How will insurance co-payments play into the healthcare system?

A state of anxiety and trepidation has overtaken many members of the public as the looming deadline of co-payments for health insurance comes closer.

Their fears are multi-pronged – will they be forced to swap their existing policies into co-payment ones?

Will they be able to afford paying for their portion of their medical claims?

Some are rushing to buy new policies now just to avoid the Sept 1 deadline when all policies – so the thinking goes – will have to have a co-payment element.

The co-payment concept will be introduced next month as per regulations by Bank Negara.

In a nutshell, co-payment is where consumers have to pay a percentage of their medical claims.

The first point to note is that co-payments in medical insurance policies, when they are introduced next month, will be entirely optional for consumers. All insurers and takaful operators will be required to introduce at least one such product, alongside existing products.

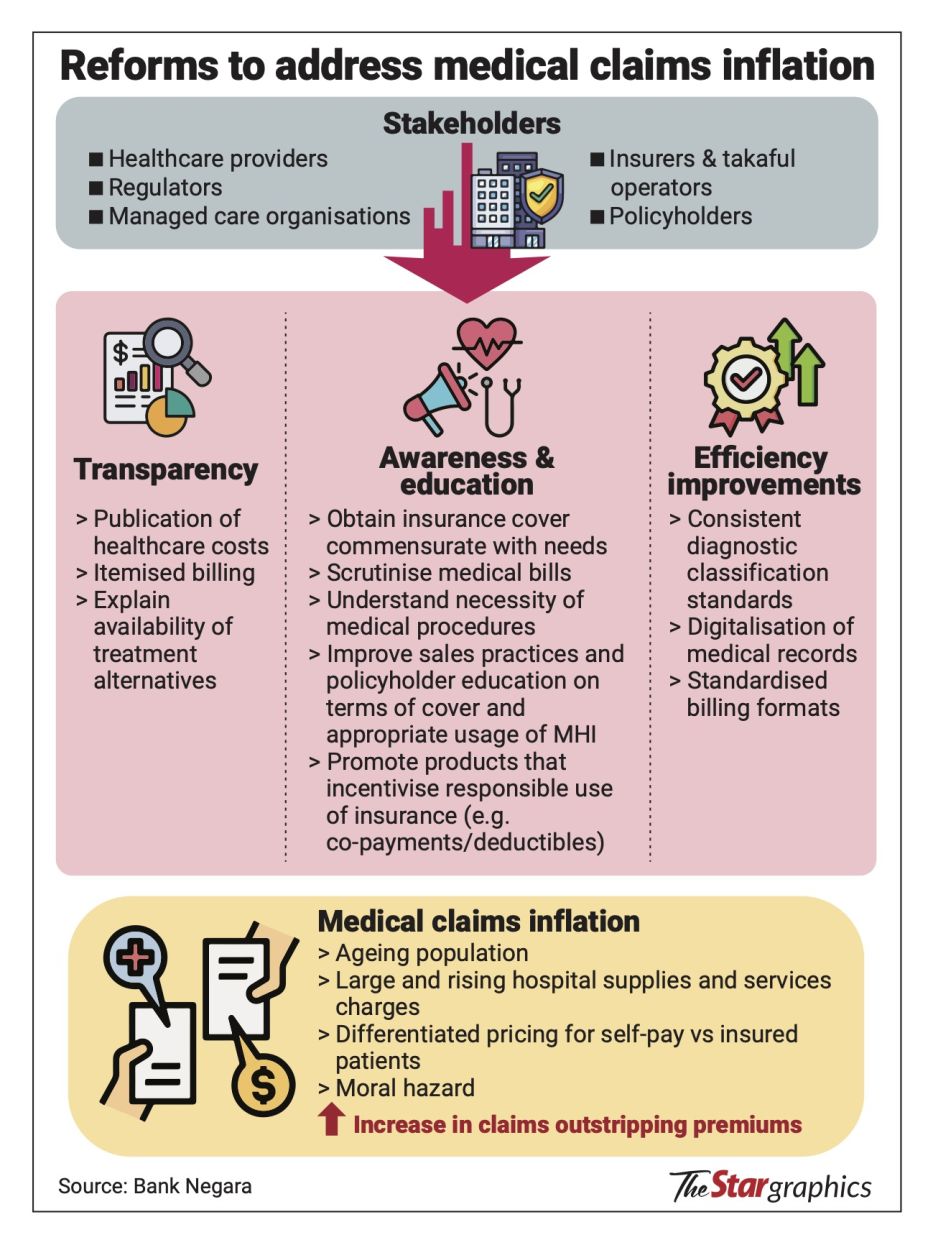

The central bank reckons that co-payments are needed due to rising insurance premiums, which, in turn, is the result of the continued increase in medical inflation.

According to the central bank, Malaysia’s medical inflation in 2023 stood at a whopping 12.6%, one of the highest in the world, with the average global rate at a mere 5.6%.

That in turn is raising the price of medical insurance premiums.

However, the factors driving medical inflation in Malaysia such as having an ageing population, a rise of non-communicable diseases and experiencing higher costs of imported medical equipment, also affect other countries. Why does it seem that other countries have a better handle on medical costs?

Mark O’Dell of the Life Insurance Association of Malaysia says this could be due to the different healthcare models that countries have.

To note, Malaysia has a two-tier healthcare system; consisting of the public universal healthcare system which is entirely government-funded, and the private healthcare sector.

O’Dell makes reference to countries that have universal health insurance coverage. In those countries, premiums are generally paid by a combination of individuals, employers, and the government.

“Some countries have national healthcare where the government controls the cost of care as a single payer. If you are a single payer, you dictate the market. In contrast, there are about 47 private insurers here offering medical insurance, which means no one controls the market. It is the providers that control the market because they are the ones who set the price,” he tells StarBizWeek.

In a single-payer healthcare system as seen in countries like Canada, Sweden and France, all residents enjoy universal health insurance coverage and the public can use both private and public healthcare facilities under this system.

