand is emerging as Teradyne’s main growth driver, while geopolitical and end market uncertainty still hang over future earnings, and then explore several alternative viewpoints before deciding how much weight to give this optimism.

Explore 9 other fair value estimates on Teradyne - why the stock might be worth as much as $184.69!

Build Your Own Teradyne Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teradyne research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Teradyne research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teradyne's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com