Forecasting The Future: 12 Analyst Projections For Victoria's Secret

12 analysts have expressed a variety of opinions on Victoria's Secret (NYSE:VSCO) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 7 | 1 | 2 |

| Last 30D | 0 | 0 | 0 | 1 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 1 |

| 2M Ago | 0 | 2 | 4 | 0 | 1 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

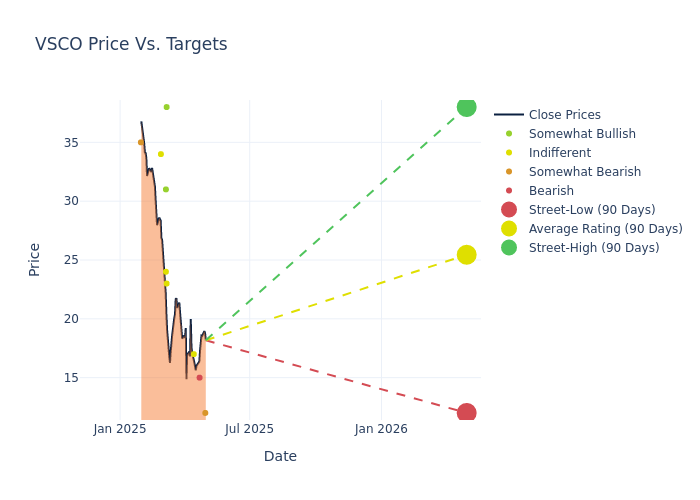

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $26.08, a high estimate of $40.00, and a low estimate of $12.00. This current average represents a 32.12% decrease from the previous average price target of $38.42.

Exploring Analyst Ratings: An In-Depth Overview

A clear picture of Victoria's Secret's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ike Boruchow | Wells Fargo | Lowers | Underweight | $12.00 | $25.00 |

| Brooke Roach | Goldman Sachs | Lowers | Sell | $15.00 | $19.00 |

| Matthew Boss | JP Morgan | Lowers | Neutral | $17.00 | $35.00 |

| Brooke Roach | Goldman Sachs | Lowers | Sell | $19.00 | $35.00 |

| Adrienne Yih | Barclays | Lowers | Overweight | $38.00 | $53.00 |

| Alex Straton | Morgan Stanley | Lowers | Equal-Weight | $23.00 | $38.00 |

| Simeon Siegel | BMO Capital | Lowers | Outperform | $31.00 | $46.00 |

| Ike Boruchow | Wells Fargo | Lowers | Equal-Weight | $25.00 | $40.00 |

| Matthew Boss | JP Morgan | Lowers | Neutral | $35.00 | $43.00 |

| Dana Telsey | Telsey Advisory Group | Lowers | Market Perform | $24.00 | $40.00 |

| Mauricio Serna | UBS | Lowers | Neutral | $34.00 | $47.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Market Perform | $40.00 | $40.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Victoria's Secret. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Victoria's Secret compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Capture valuable insights into Victoria's Secret's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Victoria's Secret analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering Victoria's Secret: A Closer Look

Victoria's Secret & Co is a retailer of women's intimate and other apparel and beauty products marketed under the Victoria's Secret, PINK, and Adore Me brand names. It also includes the merchandise sourcing and production function serving the Company and its international partners. The Company operates as a single segment designed to serve customers seamlessly through stores and online channels.

Financial Milestones: Victoria's Secret's Journey

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Victoria's Secret displayed positive results in 3M. As of 31 January, 2025, the company achieved a solid revenue growth rate of approximately 1.1%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 9.16%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Victoria's Secret's ROE excels beyond industry benchmarks, reaching 36.11%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Victoria's Secret's ROA stands out, surpassing industry averages. With an impressive ROA of 4.08%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a high debt-to-equity ratio of 4.22, Victoria's Secret faces challenges in effectively managing its debt levels, indicating potential financial strain.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.