Scorpio Tankers's Earnings: A Preview

Scorpio Tankers (NYSE:STNG) is gearing up to announce its quarterly earnings on Thursday, 2025-05-01. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Scorpio Tankers will report an earnings per share (EPS) of $2.65.

The market awaits Scorpio Tankers's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

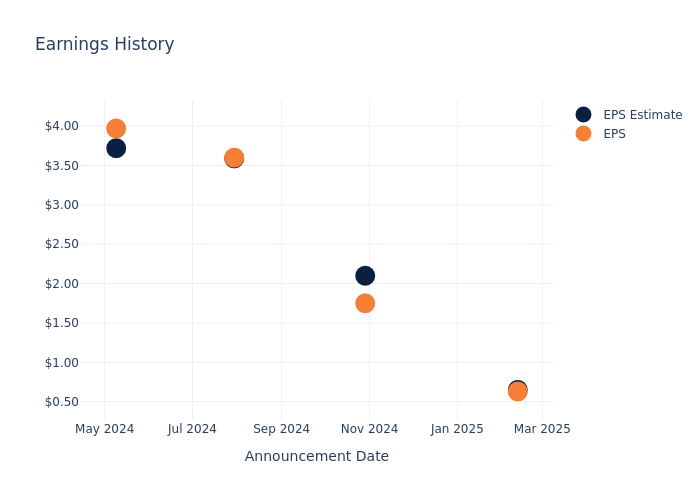

Earnings Track Record

During the last quarter, the company reported an EPS missed by $0.02, leading to a 6.69% drop in the share price on the subsequent day.

Here's a look at Scorpio Tankers's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.65 | 2.10 | 3.59 | 3.72 |

| EPS Actual | 0.63 | 1.75 | 3.60 | 3.97 |

| Price Change % | -7.000000000000001% | -2.0% | -0.0% | 1.0% |

Stock Performance

Shares of Scorpio Tankers were trading at $37.8 as of April 29. Over the last 52-week period, shares are down 47.38%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Observations about Scorpio Tankers

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Scorpio Tankers.

The consensus rating for Scorpio Tankers is Buy, derived from 3 analyst ratings. An average one-year price target of $61.33 implies a potential 62.25% upside.

Peer Ratings Comparison

The following analysis focuses on the analyst ratings and average 1-year price targets of Global Partners, DHT Holdings and Frontline, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Global Partners, with an average 1-year price target of $56.0, suggesting a potential 48.15% upside.

- Analysts currently favor an Buy trajectory for DHT Holdings, with an average 1-year price target of $13.5, suggesting a potential 64.29% downside.

- Analysts currently favor an Outperform trajectory for Frontline, with an average 1-year price target of $20.0, suggesting a potential 47.09% downside.

Insights: Peer Analysis

In the peer analysis summary, key metrics for Global Partners, DHT Holdings and Frontline are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Scorpio Tankers | Buy | -39.35% | $66.11M | 2.40% |

| Global Partners | Neutral | -5.05% | $268.83M | 2.47% |

| DHT Holdings | Buy | -8.36% | $38.56M | 5.31% |

| Frontline | Outperform | 2.56% | $113.58M | 2.85% |

Key Takeaway:

Scorpio Tankers ranks at the bottom for Revenue Growth, with the lowest percentage among peers. It also has the lowest Gross Profit among the group. However, it has the highest Return on Equity, indicating strong performance in this aspect compared to its peers.

Discovering Scorpio Tankers: A Closer Look

Scorpio Tankers Inc is a provider of marine transportation of petroleum products. It owned, lease financed, or chartered in vessels spanning three different vessel segments Handymax, MR, and LR2. The company's fleet of tankers is the eco-friendly, and newest fleet on the water hauling clean petroleum products. It provides seaborne transportation of crude oil and refined petroleum products. The company generates the majority of its revenue from LR2.

Financial Milestones: Scorpio Tankers's Journey

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Challenges: Scorpio Tankers's revenue growth over 3 months faced difficulties. As of 31 December, 2024, the company experienced a decline of approximately -39.35%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Energy sector.

Net Margin: Scorpio Tankers's net margin excels beyond industry benchmarks, reaching 33.61%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.4%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Scorpio Tankers's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.78% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Scorpio Tankers's debt-to-equity ratio is below the industry average. With a ratio of 0.3, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Scorpio Tankers visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.