Palantir, Northrop Shine Despite Market Mayhem, But Will Elon Musk's DOGE Rain On The Defense Rally?

Defense and aerospace stocks have emerged as a bright spot amid turbulent and chaotic broader market conditions, with the iShares U.S. Aerospace & Defense ETF (BATS:ITA) up 5.7% year-to-date and the VanEck Defense UCITS ETF (LON: DFNG) up 20.81%, while the S&P 500 and the Nasdaq have declined 4% and 10%, respectively, during the same period.

What Happened: However, there are concerns about the Elon Musk-led Department of Government Efficiency cutting the federal budget by $1 trillion before May this year, a move which could weigh on the sector.

The US defense industry is a key beneficiary of the $850 billion annual defense budget, which is expected to see deep cuts along with the rest of the government machinery as part of the DOGE initiative.

| Stock / ETF / Indices | Current Price | RSI | Year-to-Date Performance | 52-Week Range |

| RTX Corp (NYSE:RTX) | $132.46 | 54.36 | +16.45 (+14.18%) | 97.03 – 136.17 |

| L3Harris Technologies (NYSE:LHX) | $209.31 | 48.57 | +1.95 (+0.94%) | 193.09 – 265.74 |

| General Dynamics (NYSE:GD) | $272.58 | 64.09 | +11.57 (+4.43%) | 239.87 – 316.90 |

| TransDigm Group (NYSE:TDG) | $1,383.29 | 57.29 | +129.18 (+10.30%) | 1,176 – 1,451 |

| Lockheed Martin (NYSE:LMT) | $446.71 | 45.14 | -35.54 (-7.37%) | 419.70 – 618.95 |

| Northrop Grumman (NYSE:NOC) | $512.10 | 54.51 | +44.00 (+9.40%) | 418.60 – 555.57 |

| Palantir Inc (NASDAQ:PLTR) | $84.40 | 39.80 | +9.21 (+12.25%) | 20.33 – 125.41 |

See More: DOGE Blowback Aside, Elon Musk Thinks Tesla Stock Is Going To Do Fine: ‘It’s A Buying Opportunity’

UBS analysts believe that defense contractors and even IT solutions providers with government exposure will see their earnings come under pressure in the near term. However, it goes on to add that any downside in defense stocks will be limited, highlighting that consensus estimates have moved higher since the elections.

This is partly owing to the low valuations in this space, relative to the rest of the market, and partly to the emergence of other nations as major buyers of defense products beyond just the United States.

What It Means: With growing threats from Russia alongside waning support from the US, NATO is making a renewed push to bolster its defense capabilities. Investments in defense across Europe could go from $340 billion to $720 billion, with plenty of opportunities coming the way of US-based contractors.

Besides this, tensions in the Middle East have led to a strong demand for weapon systems and ammunition, all of which stand to make up for any losses arising from DOGE-related budget cuts.

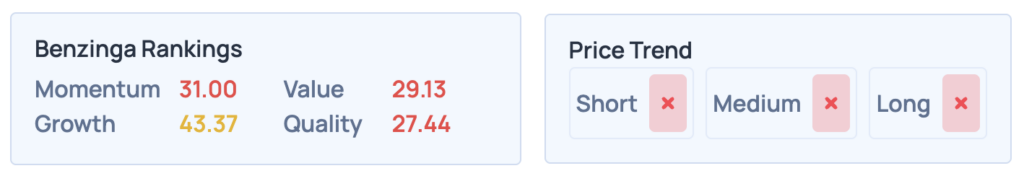

As we can see with Benzinga Edge, Lockheed Martin (NYSE:LMT) is seeing weak growth and momentum currently, but what about other major defense stocks? Check out Benzinga Edge Stock Rankings for deeper insights.

Photo Courtesy: Andrew Angelov On Shutterstock.com

Read More: