How Dividend Hike And Patent Wins At InterDigital (IDCC) Has Changed Its Investment Story

- In December 2025, InterDigital’s board declared a regular quarterly cash dividend of US$0.70 per share, payable on or about January 28, 2026, to shareholders of record as of January 14, 2026.

- At the same time, favorable rulings in patent disputes against Disney and fresh infringement claims against Amazon highlight how assertive IP enforcement could influence future licensing revenue streams.

- We’ll now explore how InterDigital’s stronger dividend commitment and recent patent litigation wins may reshape its existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

InterDigital Investment Narrative Recap

To own InterDigital, you need to believe its portfolio of wireless and video patents can keep generating recurring, enforceable licensing income across phones, consumer electronics and streaming. The latest dividend affirmation reinforces a shareholder-return story, but the more immediate swing factor is how effectively the company can translate recent legal wins and new infringement actions into durable, cash-based agreements. The biggest risk is that litigation outcomes, regulatory scrutiny or tougher negotiations make current earnings power look less repeatable.

Among the recent announcements, the board’s decision to hold the quarterly dividend at US$0.70 per share stands out in this context. It underlines management’s confidence in cash generation at a time when high-profile disputes with Disney and Amazon are testing the strength and monetization potential of InterDigital’s IP. For investors focused on catalysts, the interaction between litigation-driven revenue, recurring licenses and the rising dividend is where the story now feels most concentrated.

But investors should also be aware of how dependent this story is on ongoing patent enforcement and evolving licensing norms...

Read the full narrative on InterDigital (it's free!)

InterDigital's narrative projects $633.9 million revenue and $173.4 million earnings by 2028.

Uncover how InterDigital's forecasts yield a $412.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

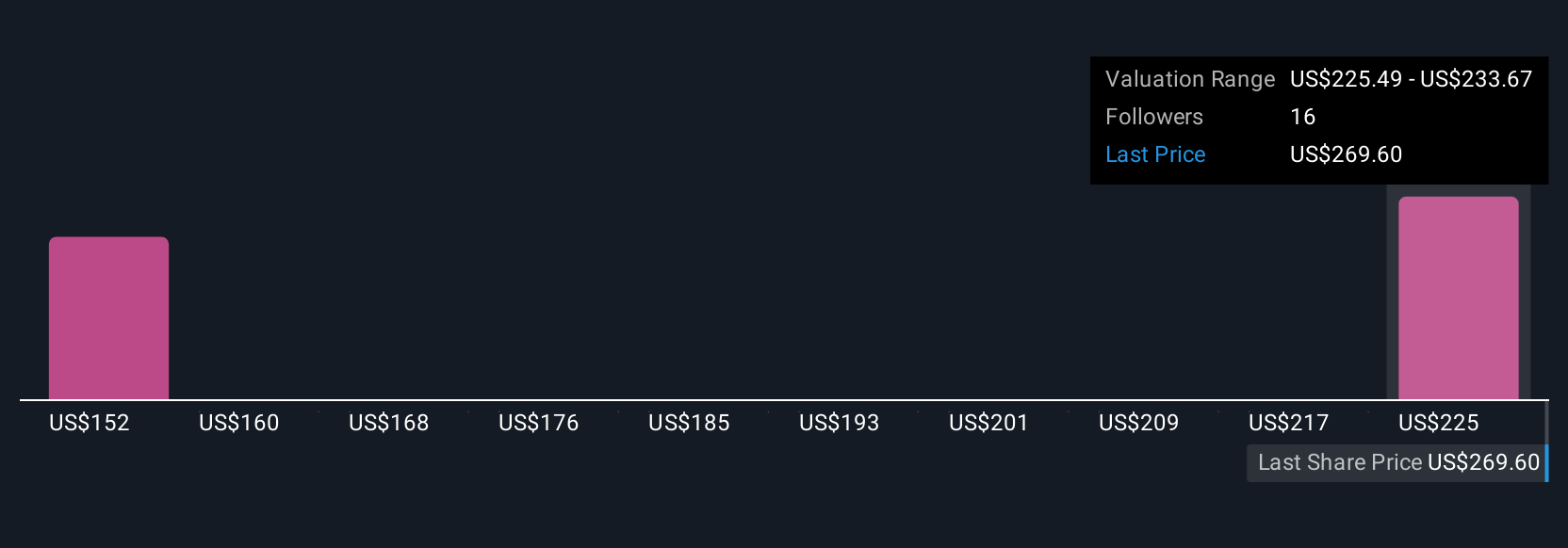

Four members of the Simply Wall St Community currently see InterDigital’s fair value anywhere between about US$71 and US$412 per share. Against that wide spread, the reliance on litigation and large licensing renewals as catalysts raises important questions about how durable the company’s recent earnings strength really is, which you may want to weigh against your own expectations before drawing conclusions.

Explore 4 other fair value estimates on InterDigital - why the stock might be worth less than half the current price!

Build Your Own InterDigital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free InterDigital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate InterDigital's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com