A Glimpse Into The Expert Outlook On DHI Group Through 5 Analysts

Analysts' ratings for DHI Group (NYSE:DHX) over the last quarter vary from bullish to bearish, as provided by 5 analysts.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 5 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 4 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

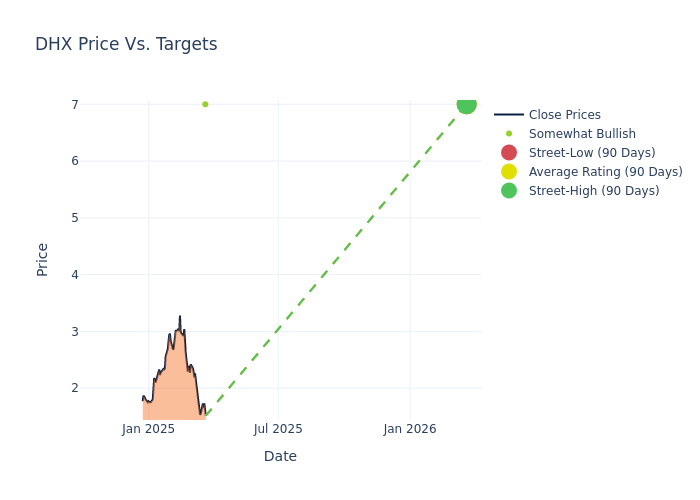

Analysts have set 12-month price targets for DHI Group, revealing an average target of $7.0, a high estimate of $7.00, and a low estimate of $7.00. No alteration is observed as the current average remains at the previous average price target.

Interpreting Analyst Ratings: A Closer Look

The analysis of recent analyst actions sheds light on the perception of DHI Group by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Gary Prestopino | Barrington Research | Maintains | Outperform | $7.00 | $7.00 |

| Gary Prestopino | Barrington Research | Maintains | Outperform | $7.00 | $7.00 |

| Gary Prestopino | Barrington Research | Maintains | Outperform | $7.00 | $7.00 |

| Gary Prestopino | Barrington Research | Maintains | Outperform | $7.00 | $7.00 |

| Gary Prestopino | Barrington Research | Maintains | Outperform | $7.00 | $7.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to DHI Group. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of DHI Group compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of DHI Group's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into DHI Group's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on DHI Group analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About DHI Group

DHI Group Inc is a provider of artificial intelligence-powered software products, online tools and services to deliver career marketplaces to candidates and employers globally. DHI's brands includes Dice and Clearance Jobs enable recruiters and hiring managers to efficiently search, match and connect with skilled technologists in specialized fields, particularly technology and those with active government security clearances. The company derive the majority of revenue came from the sale of recruitment packages, which allow customers to promote jobs on websites and source candidates through their resume databases. Recruitment packages are typically provided through contractual arrangements with annual, quarterly or monthly payment terms.

Key Indicators: DHI Group's Financial Health

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: DHI Group's revenue growth over a period of 3 months has faced challenges. As of 31 December, 2024, the company experienced a revenue decline of approximately -6.71%. This indicates a decrease in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Communication Services sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 2.94%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 0.91%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): DHI Group's ROA excels beyond industry benchmarks, reaching 0.46%. This signifies efficient management of assets and strong financial health.

Debt Management: DHI Group's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.37.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.