What Analysts Are Saying About Viavi Solutions Stock

Analysts' ratings for Viavi Solutions (NASDAQ:VIAV) over the last quarter vary from bullish to bearish, as provided by 6 analysts.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 0 | 0 | 1 | 0 |

| Last 30D | 2 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 1 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

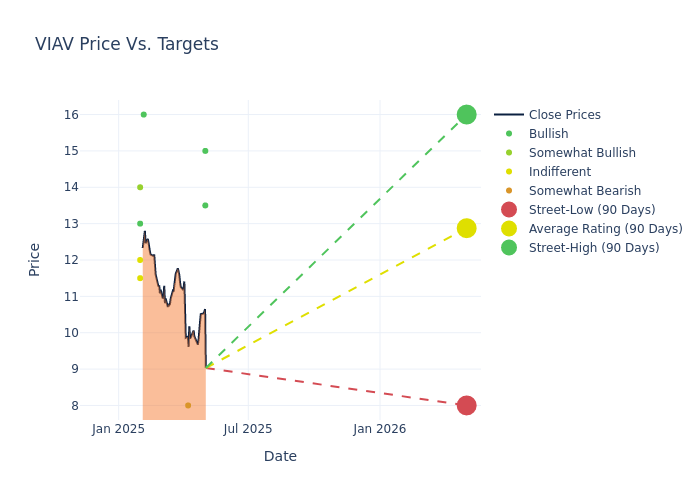

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $13.08, with a high estimate of $16.00 and a low estimate of $8.00. Surpassing the previous average price target of $12.80, the current average has increased by 2.19%.

Breaking Down Analyst Ratings: A Detailed Examination

The perception of Viavi Solutions by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mike Genovese | Rosenblatt | Raises | Buy | $13.50 | $12.00 |

| Ryan Koontz | Needham | Maintains | Buy | $15.00 | $15.00 |

| Mike Genovese | Rosenblatt | Lowers | Buy | $12.00 | $14.00 |

| Meta Marshall | Morgan Stanley | Lowers | Underweight | $8.00 | $10.00 |

| Mike Genovese | Rosenblatt | Announces | Buy | $14.00 | - |

| Jim Kelleher | Argus Research | Raises | Buy | $16.00 | $13.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Viavi Solutions. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Viavi Solutions compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Viavi Solutions's stock. This analysis reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Viavi Solutions's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Viavi Solutions analyst ratings.

About Viavi Solutions

Viavi Solutions Inc. is an international provider of network test, monitoring, and assurance solutions to communications service providers, enterprises, network equipment manufacturers, civil government, military and avionics customers. The company also offers high-performance thin-film optical coatings, providing light management solutions to anti-counterfeiting, 3D sensing, electronics, automotive, defense, and instrumentation markets. Its operating segments include Network Enablement, Service Enablement, and Optical Security and Performance Products. Geographically, it derives a majority of its revenue from the United States. Additionally, it manufactures and sells optical filters for 3D sensing products that allow facial recognition security authentication for mobile devices.

Unraveling the Financial Story of Viavi Solutions

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Viavi Solutions's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 6.4% as of 31 December, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Information Technology sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Viavi Solutions's net margin excels beyond industry benchmarks, reaching 3.36%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 1.31%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.53%, the company showcases effective utilization of assets.

Debt Management: Viavi Solutions's debt-to-equity ratio surpasses industry norms, standing at 1.01. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.