Where Jakks Pacific Stands With Analysts

In the latest quarter, 5 analysts provided ratings for Jakks Pacific (NASDAQ:JAKK), showcasing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 0 | 0 | 0 |

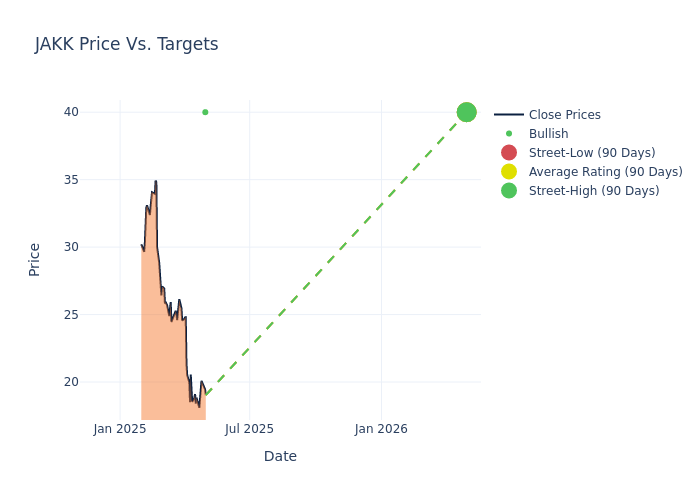

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $40.0, along with a high estimate of $40.00 and a low estimate of $40.00. No alteration is observed as the current average remains at the previous average price target.

Exploring Analyst Ratings: An In-Depth Overview

In examining recent analyst actions, we gain insights into how financial experts perceive Jakks Pacific. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Eric Beder | Small Cap Consumer Research | Maintains | Buy | $40.00 | $40.00 |

| Eric Beder | Small Cap Consumer Research | Maintains | Buy | $40.00 | $40.00 |

| Eric Beder | Small Cap Consumer Research | Maintains | Buy | $40.00 | $40.00 |

| Eric Berg | Small Cap Consumer Research | Maintains | Buy | $40.00 | $40.00 |

| Eric Beder | Small Cap Consumer Research | Maintains | Buy | $40.00 | $40.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Jakks Pacific. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Jakks Pacific compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Jakks Pacific's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Jakks Pacific's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Jakks Pacific analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Get to Know Jakks Pacific Better

Jakks Pacific Inc is a multi-product line, multi-brand toy company that designs, produces, markets, sells and distributes toys and related kid-targeted consumer products, inclusive of kids indoor and outdoor furniture, costumes and various product lines in the sporting goods and home furnishings space. Its products offering include Traditional toys and electronics such as Action figures, Toy vehicles, Dolls and accessories, Ride-on toys, Toys for pets, and others. The company's products have been divided into two segments: (i) Toys/Consumer Products and (ii) Costumes.

Jakks Pacific: Financial Performance Dissected

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Over the 3M period, Jakks Pacific showcased positive performance, achieving a revenue growth rate of 2.63% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Jakks Pacific's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -6.97%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Jakks Pacific's ROE excels beyond industry benchmarks, reaching -3.72%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of -1.88%, the company showcases effective utilization of assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.24.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.