70 Billion Reasons to Buy Alphabet Stock Right Now

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) recently gave investors some encouraging news during its first-quarter earnings release, including a better-than-feared result that was relatively upbeat for the rest of the year. This flies in the face of many investors' concerns regarding the effects of tariffs, but we'll see how tariffs affect Alphabet as we move along throughout the year.

During its Q1 earnings report, the company also made one exciting announcement: A $70 billion share repurchase authorization. This is a massive chunk of money, but some special circumstances are going on right now that will make this share repurchase plan different from the rest.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Alphabet's ad revenue stream could see some pressure in the coming months

Alphabet is better known as the parent company of Google, YouTube, and the Android operating system. It primarily makes revenue from advertising, which is why a lot of pessimism is baked into the stock. Ad spending is among the first line items to get cut when a company's facing an economic downturn, which would impact Alphabet substantially.

When Alphabet's management was asked during the company's first-quarter conference call whether they saw any effects from tariffs, they specifically called out the end of de minimis exemptions as a headwind. This can be directly tied to Alphabet's business with deep discount Chinese retailers like Temu and Shein, but Chief Business Officer Philipp Schindler made a comment that it was only a "slight" headwind. He also noted that Alphabet has a ton of experience in managing through uncertain times, and that he was confident in its ability to handle whatever situation is thrown at it.

After the earnings release, the stock initially rose, but then saw a small decline. This may indicate that the market liked what it heard, but still isn't convinced that Alphabet won't see a huge effect, despite management stating otherwise.

As a result, there likely won't be any huge catalysts to move the stock besides news headlines and the general market direction between now and its next earnings report. This is what makes the $70 billion share repurchase program so exciting: The stock is incredibly cheap.

Cheaper stocks make for more effective buy-back programs

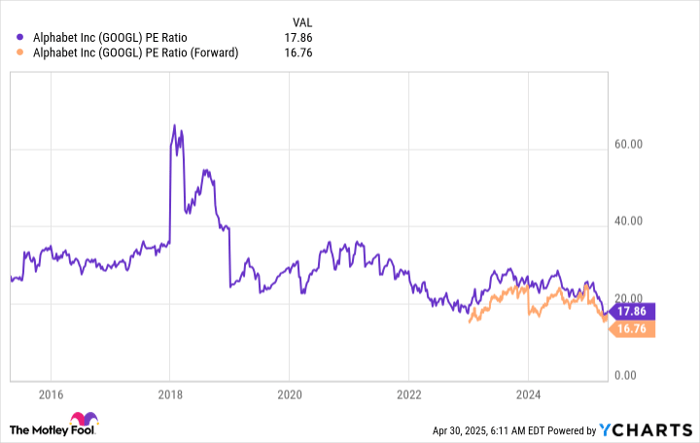

This isn't a hard concept to grasp: The cheaper the stock is, the more shares you can buy with a set budget. Alphabet's stock is among the cheapest it has been this decade, which will make this share repurchase program very effective.

GOOGL PE Ratio data by YCharts.

At 17.9 times trailing earnings and 16.8 times forward earnings, Alphabet is attractively priced, especially considering that the S&P 500 trades for 22.1 times trailing earnings and 20.5 times forward earnings.

Investors are worried about its ad revenue holding up, but they're also concerned about the ongoing attempt by the Department of Justice to break up Alphabet due to an illegal monopoly. In two separate court cases, a district judge found that Alphabet maintained an illegal monopoly in the search engine business (Google Chrome) and its ad platform. A few remedies are being floated around right now to resolve the illegal monopoly problem, but we're a long way from any resolution.

This case will undoubtedly end up at the Supreme Court, and it could take years to get there. Investors would be forgiven if they don't want to hold throughout that saga, but this is just another factor contributing to Alphabet's cheap stock price, which will make its $70 billion buyback program more effective.

By reducing the share count, Alphabet's earnings per share (EPS) will rise even if earnings stay flat, because the denominator of the equation is decreasing. This is key in the current environment, because Alphabet could see some headwinds in earnings growth as we face economic uncertainty.

While there are some dark clouds on the horizon for Alphabet, no one is sure how they will affect its stock. However, the market has already assumed that Alphabet is going to be pelted with a heavy storm. With this pessimism already baked into the stock price, I think now represents a strong buying opportunity, if you're willing to hold on through the storm for the next three to five years.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet. The Motley Fool has a disclosure policy.