TCMH struggles to stop slide

AS Tan Chong Motor Holdings Bhd (TCMH)’s fortunes continue to deteriorate, observers will wonder whether its landbank will ever be unlocked.

There had been speculation as far back as 15 years ago that TCMH would redevelop its industrial property at Segambut, Kuala Lumpur.

That was meant to boost its fortunes and all it would take was to shift their automobile production lines to another plant, which was then said to be the Ford plant in Shah Alam, which Tan Chong acquired in 2009.

However, for reasons still unknown, TCMH has not made the move to redevelop its valuable landbank.

TCMH’s principal business of selling Nissan vehicles has also been severely affected by stiff competition, resulting in its stock trading at an all-time low of 46 sen, giving it a market capitalisation of a mere RM309mil.

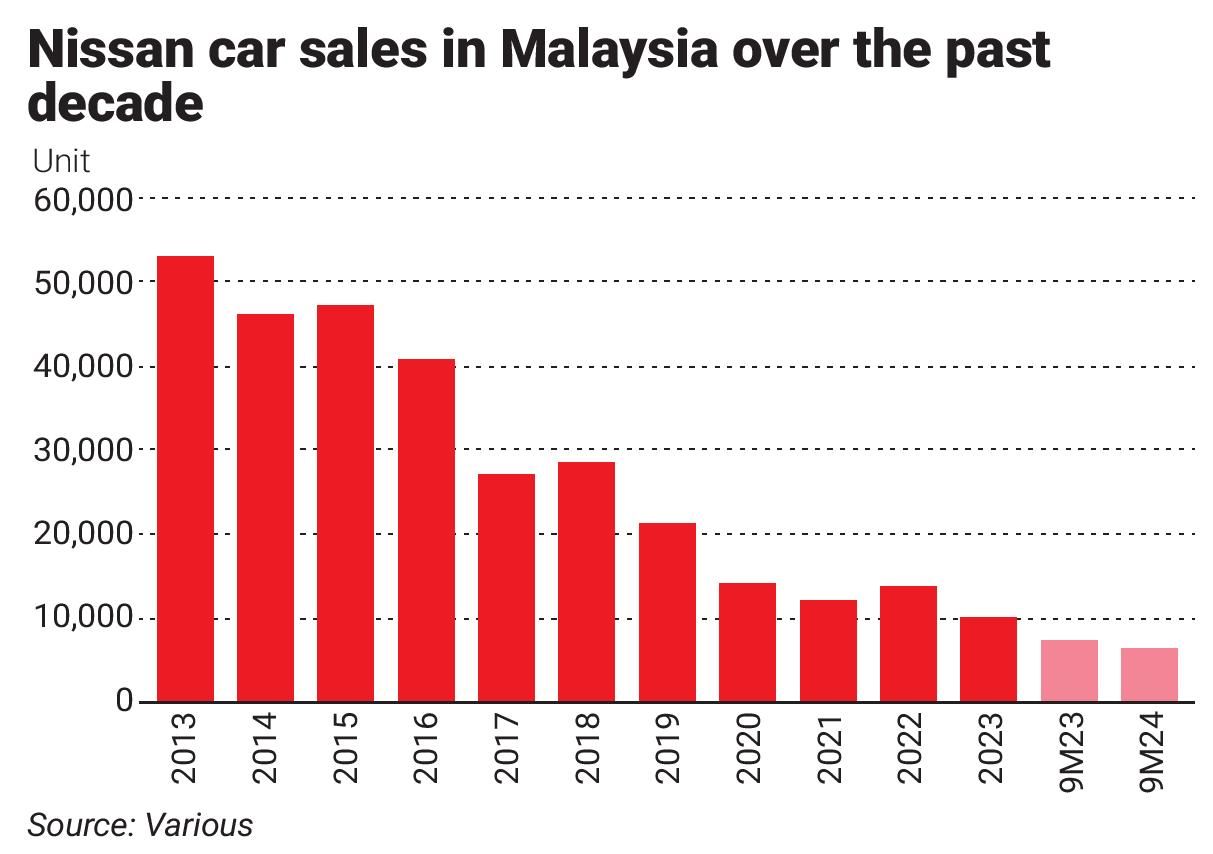

In its heyday in 2013, TCMH commanded a market cap of RM4.04bil and its Nissan business had a commendable market share of 9.3% of total industry volume (TIV) of vehicles, but sales began declining after that (see chart).

