Breaking Down Public Service Enterprise: 9 Analysts Share Their Views

Across the recent three months, 9 analysts have shared their insights on Public Service Enterprise (NYSE:PEG), expressing a variety of opinions spanning from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 3 | 3 | 0 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 1 | 0 | 0 |

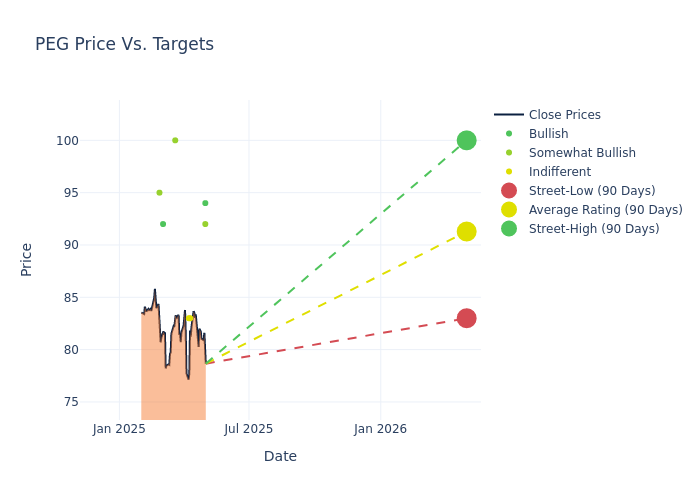

Analysts have set 12-month price targets for Public Service Enterprise, revealing an average target of $91.44, a high estimate of $100.00, and a low estimate of $83.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 2.14%.

Investigating Analyst Ratings: An Elaborate Study

The standing of Public Service Enterprise among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Shahriar Pourreza | Guggenheim | Lowers | Buy | $94.00 | $98.00 |

| Greg Gordon | Evercore ISI Group | Lowers | Outperform | $92.00 | $99.00 |

| James Thalacker | BMO Capital | Lowers | Market Perform | $83.00 | $86.00 |

| Nicholas Campanella | Barclays | Lowers | Equal-Weight | $83.00 | $84.00 |

| David Arcaro | Morgan Stanley | Raises | Overweight | $100.00 | $96.00 |

| Julien Dumoulin-Smith | B of A Securities | Lowers | Buy | $92.00 | $95.00 |

| Shahriar Pourreza | Guggenheim | Maintains | Buy | $98.00 | $98.00 |

| James Thalacker | BMO Capital | Raises | Market Perform | $86.00 | $85.00 |

| Neil Kalton | Wells Fargo | Lowers | Overweight | $95.00 | $100.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Public Service Enterprise. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Public Service Enterprise compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Public Service Enterprise's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Public Service Enterprise's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Public Service Enterprise analyst ratings.

All You Need to Know About Public Service Enterprise

Public Service Enterprise Group is the holding company for a regulated utility (PSE&G) and PSEG Power, which owns all or a share of three nuclear plans and clean energy projects. PSE&G provides regulated gas and electricity delivery services in New Jersey to a combined 4.3 million customers. Public Service Enterprise Group also operates the Long Island Power Authority system. In 2022, the company sold its gas and oil power plants in the mid-Atlantic, New York, and the Northeast.

A Deep Dive into Public Service Enterprise's Financials

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Challenges: Public Service Enterprise's revenue growth over 3M faced difficulties. As of 31 December, 2024, the company experienced a decline of approximately -5.37%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Utilities sector.

Net Margin: Public Service Enterprise's net margin excels beyond industry benchmarks, reaching 11.6%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Public Service Enterprise's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 1.9%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Public Service Enterprise's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.53%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.01.

What Are Analyst Ratings?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.