In Malaysia, it goes back to the way hospitals charge and how insurance plans are designed.

“Many insurance plans are designed to cover 100% of medical costs, which leads to claims inflation as it encourages over-utilisation. Hospitals, meanwhile, are free to charge what they like, given the lack of regulation,” says O’Dell.

He also notes other contributors to rising medical inflation such as pricing cycles (periods when premiums are allowed to be raised), wastage, abuse and even fraud.

Curbing medical inflation with co-paymentsBank Negara, in explainers on co-payments, has made reference to what is known as the buffet syndrome – where medical services are over-utilised to maximise the value of premiums paid. This is what co-payment products are attempting to address, Bank Negara says.

The central bank says that the co-payment feature that will be introduced will have a minimum RM500 deductible or a minimum 5% co-insurance or both.

What this means, if you opt for the RM500 deductible, that’s all you will have to pay when you make a medical insurance claim.

Or if you opt for the 5% co-insurance then you pay 5% of the total claim. Policy holders can opt for higher deductibles or higher co-insurance percentages, thereby paying less for their premiums.

Co-payment is not a new concept and has been around for the last 15 years or so. However, the take-up rate has remained low due to there not being a big variety of such products or a push by agents selling them. The price differentials between co-payment products and regular policies weren’t significant also. But all this is set to change.

Rapidly rising premiums coupled with Bank Negara’s ruling to force insurers to offer co-payment products should bring these products into the mainstream.

So, how much cheaper will policies with co-payment features be?

Bank Negara reckons that based on current co-payment policies in the market, the premiums are lower by between 19% and 68%.

The central bank has also shared some interesting data points. It says that claims incidence for medical insurance products with co-payment was lower than products without co-payment.

“Similar experiences are also being observed in other countries,” Bank Negara tells StarBizWeek.

“Greater take-up of co-payment products over time aims to promote more needs-based usage of healthcare services by encouraging the patient as well as the healthcare providers to be more discerning in health treatment.

“This, over the longer term, is expected to help contain the pace of escalating premiums and contribute towards more moderate medical claims inflation,” it says.

O’Dell also concurs that co-payments can result in a longer-term impact on reducing the cost of care by raising the awareness on healthcare costs among consumers and drive behavioural change.

