Breaking Down Sherwin-Williams: 11 Analysts Share Their Views

In the last three months, 11 analysts have published ratings on Sherwin-Williams (NYSE:SHW), offering a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 4 | 4 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 1 | 3 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 2 | 0 | 0 | 0 |

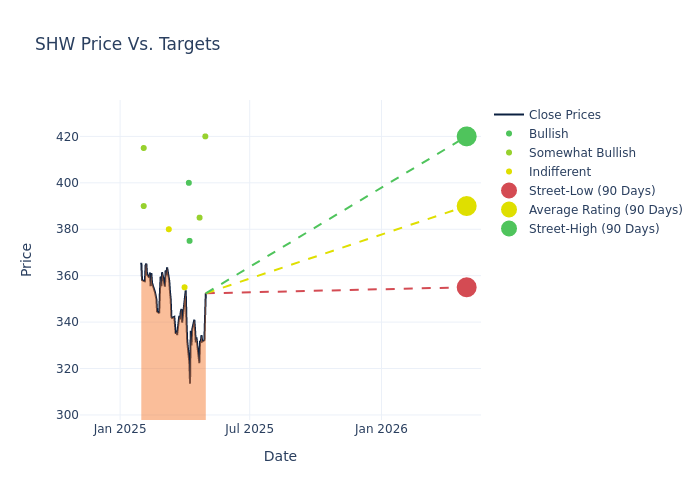

Insights from analysts' 12-month price targets are revealed, presenting an average target of $388.45, a high estimate of $423.00, and a low estimate of $350.00. This current average represents a 2.98% decrease from the previous average price target of $400.40.

Diving into Analyst Ratings: An In-Depth Exploration

A clear picture of Sherwin-Williams's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Sison | Wells Fargo | Raises | Overweight | $420.00 | $350.00 |

| Vincent Andrews | Morgan Stanley | Lowers | Overweight | $385.00 | $405.00 |

| Michael Sison | Wells Fargo | Lowers | Equal-Weight | $350.00 | $380.00 |

| Patrick Cunningham | Citigroup | Lowers | Buy | $375.00 | $423.00 |

| Joshua Spector | UBS | Lowers | Buy | $400.00 | $430.00 |

| Michael Sison | Wells Fargo | Lowers | Equal-Weight | $380.00 | $400.00 |

| Michael Leithead | Barclays | Lowers | Equal-Weight | $355.00 | $385.00 |

| Laurence Alexander | Jefferies | Lowers | Hold | $380.00 | $423.00 |

| Patrick Cunningham | Citigroup | Announces | Buy | $423.00 | - |

| Jeffrey Zekauskas | JP Morgan | Raises | Overweight | $390.00 | $370.00 |

| Arun Viswanathan | RBC Capital | Lowers | Outperform | $415.00 | $438.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Sherwin-Williams. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Sherwin-Williams compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Sherwin-Williams's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Sherwin-Williams's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Sherwin-Williams analyst ratings.

Get to Know Sherwin-Williams Better

Sherwin-Williams is the largest provider of architectural paint in the United States. The company has over 5,000 stores and sells premium paint at higher price points than most competitors. Sherwin-Williams also sells paint-related products in big-box stores and provides coatings for original equipment manufacturers.

Sherwin-Williams: Delving into Financials

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Over the 3M period, Sherwin-Williams showcased positive performance, achieving a revenue growth rate of 0.86% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Materials sector.

Net Margin: Sherwin-Williams's net margin excels beyond industry benchmarks, reaching 9.06%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Sherwin-Williams's ROE stands out, surpassing industry averages. With an impressive ROE of 11.7%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Sherwin-Williams's ROA stands out, surpassing industry averages. With an impressive ROA of 2.02%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a high debt-to-equity ratio of 2.94, Sherwin-Williams faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Basics of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.