It is no surprise that analysts have been shunning TCMH, with five sell calls on the stock.

“We stay concerned on the group’s continued weak sales volume amidst deteriorated market conditions,” Hong Leong Investment Bank Research analyst Daniel Wong notes in his report on TCMH last month.

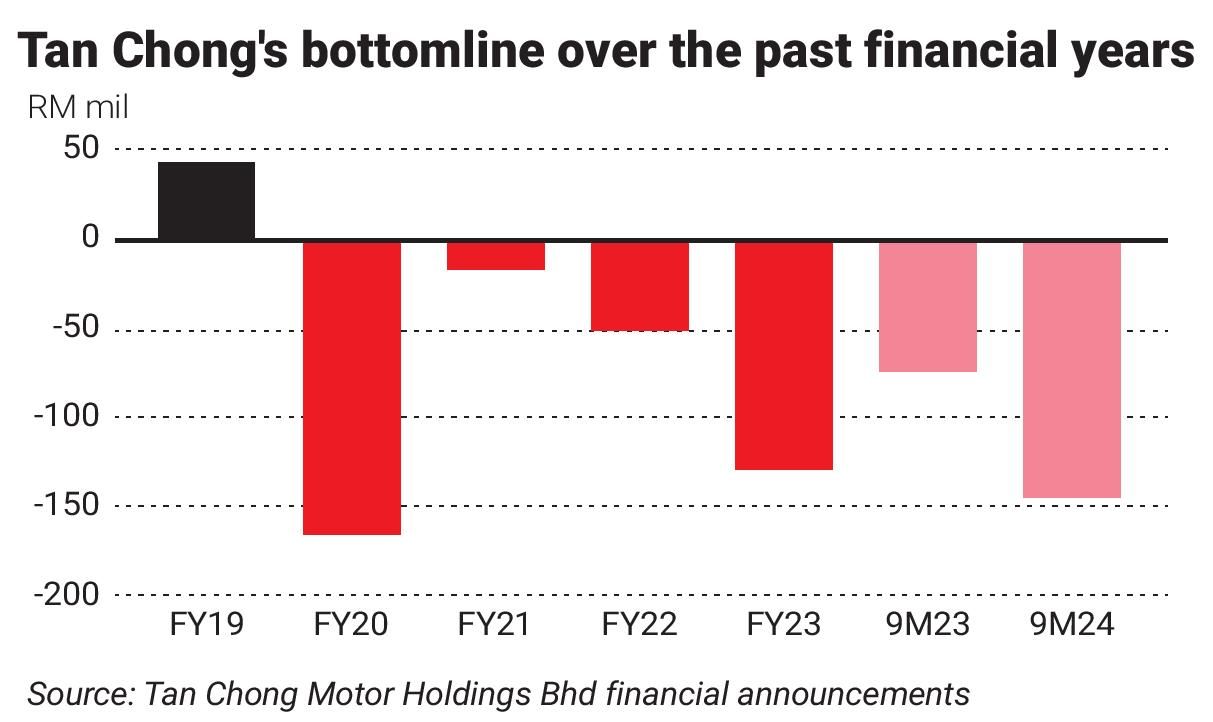

TCMH reported widening net losses to RM90.3mil for the third quarter ended Sept 30, 2024 (3Q24), compared to RM50.7mil in the same quarter last year.

Revenue also declined to RM462.7mil from RM649.8mil in 3Q23.

