Exploring High Growth Tech Stocks in the United Kingdom

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China and declining commodity prices impacting key sectors. In this environment, identifying high growth tech stocks requires a focus on companies that demonstrate resilience and adaptability amidst global economic fluctuations.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pinewood Technologies Group | 27.09% | 49.21% | ★★★★★☆ |

| Kainos Group | 9.28% | 22.99% | ★★★★★☆ |

| One Media iP Group | 6.76% | 32.48% | ★★★★☆☆ |

| Calnex Solutions | 8.93% | 53.99% | ★★★★☆☆ |

| M&C Saatchi | -17.95% | 33.24% | ★★★★☆☆ |

| Beeks Financial Cloud Group | 11.54% | 32.46% | ★★★★☆☆ |

| Skillcast Group | 14.52% | 31.61% | ★★★★☆☆ |

| Xaar | 17.96% | 123.69% | ★★★★☆☆ |

| Itim Group | 8.33% | 109.98% | ★★★★☆☆ |

| Raspberry Pi Holdings | 16.78% | 40.87% | ★★★★☆☆ |

Click here to see the full list of 11 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Kainos Group (LSE:KNOS)

Simply Wall St Growth Rating: ★★★★★☆

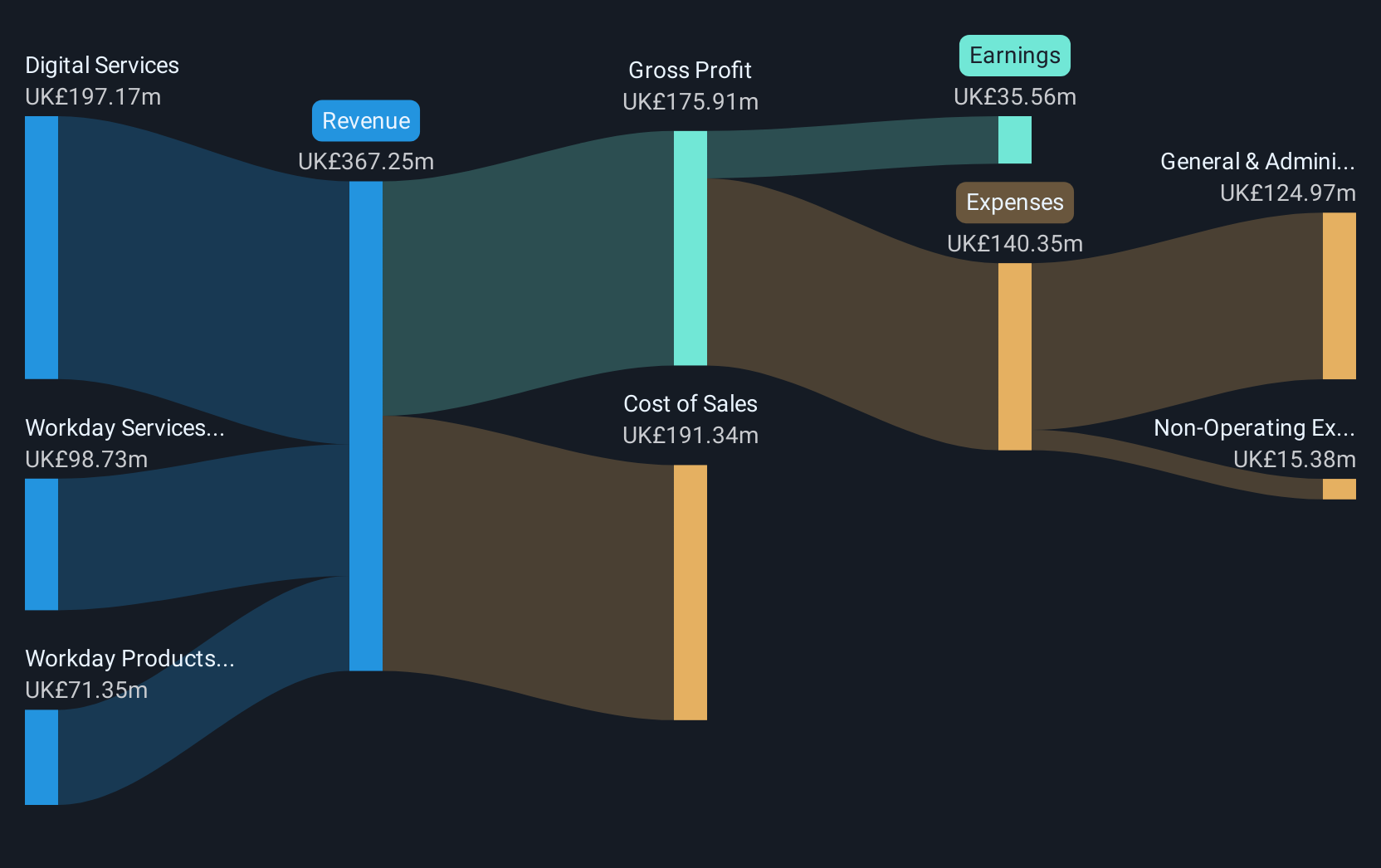

Overview: Kainos Group plc provides digital technology services across various regions including the United Kingdom, Ireland, and internationally, with a market cap of £1.29 billion.

Operations: Kainos Group plc generates revenue through three primary segments: Digital Services (£203.43 million), Workday Products (£76.28 million), and Workday Services (£100.56 million). The company operates across various regions, focusing on delivering digital technology solutions globally.

