Veralto (VLTO): Evaluating Valuation After $750 Million Share Repurchase Authorization Signals Management Confidence

Veralto (VLTO) just rolled out a fresh share repurchase program, authorizing up to $750 million in buybacks with no set end date. This move indicates that management feels confident about the company’s trajectory.

See our latest analysis for Veralto.

That confidence backed by the new buyback comes as Veralto’s 30 day share price return of 3.6 percent contrasts with a slightly negative 90 day share price return and a modest 1 year total shareholder return decline, suggesting that momentum may be starting to rebuild from a soft patch.

If this kind of capital allocation story interests you, it could be a good moment to explore other industrials with management skin in the game through fast growing stocks with high insider ownership.

With Veralto trading about 13 percent below analyst targets and roughly 26 percent below some intrinsic value estimates despite solid revenue and earnings growth, is this fresh buyback signaling a bargain, or is the market already assuming future gains?

Most Popular Narrative Narrative: 11.6% Undervalued

With Veralto last closing at $102.16 versus a narrative fair value of roughly $115.59, the story leans toward upside if the assumptions hold.

Increased adoption of digital workflow and connected software solutions (notably in PQI and Water Quality) is supporting high margin, recurring revenue streams (now 61% of total sales), improving business predictability and supporting higher net margins and EPS growth.

Curious how steady but unspectacular growth can still justify a premium style valuation? The narrative leans heavily on expanding margins and a richer future earnings multiple. Want to see which specific revenue and profit assumptions have to click for that upside case to work?

Result: Fair Value of $115.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in China, along with ongoing cost and integration pressures, could delay margin expansion and challenge the premium valuation investors are banking on.

Find out about the key risks to this Veralto narrative.

Another Way To Look At Value

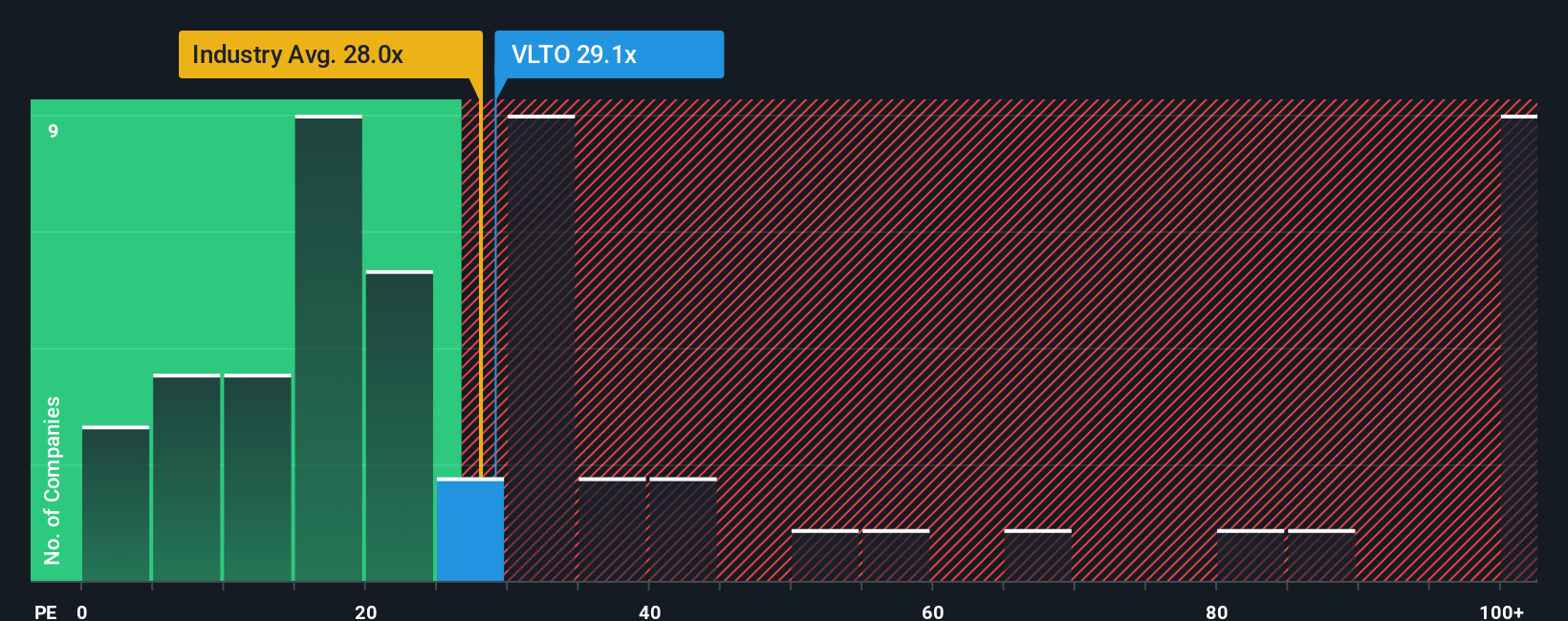

On earnings, Veralto looks more demanding. Its P E ratio of 27.8 times sits above the US Commercial Services average of 23.1 times and only a touch above its fair ratio of 27.7 times, suggesting less margin for error if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veralto Narrative

If this interpretation does not quite match your view, or you prefer to dive into the numbers yourself, you can build a complete narrative in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Veralto.

Looking for more investment ideas?

Do not stop with just one opportunity. Use the Simply Wall St Screener to uncover focused lists of stocks that match your exact investing playbook today.

- Capture early growth stories by scanning these 3578 penny stocks with strong financials that pair small market caps with stronger fundamentals than the crowd expects.

- Position yourself at the front of the tech revolution by targeting these 26 AI penny stocks that are poised to benefit most from real world AI adoption.

- Lock in better risk reward profiles by filtering for these 905 undervalued stocks based on cash flows where current prices sit meaningfully below estimated cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com