A Look at Insperity's Upcoming Earnings Report

Insperity (NYSE:NSP) is set to give its latest quarterly earnings report on Tuesday, 2025-04-29. Here's what investors need to know before the announcement.

Analysts estimate that Insperity will report an earnings per share (EPS) of $2.02.

The market awaits Insperity's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

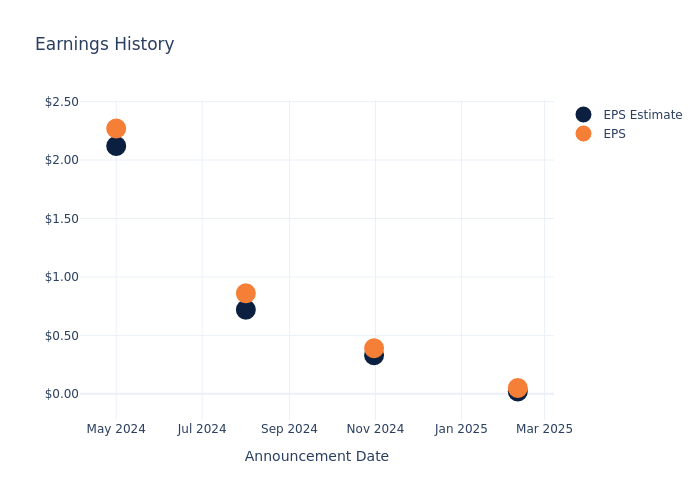

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.03, leading to a 5.7% increase in the share price the following trading session.

Here's a look at Insperity's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.02 | 0.33 | 0.72 | 2.12 |

| EPS Actual | 0.05 | 0.39 | 0.86 | 2.27 |

| Price Change % | 6.0% | -5.0% | -2.0% | -1.0% |

Performance of Insperity Shares

Shares of Insperity were trading at $79.0 as of April 25. Over the last 52-week period, shares are down 24.74%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analysts' Perspectives on Insperity

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Insperity.

Insperity has received a total of 1 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $82.0, the consensus suggests a potential 3.8% upside.

Analyzing Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Alight, Korn Ferry and First Advantage, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Alight, with an average 1-year price target of $9.75, suggesting a potential 87.66% downside.

- Analysts currently favor an Buy trajectory for Korn Ferry, with an average 1-year price target of $80.0, suggesting a potential 1.27% upside.

- Analysts currently favor an Outperform trajectory for First Advantage, with an average 1-year price target of $19.0, suggesting a potential 75.95% downside.

Peers Comparative Analysis Summary

The peer analysis summary outlines pivotal metrics for Alight, Korn Ferry and First Advantage, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Insperity | Neutral | 2.09% | $218M | -8.11% |

| Alight | Buy | -0.29% | $271M | 0.19% |

| Korn Ferry | Buy | -0.05% | $165.36M | 3.23% |

| First Advantage | Outperform | 51.62% | $138.63M | -9.01% |

Key Takeaway:

Insperity ranks at the bottom for Revenue Growth and Gross Profit, with negative percentages. It also has the lowest Return on Equity among its peers. However, it is rated as Neutral, which is better than being rated as Outperform or Buy.

Unveiling the Story Behind Insperity

Insperity Inc is a company that provides a wide range of human resources and business solutions designed to help businesses improve their performance. Small and midsize enterprises are the company's primary target customers. Majority of the company's products are offered through the company's Workforce Optimization and Workforce Synchronization solutions, which comprise various human resource functions, such as payroll and employment administration, employee benefits and compensation, government compliance, performance management, training and development services, and human capital management. The company generates all of its revenue in the United States.

Unraveling the Financial Story of Insperity

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Insperity's remarkable performance in 3 months is evident. As of 31 December, 2024, the company achieved an impressive revenue growth rate of 2.09%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Insperity's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of -0.56%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Insperity's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -8.11%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Insperity's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -0.4%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Insperity's debt-to-equity ratio stands notably higher than the industry average, reaching 4.48. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for Insperity visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.