A Glimpse of Cognyte Software's Earnings Potential

Cognyte Software (NASDAQ:CGNT) is preparing to release its quarterly earnings on Tuesday, 2025-12-09. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Cognyte Software to report an earnings per share (EPS) of $-0.04.

Anticipation surrounds Cognyte Software's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

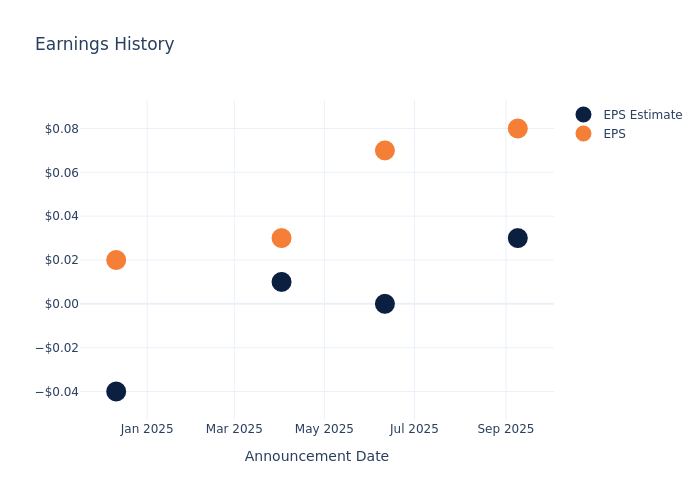

Historical Earnings Performance

During the last quarter, the company reported an EPS beat by $0.05, leading to a 2.25% drop in the share price on the subsequent day.

Cognyte Software Share Price Analysis

Shares of Cognyte Software were trading at $8.65 as of December 05. Over the last 52-week period, shares are down 11.17%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Opinions on Cognyte Software

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Cognyte Software.

Cognyte Software has received a total of 1 ratings from analysts, with the consensus rating as Buy. With an average one-year price target of $14.0, the consensus suggests a potential 61.85% upside.

Comparing Ratings Among Industry Peers

This comparison focuses on the analyst ratings and average 1-year price targets of Sprout Social, Similarweb and Docebo, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Sprout Social, with an average 1-year price target of $15.0, suggesting a potential 73.41% upside.

- Analysts currently favor an Buy trajectory for Similarweb, with an average 1-year price target of $14.0, suggesting a potential 61.85% upside.

- Analysts currently favor an Buy trajectory for Docebo, with an average 1-year price target of $35.17, suggesting a potential 306.59% upside.

Peers Comparative Analysis Summary

The peer analysis summary outlines pivotal metrics for Sprout Social, Similarweb and Docebo, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Cognyte Software | Buy | 15.52% | $69.76M | 0.74% |

| Sprout Social | Buy | 12.62% | $89.81M | -4.95% |

| Similarweb | Buy | 10.94% | $57.19M | -17.83% |

| Docebo | Buy | 11.16% | $49.49M | 15.29% |

Key Takeaway:

Cognyte Software ranks at the top for Revenue Growth and Gross Profit, while it is in the middle for Return on Equity among its peers.

Unveiling the Story Behind Cognyte Software

Cognyte Software Ltd provides security analytics software that empowers governments and enterprises with Actionable Intelligence. Its interface software is designed to help customers accelerate and improve the effectiveness of investigations and decision-making.

Cognyte Software's Economic Impact: An Analysis

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Cognyte Software displayed positive results in 3 months. As of 31 July, 2025, the company achieved a solid revenue growth rate of approximately 15.52%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Cognyte Software's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 1.51%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 0.74%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Cognyte Software's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.3%, the company showcases efficient use of assets and strong financial health.

Debt Management: Cognyte Software's debt-to-equity ratio is below the industry average. With a ratio of 0.15, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Cognyte Software visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.