Kainos Group's strategic maneuvers, including a robust share repurchase program, underscore its commitment to shareholder value. Recently, the company initiated a repurchase of up to £30 million worth of shares, aiming to reduce share capital. This move coincides with an interim dividend increase to 9.8 pence per share, reflecting confidence in its financial health despite a recent dip in net income from £25.43 million to £20.58 million year-over-year as reported in their latest half-year results. With revenue growth outpacing the UK market average at 9.3% annually compared to 4.3%, and earnings expected to surge by approximately 23% per annum, Kainos is navigating through its industry challenges while maintaining a focus on innovation and operational efficiency.

- Click to explore a detailed breakdown of our findings in Kainos Group's health report.

Gain insights into Kainos Group's past trends and performance with our Past report.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider with operations in the United Kingdom, Europe, Africa, Asia, the Middle East, and internationally, and has a market cap of £371.99 million.

Operations: Pinewood Technologies Group generates revenue primarily through its cloud-based dealer management software, catering to a global clientele across various regions including the UK, Europe, Africa, Asia, and the Middle East. The company focuses on delivering solutions that streamline automotive dealership operations.

Pinewood Technologies Group, amidst a challenging fiscal period with a net loss of £0.7 million from a previous profit of £5 million, still shows promise with an inclusion in the FTSE 250 Index. This move reflects broader market recognition and potential for recovery. Notably, its revenue growth at 27.1% annually outstrips the UK market average of 4.3%, signaling robust sales dynamics despite recent financial setbacks. The recent board enhancements with tech veterans like Shruthi Chindalur could steer the company towards leveraging technological advancements and strategic market positioning effectively.

