Where Mosaic Stands With Analysts

Analysts' ratings for Mosaic (NYSE:MOS) over the last quarter vary from bullish to bearish, as provided by 16 analysts.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 5 | 9 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 3 | 2 | 0 | 0 |

| 2M Ago | 0 | 2 | 3 | 0 | 0 |

| 3M Ago | 0 | 0 | 3 | 1 | 0 |

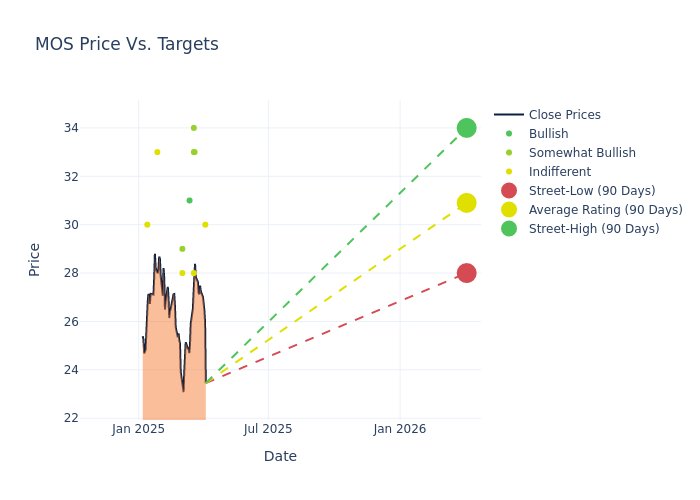

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $29.88, a high estimate of $34.00, and a low estimate of $26.00. Witnessing a positive shift, the current average has risen by 1.19% from the previous average price target of $29.53.

Exploring Analyst Ratings: An In-Depth Overview

An in-depth analysis of recent analyst actions unveils how financial experts perceive Mosaic. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Andrew Wong | RBC Capital | Maintains | Sector Perform | $30.00 | $28.00 |

| Kristen Owen | Oppenheimer | Maintains | Outperform | $33.00 | $33.00 |

| Richard Garchitorena | Wells Fargo | Raises | Equal-Weight | $28.00 | $26.00 |

| Ben Isaacson | Scotiabank | Raises | Sector Outperform | $34.00 | $31.00 |

| Benjamin Theurer | Barclays | Raises | Overweight | $33.00 | $27.00 |

| Duffy Fischer | Goldman Sachs | Announces | Buy | $31.00 | - |

| Benjamin Theurer | Barclays | Maintains | Equal-Weight | $27.00 | $27.00 |

| Andrew Wong | RBC Capital | Raises | Sector Perform | $28.00 | $27.00 |

| Richard Garchitorena | Wells Fargo | Lowers | Equal-Weight | $26.00 | $29.00 |

| Christopher Parkinson | Mizuho | Lowers | Neutral | $28.00 | $29.00 |

| Ben Isaacson | Scotiabank | Lowers | Sector Outperform | $31.00 | $34.00 |

| Jeffrey Zekaukas | JP Morgan | Raises | Overweight | $29.00 | $26.00 |

| Charles Neivert | Piper Sandler | Raises | Neutral | $33.00 | $30.00 |

| Benjamin Theurer | Barclays | Lowers | Underweight | $27.00 | $30.00 |

| Nigel Dally | Morgan Stanley | Lowers | Equal-Weight | $30.00 | $40.00 |

| Charles Neivert | Piper Sandler | Raises | Neutral | $30.00 | $26.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Mosaic. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Mosaic compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Capture valuable insights into Mosaic's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Mosaic analyst ratings.

Unveiling the Story Behind Mosaic

Mosaic is one of the largest phosphate and potash producers in the world. The company's assets include phosphate rock mines in Florida, Brazil, and Peru and potash mines in Saskatchewan, New Mexico, and Brazil. Mosaic also runs a large fertilizer distribution operation in Brazil through its Mosaic Fertilizantes business.

Mosaic: Financial Performance Dissected

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Decline in Revenue: Over the 3 months period, Mosaic faced challenges, resulting in a decline of approximately -10.59% in revenue growth as of 31 December, 2024. This signifies a reduction in the company's top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Mosaic's net margin excels beyond industry benchmarks, reaching 6.0%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Mosaic's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.45% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Mosaic's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.73%, the company showcases efficient use of assets and strong financial health.

Debt Management: Mosaic's debt-to-equity ratio is below the industry average. With a ratio of 0.39, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.