It's Down 26% But Tokyo Electric Power Company Holdings, Incorporated (TSE:9501) Could Be Riskier Than It Looks

Tokyo Electric Power Company Holdings, Incorporated (TSE:9501) shares have had a horrible month, losing 26% after a relatively good period beforehand. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 22%.

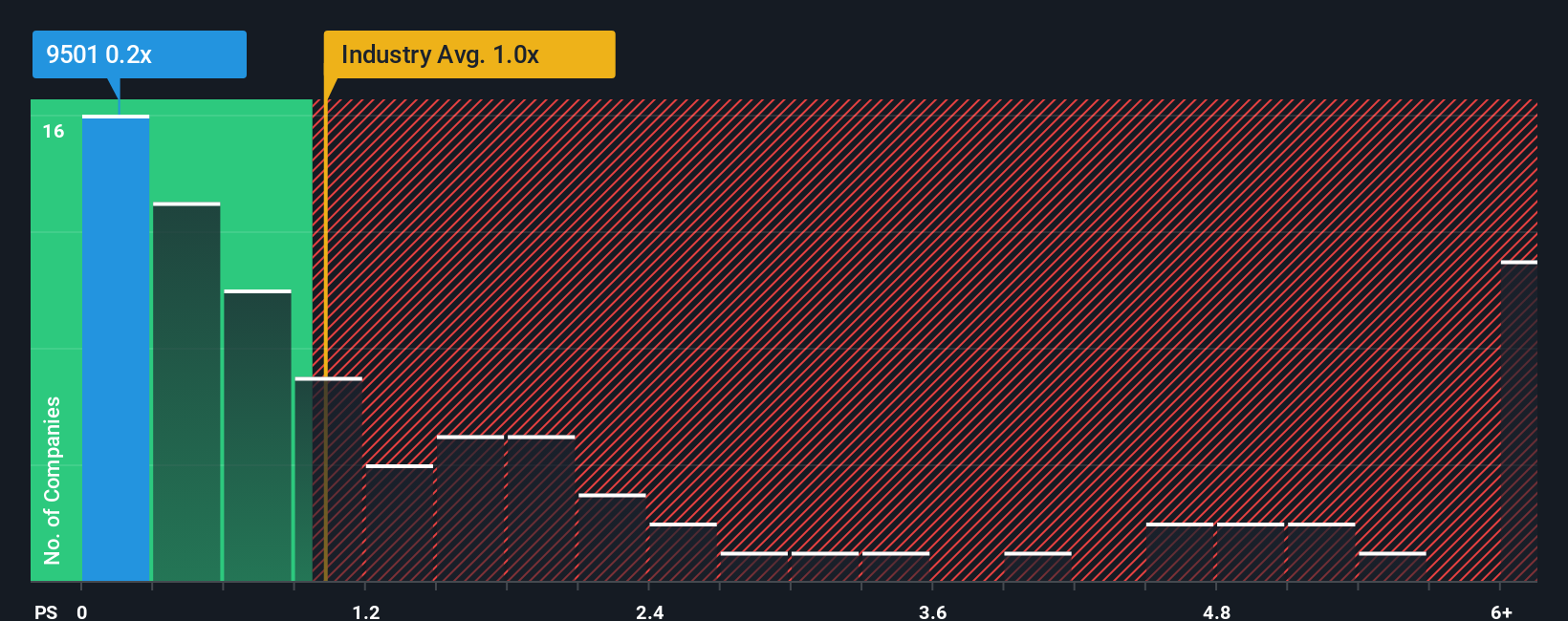

In spite of the heavy fall in price, there still wouldn't be many who think Tokyo Electric Power Company Holdings' price-to-sales (or "P/S") ratio of 0.2x is worth a mention when it essentially matches the median P/S in Japan's Electric Utilities industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Tokyo Electric Power Company Holdings

What Does Tokyo Electric Power Company Holdings' Recent Performance Look Like?

Tokyo Electric Power Company Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tokyo Electric Power Company Holdings.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Tokyo Electric Power Company Holdings' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.3%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should demonstrate some strength in company's business, generating growth of 2.6% per year as estimated by the four analysts watching the company. Meanwhile, the broader industry is forecast to contract by 1.1% each year, which would indicate the company is doing better than the majority of its peers.

Despite the marginal growth, we find it odd that Tokyo Electric Power Company Holdings is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What We Can Learn From Tokyo Electric Power Company Holdings' P/S?

Following Tokyo Electric Power Company Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Tokyo Electric Power Company Holdings currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. The market could be pricing in the event that tough industry conditions will impact future revenues. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Plus, you should also learn about these 2 warning signs we've spotted with Tokyo Electric Power Company Holdings.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.