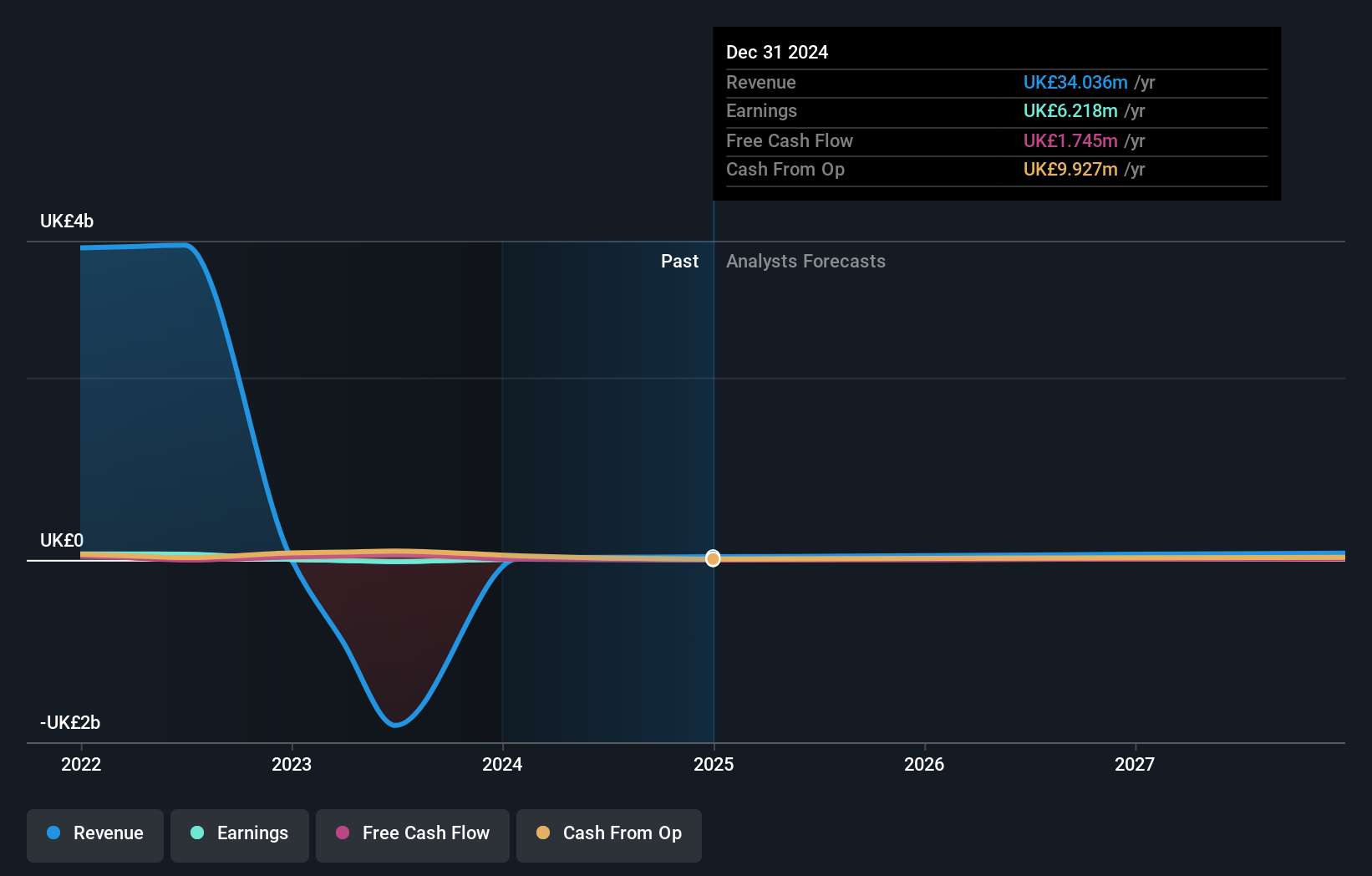

Raspberry Pi Holdings (LSE:RPI)

Simply Wall St Growth Rating: ★★★★☆☆

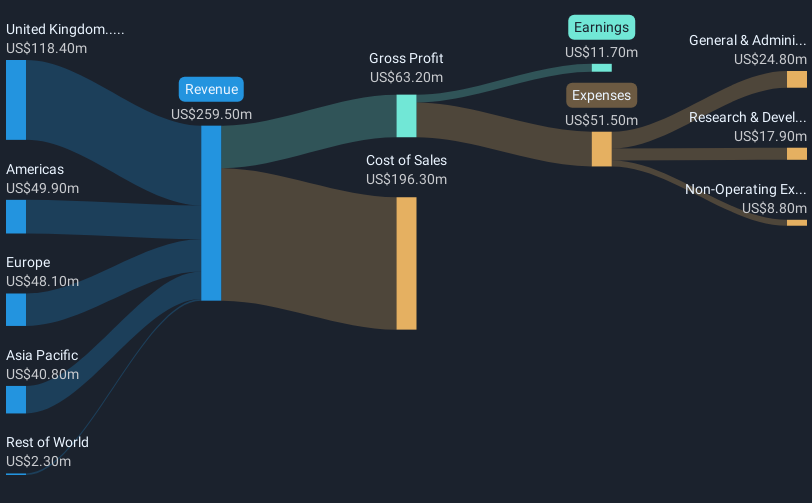

Overview: Raspberry Pi Holdings plc designs and develops single-board computers, compute modules, and semiconductors for markets in the United Kingdom, Europe, the United States, Asia Pacific, and internationally with a market cap of £630.74 million.

Operations: Raspberry Pi Holdings generates revenue primarily from its computer hardware segment, which accounts for $251 million. The company's operations span multiple regions, including the UK, Europe, the US, and Asia Pacific.

Raspberry Pi Holdings is navigating a transformative landscape with its strategic pivot towards enterprise solutions, evidenced by its recent collaboration with NComputing to launch the Raspberry Pi 500+ all-in-one keyboard computer. This partnership caters to the growing demand for secure, cost-effective desktop alternatives in response to Windows 10's end-of-life and the challenges of migrating to Windows 11. Despite a dip in earnings from $7.6 million to $5.4 million year-over-year and a slight decline in sales from $144 million to $135.5 million, Raspberry Pi's innovative approach positions it uniquely within the tech sector. The company's R&D focus remains robust, aligning with industry needs for enhanced cybersecurity and operational efficiency in IT management.

Where To Now?

- Investigate our full lineup of 11 UK High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com