What Calumet (CLMT)'s DOE-Backed Refinancing and Montana Renewables Expansion Means For Shareholders

- Calumet, Inc. recently presented at the Bank of America Leveraged Finance Conference in Boca Raton, updating investors on its specialty hydrocarbons and renewable fuels platform, including Montana Renewables.

- A key focus was the previously secured US$1.44 billion DOE-guaranteed loan, aimed at refinancing higher-cost debt and funding expansion of sustainable aviation fuel capacity, which could materially reshape the company’s balance sheet and growth profile.

- We’ll now assess how the DOE-backed refinancing and Montana Renewables expansion plans may influence Calumet’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Calumet Investment Narrative Recap

To own Calumet, I think you have to believe that Montana Renewables can turn the business into a higher margin, lower leverage specialty and renewables platform. The DOE guaranteed US$1.44 billion refinancing directly touches the key near term catalyst, MaxSAF ramp up, while also addressing the biggest current risk in my view: the company’s still heavy debt load and constrained financial flexibility.

At Boca Raton, management tied the DOE backed loan to plans for expanding Montana Renewables’ sustainable aviation fuel output, reinforcing MaxSAF as the center of the story. With annual interest savings guided at about US$80 million, this single financing move sits at the intersection of the main upside driver and Calumet’s balance sheet risk, and will likely be a reference point for how investors think about execution on the Q3 2025 turnaround in earnings.

Yet while the refinancing eases pressure, investors should still be aware of how exposed Calumet remains to policy shifts around renewable fuel credits and tax incentives...

Read the full narrative on Calumet (it's free!)

Calumet’s narrative projects $5.1 billion revenue and $40.3 million earnings by 2028. This requires 8.0% yearly revenue growth and an earnings increase of about $493 million from -$452.8 million today.

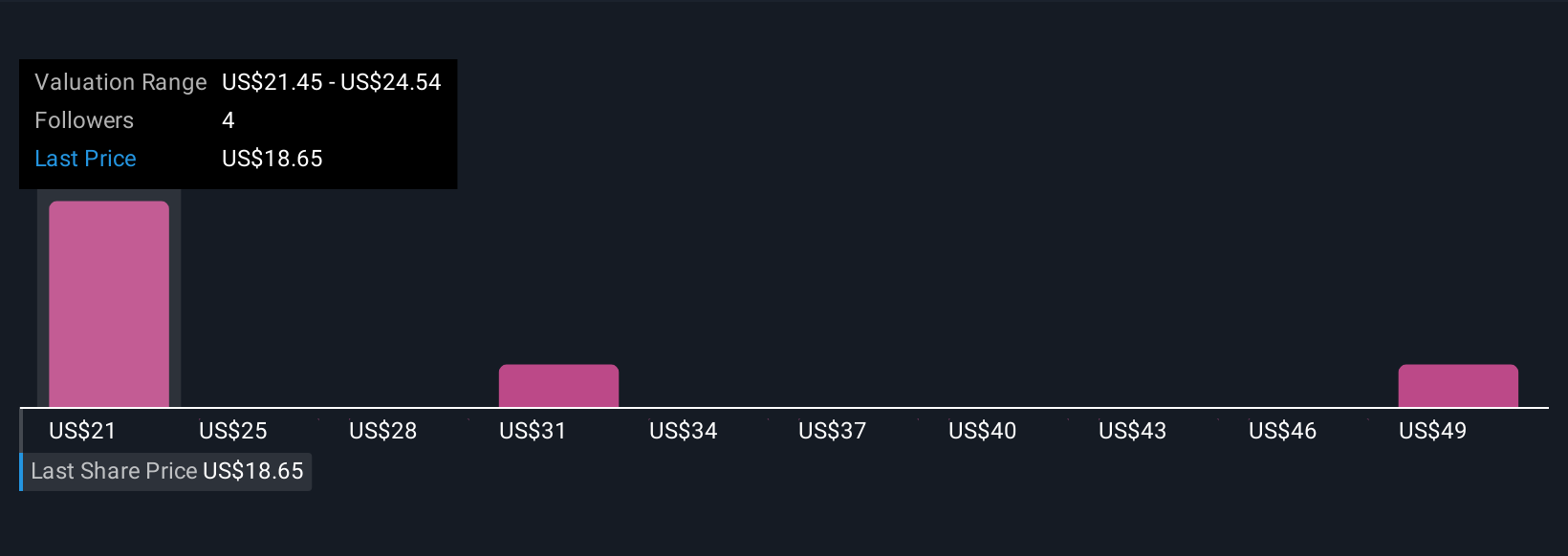

Uncover how Calumet's forecasts yield a $21.45 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly US$21 to US$52 per share, showing how far apart individual views can be. Against that wide range, the MaxSAF expansion and DOE refinancing highlight how much of Calumet’s future still rests on successful execution and a supportive regulatory framework for renewables.

Explore 3 other fair value estimates on Calumet - why the stock might be worth over 2x more than the current price!

Build Your Own Calumet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Calumet research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Calumet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Calumet's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com