What Analysts Are Saying About Arch Capital Group Stock

Analysts' ratings for Arch Capital Group (NASDAQ:ACGL) over the last quarter vary from bullish to bearish, as provided by 11 analysts.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 6 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 5 | 0 | 0 | 0 |

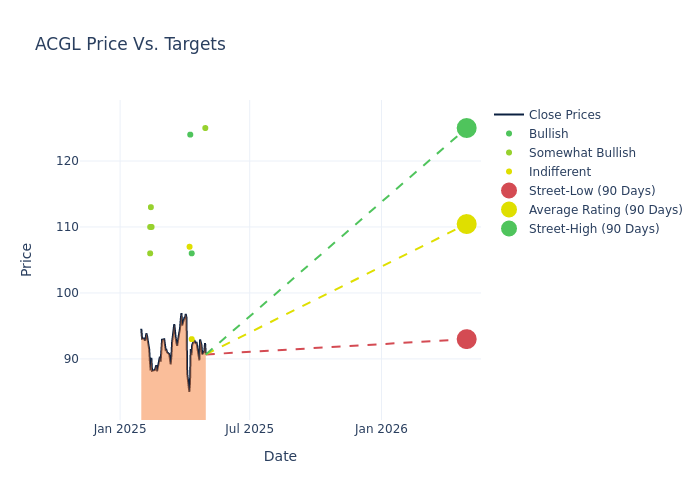

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $113.27, a high estimate of $127.00, and a low estimate of $93.00. This current average has decreased by 3.11% from the previous average price target of $116.91.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of Arch Capital Group's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Matthew Carletti | JMP Securities | Maintains | Market Outperform | $125.00 | $125.00 |

| Alex Scott | Barclays | Lowers | Equal-Weight | $93.00 | $100.00 |

| Yaron Kinar | Jefferies | Raises | Buy | $106.00 | $105.00 |

| Brian Meredith | UBS | Lowers | Buy | $124.00 | $127.00 |

| Jimmy Bhullar | JP Morgan | Raises | Neutral | $107.00 | $106.00 |

| Brian Meredith | UBS | Lowers | Buy | $127.00 | $131.00 |

| Michael Phillips | Morgan Stanley | Lowers | Overweight | $110.00 | $115.00 |

| Meyer Shields | Keefe, Bruyette & Woods | Lowers | Outperform | $113.00 | $120.00 |

| Scott Heleniak | RBC Capital | Lowers | Outperform | $110.00 | $125.00 |

| Elyse Greenspan | Wells Fargo | Lowers | Overweight | $106.00 | $107.00 |

| Matthew Carletti | JMP Securities | Maintains | Market Outperform | $125.00 | $125.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Arch Capital Group. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Arch Capital Group compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Arch Capital Group's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Capture valuable insights into Arch Capital Group's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Arch Capital Group analyst ratings.

Delving into Arch Capital Group's Background

Arch Capital Group Ltd is a Bermuda company that writes insurance and reinsurance with operations in the United States, Canada, Europe, Australia, and the United Kingdom. The business operates through three underwriting segments: insurance, reinsurance, and mortgage. The insurance segment provides specialty risk solutions to clients across various industries. The reinsurance segment provides reinsurance services which cover property catastrophe, property, liability, marine, aviation and space, trade credit and surety, agriculture, accident, life and health, and political risk. The mortgage business provides risk management and risk financing products to the mortgage insurance sectors through platforms in the U.S., Europe and Bermuda.

Understanding the Numbers: Arch Capital Group's Finances

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Over the 3M period, Arch Capital Group showcased positive performance, achieving a revenue growth rate of 19.09% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Financials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Arch Capital Group's net margin is impressive, surpassing industry averages. With a net margin of 20.51%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Arch Capital Group's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.46% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Arch Capital Group's ROA stands out, surpassing industry averages. With an impressive ROA of 1.28%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Arch Capital Group's debt-to-equity ratio is below the industry average. With a ratio of 0.14, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.