While it may well be several years before the impact can be seen, Manulife Holdings Bhd group CEO Vibha Coburn had previously said that rate of medical inflation in Malaysia should come down by between 1% and 3% with the introduction of co-payments.

One thing is clear, if nothing is done, insurance premiums will continue to rise, making it increasingly unaffordable for anyone to own insurance or private healthcare in the future.

O’Dell estimates this could take place in the next 10 years.

“Co-payments will actually increase the number of people who will be interested in private medical insurance, especially the younger generation or healthier individuals who tend to get hospitalised less can now consider owning private medical insurance with lower premiums,” he opines.

Meanwhile, Bank Negara has stressed that consumers with existing medical policies without a co-payment feature can continue to keep their current coverage.

This is contrary to what some unscrupulous insurance agents are touting, rushing consumers to buy policies before the Sept 1 deadline.

Existing policyholders will also not be required to switch to a plan with co-payment features at policy renewal, though the option may be offered.

Other tools to fix rising medical inflation

The fact remains that medical inflation is a complex issue and there are no overnight fixes.

Some think the rollout of the co-payment feature is a band-aid solution to plug a gaping wound that are the systemic issues of our healthcare system.

Bank Negara in its policy document it published early this year on the medical insurance sector, stated it is planning to introduce a central medical claims data platform which will allow for better analysis of medical claims data, including but not limited to facilitating the disclosure and publication of information relevant to drivers of the medical inflation rate and medical claims trends.

Additionally, the central bank will also require insurers and takaful operators to provide a comprehensive product disclosure sheet that clearly outlines the features, benefits, limitations and any co-payment requirements associated with medical and health insurance products.

This aims to help consumers make informed decisions regarding their insurance options.

Both initiatives are scheduled to start next year.

O’Dell also calls for more initiatives on cost containment at private hospitals, in which he says there is “not enough evidence to show that private hospitals are serious” about it.

“One of the major things we are trying to push for is the adoption of diagnostic-related group (DRG) pricing, which is a form of package pricing based on the complexity of the patient’s condition as opposed to a la carte pricing in private hospitals. We would like the MoH to mandate the setting up of formal cost containment units or processes within the private hospital.

“We are not promoting that they regulate the costs of the private hospital, but we just think that they can do a much better job at controlling costs,” he says.

Not all agree with co-paymentsThere are detractors to co-payments. Some media reports have alluded that the introduction of co-payments could lead to financial catastrophe for the public.

This is on the basis that they would not be able to afford making the co-payments in those times of emergency.

Even a 5% co-payment could be problematic, they argue. For someone incurring a RM60,000 hospital bill for instance, would mean an out-of-pocket payment of RM3,000.

Concerns are also raised whether there will be a mass exodus migrating from private healthcare to public healthcare as a result, when insurance with the added co-payment features becomes unaffordable. This would also put a further strain on the already overburdened public hospitals.

The Association of Private Hospitals of Malaysia’s president Datuk Dr Kuljit Singh is one of the detractors of co-payments. He reckons that the main thing that needs to be addressed to solve Malaysia’s healthcare problems is to fix the ailing public healthcare system.

“The government’s efforts to realign and restructure private healthcare – such as introducing co-payments and drug pricing controls – are steps in the right direction, but they do not address the core issue: the overwhelming number of people waiting for treatment in public healthcare.

“These initiatives do not help those who rely on the public system, many of whom cannot even afford insurance, let alone co-payments,” he says.

Instead, Kuljit posits that the solution to Malaysia’s creaking healthcare system should take the form of more sustainable public-private partnerships (PPPs).

“PPPs in Malaysian healthcare provide advantages such as increased service accessibility, improved infrastructure, and shared cost benefits. By using private sector expertise and resources, they can enhance efficiency and alleviate the burden on public money.

“Nevertheless, there are obstacles that need to be addressed, such as the possibility of exceeding the budget, fairness concerns in delivering services, and apprehensions of prioritising financial gain over the well-being of patients.

“Successful implementation of PPPs in the healthcare sector requires a careful balance between the interests of the public and private sectors, as well as a focus on accountability and maintaining high quality standards,” he says.