Assessing Levi Strauss: Insights From 11 Financial Analysts

Levi Strauss (NYSE:LEVI) underwent analysis by 11 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 5 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 4 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 0 | 0 | 0 |

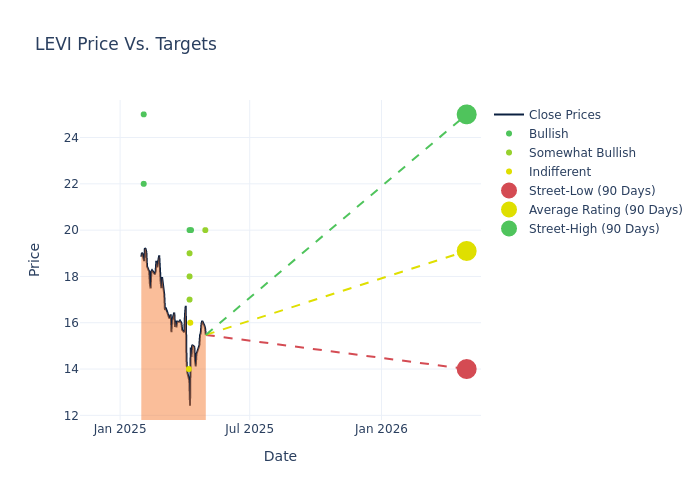

Insights from analysts' 12-month price targets are revealed, presenting an average target of $19.45, a high estimate of $25.00, and a low estimate of $14.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 6.17%.

Understanding Analyst Ratings: A Comprehensive Breakdown

A clear picture of Levi Strauss's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ike Boruchow | Wells Fargo | Raises | Overweight | $20.00 | $17.00 |

| Christopher Nardone | B of A Securities | Raises | Buy | $20.00 | $17.00 |

| Alex Straton | Morgan Stanley | Lowers | Equal-Weight | $16.00 | $17.00 |

| Paul Kearney | Barclays | Lowers | Overweight | $18.00 | $22.00 |

| Drew Crum | Stifel | Lowers | Buy | $20.00 | $25.00 |

| Matthew Boss | JP Morgan | Lowers | Overweight | $17.00 | $19.00 |

| Dana Telsey | Telsey Advisory Group | Lowers | Outperform | $19.00 | $23.00 |

| Paul Lejuez | Citigroup | Lowers | Neutral | $14.00 | $19.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Outperform | $23.00 | $23.00 |

| Jay Sole | UBS | Lowers | Buy | $25.00 | $26.00 |

| Robert Drbul | Guggenheim | Raises | Buy | $22.00 | $20.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Levi Strauss. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Levi Strauss compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Levi Strauss's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Levi Strauss's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Levi Strauss analyst ratings.

Get to Know Levi Strauss Better

Levi Strauss & Co is involved in designing, marketing, and selling products that include jeans, casual and dresses pants, tops, shorts, skirts, jackets, footwear, and related accessories directly or through third parties and licensees for men, women, and children under Levi's, Dockers, Signature by Levi Strauss & Co. and Denizen brands. The company manages its business according to three regional segments: the Americas, which is the key revenue driver; Europe; and Asia.

Key Indicators: Levi Strauss's Financial Health

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Positive Revenue Trend: Examining Levi Strauss's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 3.15% as of 28 February, 2025, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Levi Strauss's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 8.84%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Levi Strauss's ROE stands out, surpassing industry averages. With an impressive ROE of 6.74%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Levi Strauss's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.15% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 1.06, Levi Strauss adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.