Does Blue Owl Capital’s (OWL) Insider Buying Offset Liquidity Concerns In Its Evolving Investment Model?

- In 2025, Blue Owl Capital faced securities class actions and scrutiny over redemption limits and liquidity pressures at its business development companies, even as it expanded into digital infrastructure and evergreen funds.

- Amid these concerns, executives and employees collectively bought more than US$200,000,000 of stock, a rare show of internal support alongside legal and operational challenges.

- We’ll now examine how this insider buying wave amid liquidity and redemption concerns may affect Blue Owl Capital’s existing investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Blue Owl Capital Investment Narrative Recap

To own Blue Owl Capital, you need to believe its mix of private credit, real assets and digital infrastructure can keep attracting fresh capital despite earnings volatility and funding costs. Right now, the key near term catalyst is whether fundraising in its evergreen and BDC platforms stays resilient, while the biggest risk is that liquidity and redemption concerns, now at the center of class action claims, deter allocators or tighten regulatory scrutiny in a way that weighs on margins.

The most relevant recent development here is the US$200,000,000 plus of insider buying across Blue Owl’s stock and its BDCs. That scale of internal participation sits directly against the backdrop of weaker Q3 results, merger turmoil and lawsuits over alleged liquidity missteps, and will likely be read alongside the company’s push into evergreen and digital infrastructure products when investors weigh near term sentiment shifts around the shares.

Yet investors should also be aware of how the redemption limits and potential 20% haircut for some BDC holders could...

Read the full narrative on Blue Owl Capital (it's free!)

Blue Owl Capital's narrative projects $4.2 billion revenue and $5.1 billion earnings by 2028. This requires 17.5% yearly revenue growth and about a $5.0 billion earnings increase from $75.4 million today.

Uncover how Blue Owl Capital's forecasts yield a $21.40 fair value, a 32% upside to its current price.

Exploring Other Perspectives

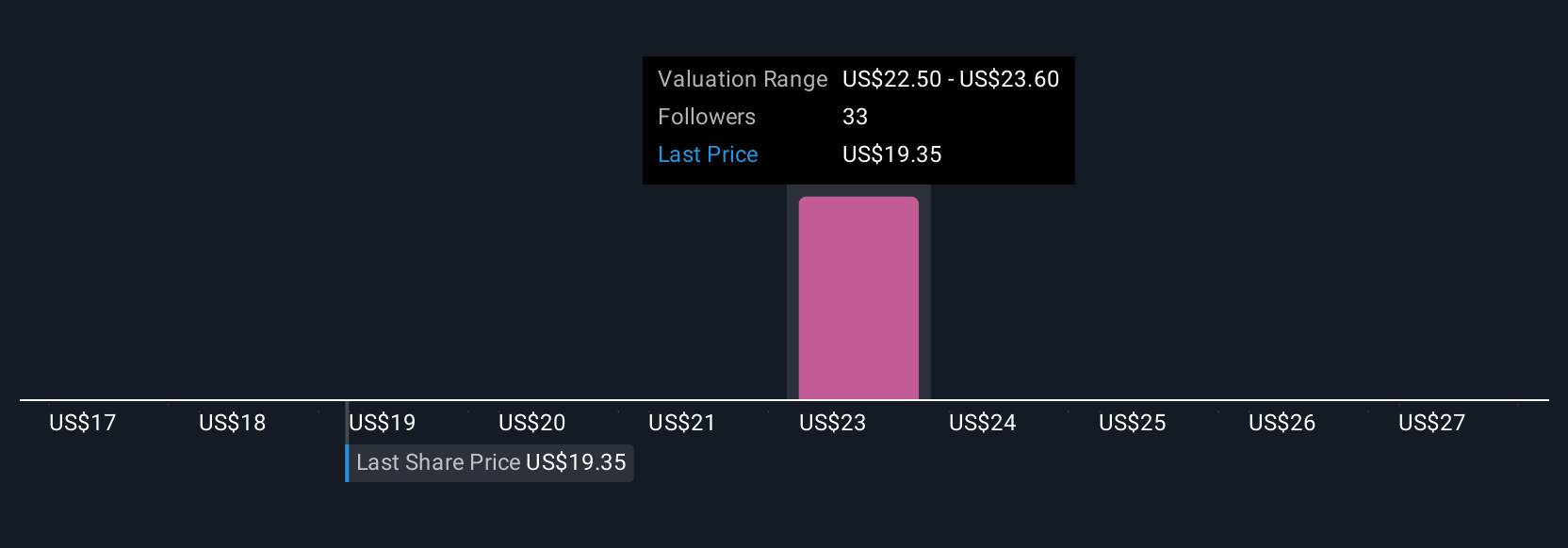

Six Simply Wall St Community fair value estimates for Blue Owl range from about US$0.54 to US$28, underscoring how far apart individual views can be. Against that spread, the current focus on liquidity and redemption risks in its BDCs will likely shape how you interpret those valuations and the company’s ability to sustain fee growth.

Explore 6 other fair value estimates on Blue Owl Capital - why the stock might be worth as much as 72% more than the current price!

Build Your Own Blue Owl Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Owl Capital research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Blue Owl Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Owl Capital's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com