RBC Bearings (RBC): Assessing Valuation After a Strong Year-to-Date Share Price Rally

RBC Bearings (RBC) has quietly turned into one of the stronger compounders in industrials, with the stock up roughly 16% over the past 3 months and nearly 50% year to date.

See our latest analysis for RBC Bearings.

At around $443.44 per share, RBC’s strong year to date share price return and hefty three year total shareholder return suggest momentum is still building as investors grow more comfortable paying up for its growth and margin profile.

If RBC’s run has you thinking about where else durable growth might be hiding, now is a good time to explore fast growing stocks with high insider ownership.

Yet with shares now near record highs, a triple digit three year return, and only a modest gap to Wall Street targets, investors are asking whether RBC is still a buy or if future growth is already priced in.

Most Popular Narrative: 7.6% Undervalued

With RBC trading at 443.44 dollars versus a narrative fair value near 479.83 dollars, the story leans supportive of further upside if the forecasts land.

Ongoing capacity expansions and selective CapEx in key growth businesses (notably aerospace and defense) are aligned with rising OEM build rates and new long-term contracts, positioning the company to capture increased content per aircraft/engine and strengthen gross margins and earnings as OEM production ramps up.

Want to see what is baked into those higher margins and earnings power, and how aggressive the long term growth curve really is? Read the complete narrative to unpack the specific revenue trajectory, profitability shift, and valuation multiple that underpin this seemingly confident fair value call.

Result: Fair Value of $479.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained supply chain bottlenecks or a stumble integrating VACCO could derail margin expansion and push earnings well below what the narrative implies.

Find out about the key risks to this RBC Bearings narrative.

Another Angle on Valuation

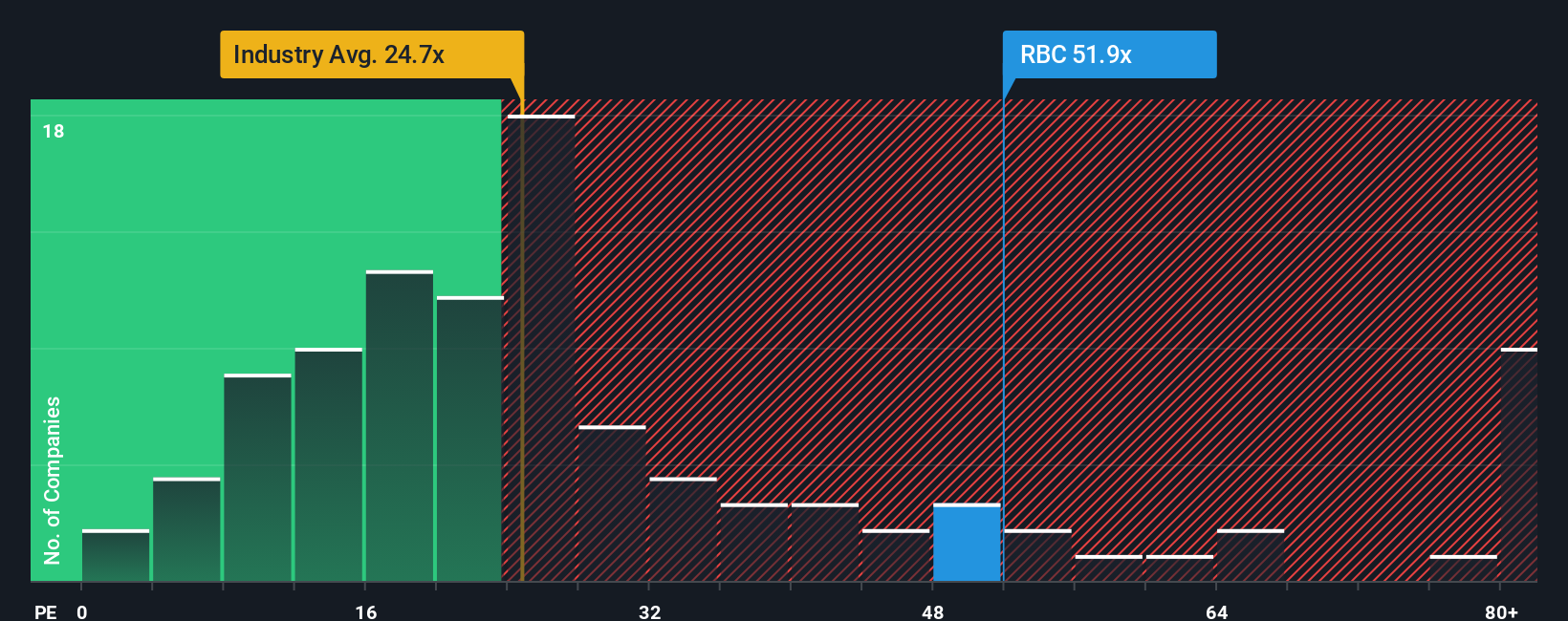

While the narrative fair value suggests 7.6 percent upside, our numbers on earnings multiples tell a different story. At 54.1 times earnings versus 25.5 times for the US Machinery industry and a fair ratio of 30 times, RBC screens as richly priced, which raises the risk of a sharp de rating if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RBC Bearings Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding RBC Bearings.

Ready for more high conviction ideas?

If RBC Bearings impressed you, do not stop here. Let us quickly line up a few more focused opportunities that could reshape your watchlist.

- Capture aggressive growth potential by scanning these 26 AI penny stocks that could redefine entire industries with scalable, data driven business models.

- Lock in more resilient portfolio income by reviewing these 15 dividend stocks with yields > 3% delivering consistent cash returns above market level yields.

- Target meaningful upside by evaluating these 908 undervalued stocks based on cash flows that the market may be mispricing based on strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com