For the nine-month period (9M24), TCMH’s revenue dropped to RM1.57bil from RM1.89bil a year earlier, while net losses doubled to RM146.1mil from RM73.9mil in 9M23.

The company attributes its weaker performance to “softer consumer sentiment and a highly competitive business landscape in both the local and overseas markets”.

Higher net foreign exchange losses also impacted its results.

Previously, the company had cited supply chain constraints, a lack of a refreshed product line-up, and currency pressures as factors weighing on profitability.

TCMH has yet to reply to questions from StarBiz 7 for this article.

Entry of China cars

Adding to these difficulties is the increasing dominance of Chinese carmakers in key markets.

Nissan, TCMH’s principal brand, has not been immune to these pressures.

Globally, Nissan has been facing intensified competition from brands such as BYD and Chery, which have made significant inroads by offering feature-packed electric and hybrid vehicles at highly competitive prices.

This disruption has forced Nissan, headquartered in Yokohama, Japan, to cut 9,000 jobs and reduce its manufacturing capacity.

In Malaysia, the rise of Chinese marques is reshaping market dynamics, with automakers across the mid to luxury segments struggling to maintain their foothold.

BYD and Chery collectively sold 18,708 passenger vehicles in 9M24 in Malaysia, a staggering six-fold increase from the same period last year.

Their market share now stands at 3.5% of TIV in Malaysia, up from barely 1% previously, signalling a clear shift in consumer preferences driven by affordability and advanced technology.

This has prompted some local players to forge partnerships with Chinese automakers.

For example, Sime Darby Bhd has teamed up with BYD, while Bermaz Auto Bhd has partnered with XPeng.

Notably, TCMH’s sister company, Warisan TC Holdings Bhd, has secured an exclusive partnership as the distributor of China’s GAC AION electric vehicles and spare parts in Malaysia.

TCMH, however, has yet to form any such alliance.

Turnaround efforts

This does not mean TCMH is letting things be. It is rolling out strategic initiatives, including last week’s launch of the hybrid Nissan Kicks e-Power vehicle, which offers an electric driving experience powered by a petrol engine that charges the battery.

The company has also outlined plans for additional vehicle launches over the next 24 months, with expectations that the Nissan segment will “regain some of its lost ground moving forward”.

TCMH also plans for the first time to export vehicles made and assembled at its Malaysian plant. This initiative is part of TCMH’s strategic partnership with Nissan Motor Co Ltd.

Analysts, however, are cautiously optimistic, citing concerns over the viability and scale of exports.

“The feasibility depends on the target export markets and the competitiveness of the vehicles they plan to produce,” an industry analyst remarks.

“If it’s a small volume, the economics can be challenging. Large-scale exports, on the other hand, might offer a better chance of success.”

Besides product launches and export plans, TCMH is focusing on improving operations and cash flow management.

Potential of land redevelopment

The obvious value in TCMH’s landbank can be seen in its net asset value, which stands at RM3.93 per share today.

Its annual report cites key properties as its Segambut land, which spans two million sq ft with a net book value of RM515.09mil, and its Serendah land, covering 7.3 million sq ft with a net book value of RM272.46mil.

Overseas, the company’s key lands include one in Myanmar, measuring 2.2 million sq ft with a net book value of RM167.47mil, and another in Vietnam, with 1.4 million sq ft valued at RM106.17mil.

The company’s policy is to revalue assets every three years, with the last update in 2022.

However, if the company were to embark on property development, it would require different financial dynamics, involving investment or possibly a joint venture with a major property company.

TCMH had RM1.7bil in borrowings as of Sept 30, with cash holdings of RM383.45mil.

Year-to-date, its stock price has fallen by 51% to 47 sen per share from 96 sen.

With a target price of 35 sen, HLIB Research’s Daniel believes there has been “a lack of meaningful restructuring or strategic movement from management to turn the company around.”