Securities Suits Over Infant Formula Unit Might Change The Case For Investing In Perrigo (PRGO)

- Perrigo is facing multiple securities class action lawsuits after investors alleged the company misled the market about the value, investment needs, and manufacturing quality of its acquired infant formula business, following disappointing results and a strategic review that deemed the unit less central.

- The core allegation is that Perrigo understated the capital and operational demands of the Nestlé infant formula acquisition, potentially inflating reported performance and now forcing a reassessment of how this business fits within the broader self-care portfolio.

- We’ll now explore how the alleged underinvestment and manufacturing deficiencies in Perrigo’s infant formula unit could reshape its investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Perrigo Investment Narrative Recap

Perrigo’s story still rests on the idea that a focused, cost-efficient self-care platform can turn consistent demand for OTC and store-brand products into improving profitability. The infant formula lawsuits and weaker outlook put that thesis under pressure in the near term, as they touch both on the most important short term catalyst (stabilizing nutrition and cash flow) and the biggest risk today: execution and credibility around the infant formula acquisition.

The November 5, 2025 announcement, where Perrigo cut its 2025 net sales outlook to negative 2.5% to negative 3.0% and launched a strategic review of the infant formula unit, is central to this. It directly links the alleged underinvestment and manufacturing issues to softer financial performance, and raises questions about how much of management’s turnaround and cost-savings plan can be realized without more disruption to the portfolio or additional capital needs.

Yet investors should be aware that if infant formula quality or investment concerns extend beyond what is currently disclosed, the impact on...

Read the full narrative on Perrigo (it's free!)

Perrigo’s narrative projects $4.6 billion revenue and $183.6 million earnings by 2028. This requires 1.7% yearly revenue growth and a $243.1 million earnings increase from -$59.5 million today.

Uncover how Perrigo's forecasts yield a $21.50 fair value, a 60% upside to its current price.

Exploring Other Perspectives

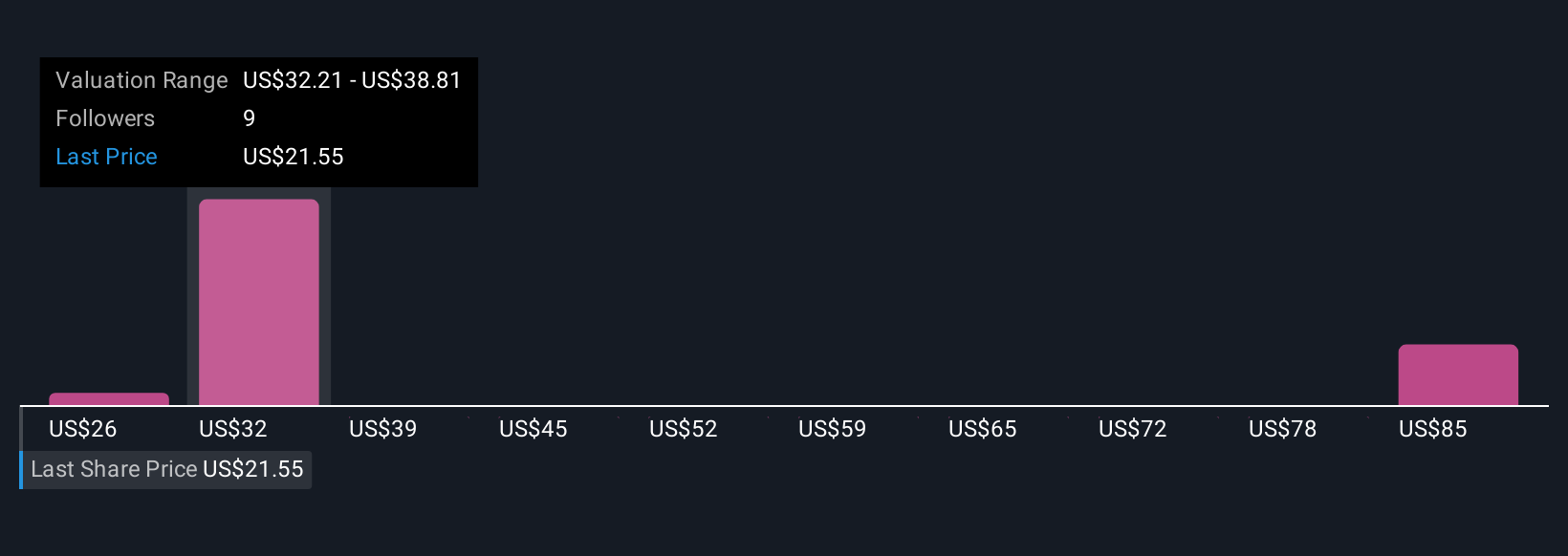

Four members of the Simply Wall St Community value Perrigo between US$21.50 and about US$58.28, pointing to very different views on upside. Set against allegations that past results were overstated due to underinvestment and manufacturing deficiencies in infant formula, these gaps in expectations highlight why you may want to compare several risk and return scenarios before forming your own view.

Explore 4 other fair value estimates on Perrigo - why the stock might be worth over 4x more than the current price!

Build Your Own Perrigo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perrigo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Perrigo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perrigo's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com