Fastly (FSLY): Reassessing Valuation After Upsized $160 Million Convertible Notes Offering

Fastly (FSLY) just upsized its new 0% convertible senior notes offering to $160 million from $125 million, a move that reshapes its debt stack and immediately feeds into how investors view future dilution.

See our latest analysis for Fastly.

The upsized deal landed alongside a sharp 1 day share price return of minus 8.68 percent and a weaker 7 day share price return of minus 10.54 percent. However, this follows a robust 90 day share price return of 37.52 percent and a modestly positive 3 year total shareholder return of 9.81 percent, suggesting momentum is cooling in the near term rather than breaking the longer trend.

If this kind of capital raising has you rethinking where growth and risk sit in your portfolio, it could be a good moment to scout high growth tech and AI stocks as potential alternatives.

With the stock now trading close to analyst targets and the new convertibles struck at a hefty premium, is Fastly quietly undervalued after the pullback, or is the market already factoring in most of its future growth?

Most Popular Narrative: Fairly Valued

Fastly's narrative fair value of $10.42 sits almost exactly in line with the last close at $10.52, framing a finely balanced valuation debate.

The acceleration of cloud migration and edge computing, combined with Fastly's increased product velocity (especially in Compute and adaptive observability analytics at the edge), expands the company's addressable market and underpins durable multi-year revenue growth.

Want to see how steady top line growth, rising margins and a punchy future earnings multiple all intersect in this story? The narrative pins its fair value on a specific glide path for revenue expansion, margin lift and share count that might surprise you. Curious which assumption really does the heavy lifting in that equation? Dive in to unpack the full blueprint behind this valuation call.

Result: Fair Value of $10.42 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering CDN pricing pressure and customer concentration mean that any stumble in security growth or any uptick in churn could quickly unravel that fair value case.

Find out about the key risks to this Fastly narrative.

Another Lens on Value

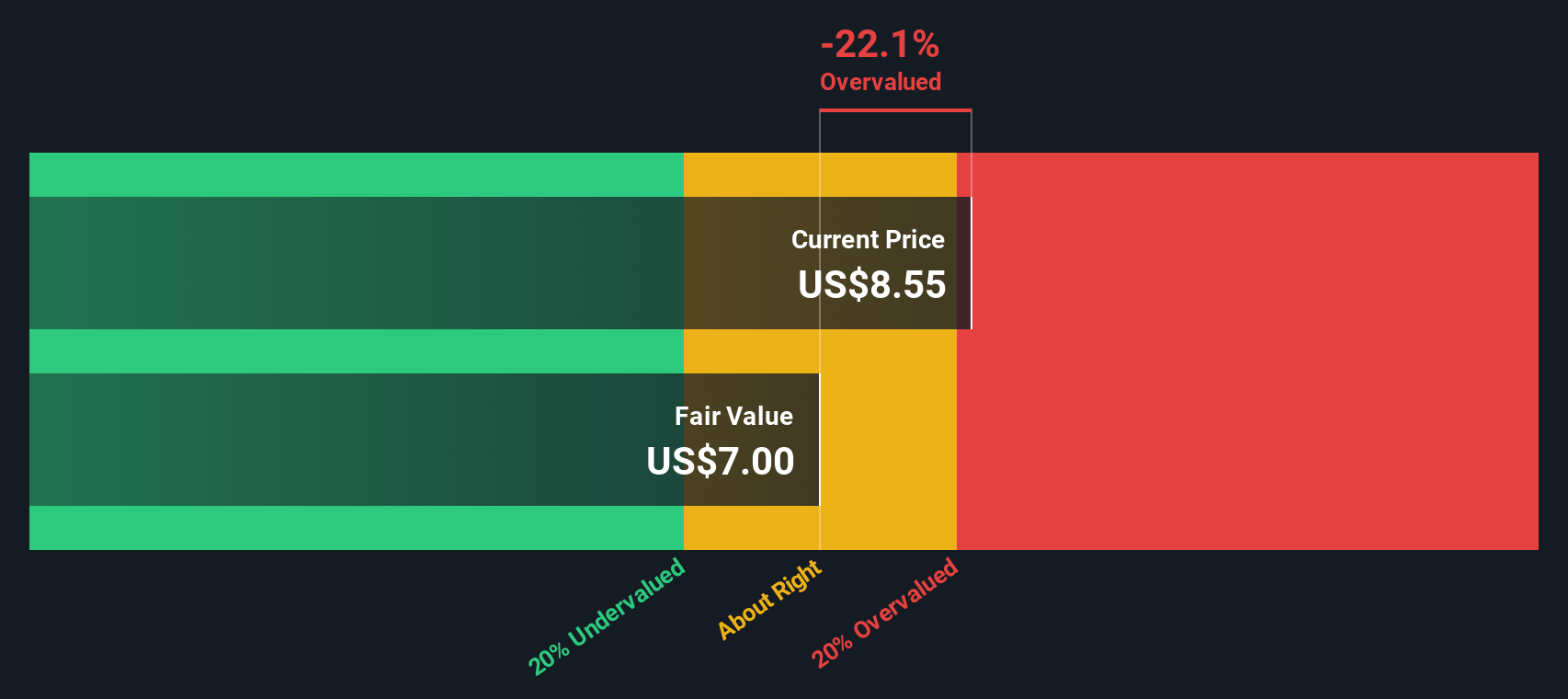

While the narrative sees Fastly as roughly fairly priced, our SWS DCF model paints a tougher picture, suggesting the shares are overvalued at $10.52 versus a fair value of about $5.46. Will fundamentals catch up to the current price? Or does downside risk dominate from here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fastly Narrative

If you see the story differently or prefer to conduct your own research, you can build a personalized thesis in minutes using Do it your way.

A great starting point for your Fastly research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself the edge by scanning fresh opportunities in minutes with targeted screeners built to match different return and risk profiles.

- Capture potential mispricings early by running through these 898 undervalued stocks based on cash flows that may offer stronger cash flow support for their share prices.

- Supercharge your growth bucket by zeroing in on these 27 AI penny stocks where structural tailwinds and innovation can compound returns over time.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% that may help balance volatility with reliable cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com