A Glimpse of Acadian Asset Management's Earnings Potential

Acadian Asset Management (NYSE:AAMI) is set to give its latest quarterly earnings report on Thursday, 2025-05-01. Here's what investors need to know before the announcement.

Analysts estimate that Acadian Asset Management will report an earnings per share (EPS) of $0.50.

Investors in Acadian Asset Management are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

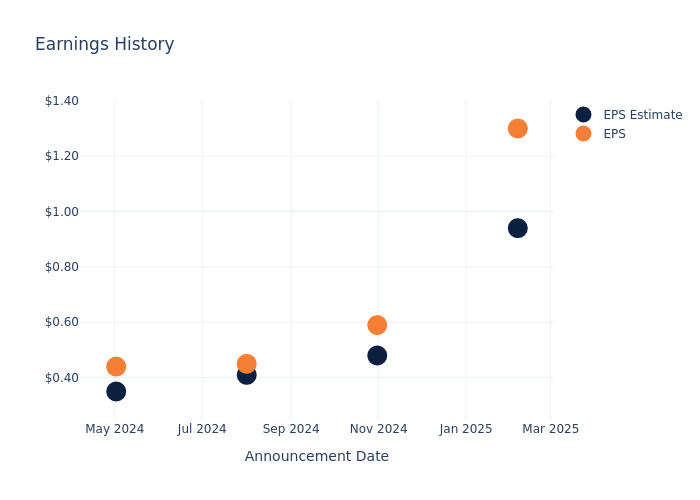

Past Earnings Performance

Last quarter the company beat EPS by $0.36, which was followed by a 0.08% increase in the share price the next day.

Here's a look at Acadian Asset Management's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.94 | 0.48 | 0.41 | 0.35 |

| EPS Actual | 1.30 | 0.59 | 0.45 | 0.44 |

| Price Change % | 0.0% | 4.0% | -3.0% | -0.0% |

Stock Performance

Shares of Acadian Asset Management were trading at $26.69 as of April 29. Over the last 52-week period, shares are up 17.11%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Perspectives on Acadian Asset Management

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Acadian Asset Management.

With 3 analyst ratings, Acadian Asset Management has a consensus rating of Neutral. The average one-year price target is $25.33, indicating a potential 5.1% downside.

Analyzing Analyst Ratings Among Peers

This comparison focuses on the analyst ratings and average 1-year price targets of Virtus Inv, P10 and WisdomTree, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Underperform trajectory for Virtus Inv, with an average 1-year price target of $183.14, suggesting a potential 586.17% upside.

- Analysts currently favor an Outperform trajectory for P10, with an average 1-year price target of $14.0, suggesting a potential 47.55% downside.

- Analysts currently favor an Sell trajectory for WisdomTree, with an average 1-year price target of $8.5, suggesting a potential 68.15% downside.

Overview of Peer Analysis

Within the peer analysis summary, vital metrics for Virtus Inv, P10 and WisdomTree are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Acadian Asset Management | Neutral | 27.90% | $91.70M | 4047.62% |

| Virtus Inv | Underperform | -6.69% | $126.21M | 3.20% |

| P10 | Outperform | 34.80% | $45.59M | 1.51% |

| WisdomTree | Sell | 21.85% | $57.81M | 6.76% |

Key Takeaway:

Acadian Asset Management ranks highest in Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

Discovering Acadian Asset Management: A Closer Look

Acadian Asset Management Inc is a holding company that operates a systematic investment management business through its subsidiary, that offers institutional investors across the globe access to a diversified array of systematic investment strategies designed to meet a range of risk and return objectives.

A Deep Dive into Acadian Asset Management's Financials

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Acadian Asset Management displayed positive results in 3 months. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 27.9%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Financials sector.

Net Margin: Acadian Asset Management's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 25.33%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Acadian Asset Management's ROE stands out, surpassing industry averages. With an impressive ROE of 4047.62%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Acadian Asset Management's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 6.75%, the company showcases efficient use of assets and strong financial health.

Debt Management: Acadian Asset Management's debt-to-equity ratio is notably higher than the industry average. With a ratio of 17.08, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

This article was generated by Benzinga's automated content engine and reviewed by an editor.